Visualizing Saudi Arabia in MSCI EM – Some Questions

- When is the inclusion likely to happen: 2018/2019/2020?

- What will be Saudi Arabia’s weight in the index? And

- How much fund flows can be expect post inclusion?

- When is the inclusion likely to happen: 2018/2019/2020?

MSCI has lauded the progress in Saudi Arabian capital market ushering its entry into the emerging markets. The kingdom will be third in the GCC league after UAE and Qatar that were included in the index in 2014. Thanks to plethora of reforms implemented by the Capital Markets Authority and Tadawul after 2015 when KSA was categorised as MSCI standalone index.

Saudi has progressed swiftly compared to UAE and Qatar that took six years to implement reforms to be a part of the index. Given the fact that MSCI is happy with the progress, let us look back at what they have done till now and why they are not very far from the inclusion.

One major impediment for Saudi Arabia in entering the MSCI EM was the T+0 settlement cycle which it had been following. Capital Market Authority (CMA) and Tadawul have changed the cycle from T+0 to a T+2 cycle on 23rd April 2017. This was a longstanding hurdle that has been cleared. Following the change in settlement cycle, Saudi Arabia also introduced short selling in April 2017. Liberalization on foreign ownership limit to 49% from the existing 10% in Saudi listed companies has been initiated and the definition of foreign institutional investors has been broadened to include sovereign wealth funds. Minimum value of assets under management for QFIs was reduced to 3.75 billion Saudi riyals (USD 1bn), compared with the current 18.75bn riyals (USD 5bn). CMA has introduced new corporate governance policies to ensure more accountability and transparency. The new policy is expected to be implemented from February 2018. In most of the other parameters, KSA is at par with the Qatar and UAE. Aramco is expected add USD 50 Bn to the Saudi market and completing the issue with domestic and retail investors alone would be close to impossible. Foreign institutional investors’ have a key role to play in the subscription. Fund managers prefer to invest in stocks and indices that are classified and tracked by agencies such as MSCI. An upgrade of the Saudi market to EM would provide impetus for fund managers to invest in the IPO. It is hence implicit that the CMA has made considerable work on the ground to achieve it. MSCI scheduled to start the review for Saudi’s claim to join emerging markets in June 2017, we can be expected to be a part of the index by 2018 as the review process takes eleven months.

- What will be Saudi Arabia’s weight in the index?

We have estimated the weightage of Saudi Arabia in the MSCI EM index to be 2.57% after considering the possible stocks that would be a part of the EM index and based factors such as free-float market capitalization and liquidity.

Institutional investors have expressed that it would be a perfect time for the index inclusion as Aramco IPO has also been planned during the same period. Provided that the IPO and index inclusion happens together, it is expected to lead to significant inflows from international funds into Saudi market (Source: EFG Hermes). Aramco’s market capitalization can be expected to be USD 50 Bn (5% of USD 1 trillion), which if added to the index would increase the weight to 3.71%.

- How much fund flows can be expected post inclusion?

UAE’ weightage in the EM index was 0.35% in 2014, which must have translated to a fund flow of USD 5.25 Bn.

However, the initial funds (three months after the inclusion) that entered UAE markets was USD 0.85 bn. The weightage of UAE stocks have almost doubled in the last couple of years, though the fund flow is still estimated to be about USD 2 bn.

Going by similar trends and assuming the traction in fund flows happen gradually, our estimates for Saudi Arabia’s fund flows in the initial phases (three to six months after inclusion) is around USD 6 to USD 7 bn and this could increase to USD 9 to 10 bn with the inclusion of Aramco (Source: Estimates based on UAE).

Concluding Remarks

2018 would be a year of rejoice for CMA and Tadawul if the MSCI EM inclusion happens as anticipated, but definitely not the time to rest on the laurels. Stories from other emerging markets would tell us why.

Dubai and Abu Dhabi markets soared 107% and 63% in 2013, the time when MSCI announced that UAE stocks would be a part of the emerging markets index in 2014. International investors poured money into UAE markets, especially as it was considered a safe investment destination in GCC. Economic growth was pushed back after the second half of 2014 with oil prices starting to fall as a result of which UAE markets tumbled in 2015. MSCI EM inclusion in 2014 was not enough to hold the investors. Similar was the case with Pakistan, which lost its EM status in 2008 after being a part of the index from 1990’s. Geopolitical tensions and poor economic growth led to the liquidity crunch in the Karachi stock exchange following which it was downgraded to Frontier markets. It has taken nine years since then for Pakistan to improve the liquidity position, instil confidence among the investors and bounce back to the EM status which is very likely to happen by the end of May 2017. These are instances that indicate Saudi Arabia cannot expect money to flow into its markets just because stocks are listed in the MSCI EM. Apart from the larger economic reforms planned which would be fundamental for the growth of Saudi markets, Tadawul and CMA will have to work further to streamline the process of registration for investors, protecting the rights of foreign players and encourage market making.

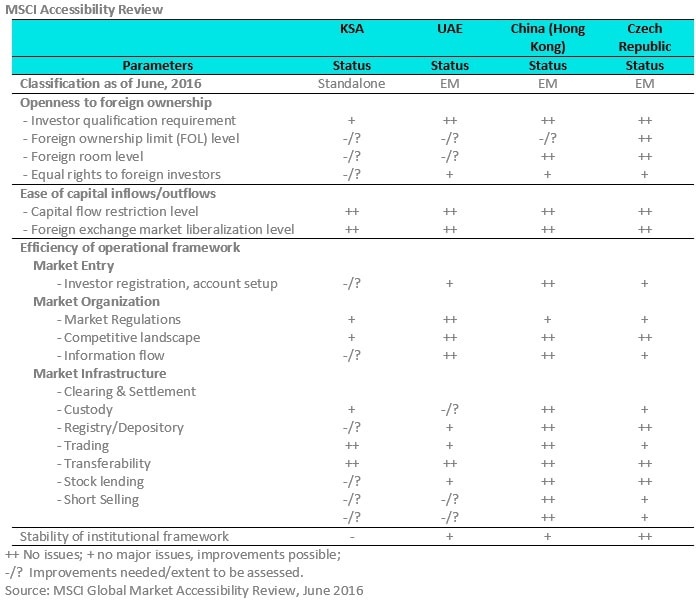

Looking at Hong Kong and Czech Republic, the two emerging markets that have received positive feedback from MSCI on all parameters used for evaluation in its accessibility review reveals that Saudi Arabia has more work to be done. Saudi Arabia’s regulations have to provide equal rights to foreign investors due to which it has been rated as needs improvement in the ‘openness to foreign ownership parameter’. Aspects of market infrastructure such as establishment of custodian, making provisions for short selling, stock lending and developing products such as exchange traded funds (ETFs) and hedge funds are areas that need focus. Investor registration and account setup will have to be established to ensure ease of market entry.

Saudi Arabia has been restructuring its economy to reduce its dependency on oil. Capital markets reforms and increasing foreign as well as institutional investor participation has been one of its main components. Given the vision Saudi aims to achieve in 2030, the CMA and Tadawul will have to work tirelessly to reform its market and build an investor friendly environment before and even after the inclusion in MSCI emerging markets index.