-

[gtranslate]

- Login

August 2016

UAE Asset Management

Industry Research Report

Pages : 65

Executive Summary

What is this report about?UAE Asset management industry is the third largest in GCC after KSA and Kuwait. There is however a lack of mutual fund penetration in UAE indicated by the low AuM/GDP ratio (0.2%). Lack of foreign institutional participation and restrictions on the same is a major deterrent for the development of the industry. In this report, we have analyzed the funds based on their asset classes and detailed on their performance, and compared it with the benchmarks. The report also covers details of the major market participants in UAE, the industry architecture, and recent regulatory changes relating to asset management.

Who will benefit and why?

The report will help institutional investors and high net worth individuals to understand about the industry. It will also benefit fund managers, asset management companies, investment banks, and regulatory authorities.

How exhaustive is this report?

We have provided a detailed analysis of the funds and their performance. The report covers aspects relating to the industry challenges, the impact of low oil prices on capital and debt markets, and the role of market participants such as sovereign wealth funds and pension funds.

Table of Content

- Executive Summary

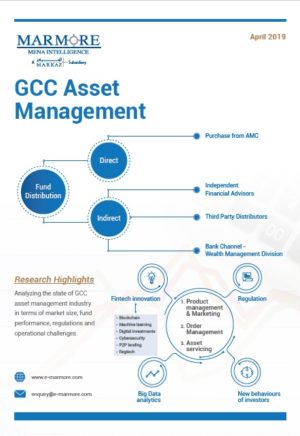

- Industry Architecture: Needs focus on product diversification

- Mutual Fund Analysis

- Market Segments: More scope for debt markets to develop

- Market Participants: Predominately Government

- Frontier to Emerging Markets and MSCI Stance

- Industry Challenges

- Regulatory Bodies & Developments

- Annexure

Key Questions Addressed in this report

- What are the various funds and how have they performed?

- What is the architecture of asset management industry?

- How are the funds distributed among various asset classes in the UAE?

- Who are the major participants in the market?

- What are the recent regulatory changes in the UAE ?

This report can add value to

Customize this report

Why Custom Research?

- Research and intelligence to suit your business requirements

- Informed decision making

What are Benefits of Customization?

- To-the-point, long or short research reports could be requested

- Reports are exclusively prepared for you

You Ask We Deliver

- Over a decade Marmore has successfully navigated this space of customized research to serve its clients and cater to their unique requirements.

- Our customized research support spans sector research, equity and credit investment notes, modelling, valuation, investment screening, periodical etc.

- We offer clients with intelligence and insights on unexplored and under-researched areas that help stakeholders take well-informed business and investment decisions.

- Our offerings marries the challenges of cost, time, scope & data availability to generate actionable outcomes that are specific to our clients’ needs.

FAQ

Is regular update for this available?The report will be updated yearly. However, if required, upon specific request we could provide you with an update.

Can I only download certain sections of the report?

Yes. The user can access certain sections of the report upon request, and this will be available at a nominal price.

Executive Summary

Table of Content

Key Questions Addressed in this report

This report can add value to

Customize this report

FAQ

Related Reports

April 2019

October 2015

Recently Browsed

April 2018

Tax Cuts and Jobs Act – Corporate America...

January 2021