GCC SWFs Asset Allocation Strategies

The GCC SWFs are bestowed with the responsibility to preserve and grow the national wealth for the future generations and simultaneously, facilitate social development, economic diversification and enhancement of the domestic infrastructure. Based on these objectives the SWFs have been successful in devising and executing their investment strategy in the past. However, over the last few years, the regional SWFs have been operating under several challenges such as low interest rates, new normal oil prices, geopolitical shocks and beginning of quantitative tightening. These significant macroeconomic challenges translate into an extremely difficult investment environment, forcing the SWFs to revisit their asset allocation strategies.

Wider Asset Classes being Considered

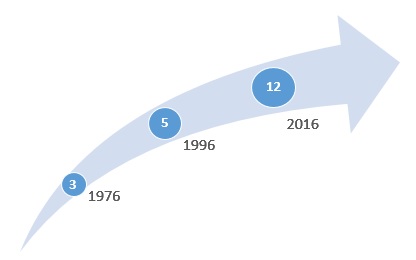

The SWF has grown in sophistication over time as evidenced by the number of asset classes invested. For instance, ADIA which invested in mere three asset classes in 1976 now invests in 12 asset classes as of 2016.

Number of Asset Class Invested by ADIA

Source: ADIA

Similarly, the investments by KIA comprised of 33 portfolios and 19 mandates during 1993, which has now increased to 133 portfolios and 36 mandates.

Kuwait Investment Authority Investments

Source: KIA

Note (*): Include 6 separate European countries equity mandates, which were subsequently consolidated due to the introduction of the Euro. In addition, 3 country specific bond mandates were merged into one global bond mandate

Further, KIA has focused on portfolio diversification by distributing its investments across countries to increase returns and reduce risks. In 2004, KIA investments were spread across 37 countries of which 10 were emerging nations. In 2017, its investments are allocated across 120 countries of which 81 are emerging nations. It is evident that KIA has been decreasing its exposure to developed economies and has been increasing its allocation in higher growth emerging markets.

Growing Prominence of Alternative Investments

Another prominent trend that emerged as a consequence of this challenging environment is flight of capital from traditional safe haven such as Government bonds, towards more risky but higher return generating asset classes such as equities and alternative investments.

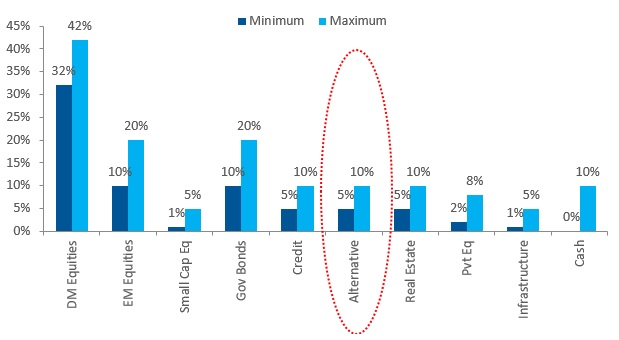

Asset Allocation Limits at ADIA

Source: ADIA

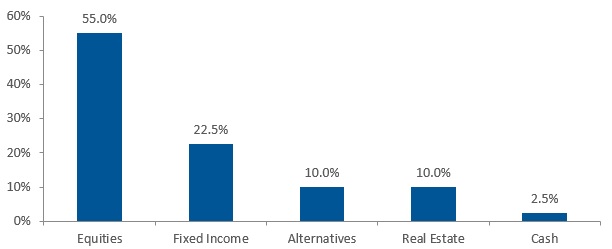

Kuwait Future Generation Fund (FGF) Asset Composition

Source: KIA

Going forward, alternative investments is expected to gain further allocation in portfolios as a preferred asset class for the following reasons. Firstly, the quest for higher returns due to the low interest rate environment will make alternative assets an attractive asset class. Secondly, the pressure to manage fiscal deficit through drawdown from assets would result in liquidation of low return generating liquid assets and retain assets with the possibility to generate higher returns. Thirdly, the SWFs have the advantage of investment size and long-term investment horizon. This presents the SWFs an opportunity to invest in wider range of illiquid alternative investments and earn an additional premium for doing so.

Drop in Developed Market Exposure

Another trend that has emerged recently is the growing negative sentiment among SWFs towards U.S assets. According to a survey conducted by Sovereign Wealth Fund Institute, sovereign investors planning to underweight U.S. assets in the next 12 months has jumped to 43% in February-2018 compared to 25% in the December-2017 survey. An example to substantiate this survey result would be the ADIA asset allocation policy which permitted up-to 45% of portfolio invested in developed market equities in 2010, was reduced to 42% as of 2016. The possibility of additional rate hikes by U.S Fed and the increased risk of trade wars as a consequence of action by U.S. President Donald Trump to slap tariffs on a variety of imports could have triggered this shift of sentiment.

Increased Focus on Local Economies

Partly driven by stagnant economy and Euro Zone debt crisis in developed economies and partly by local factors, such as regional geopolitical tension, SWFs are increasingly focusing their attention on their local markets. SWFs often turn up as financiers for national development programs.

For instance, Kuwaiti government supplemented the existing health care capacity by establishing Kuwait Health Assurance Company in 2015 with an estimated capital of USD 1.1 billion, KIA is expected to hold 24% stake. While in Qatar, Qatar Investment Authority (QIA) brought more than USD 20bn back onshore to cushion the impact of a regional embargo imposed on the Gulf state. QIA deposits were being used to create a “buffer” and provide liquidity in the banking system after capital outflows of more than USD 30bn. QIA is also considering invest in local real estate development Katara and national carrier Qatar Airways as to strategy to support many state organizations.

Similarly, Saudi’s Public Investment Fund (PIF) too has increased its domestic focus with its PIF program. The Program is expected to create new companies, new ecosystems, and develop large-scale infrastructure and real estate projects. By doing so, the new domestic assets are expected to reach 20% of total PIF assets under management by 2020.

Conclusion

The asset allocation strategy of the regional SWFs has evolved a long way since its initial days. Moreover, the challenging investment environment has acted as a catalyst for the change in the strategy. In summary, the regional SWFs have moved away from their asset allocation strategy of being predominantly reliant on the overseas markets and more traditional asset classes such as equities and bonds. The SWFs appear to have matured to be more comfortable with taking exposure in risker assets classes such as alterative investment and are also ready to bet on the domestic companies, at the same time complementing the economic diversification agenda.