UAE Contracting – Riding high on Expo 2020

The opportunities in the contracting sector can be subdivided into various sub-sectors like real estate, oil & gas, infrastructure, power and petrochemicals. Of all the sub-sectors, real estate is gaining the most momentum as 57.7% projects in pipeline as of April 2015 belong to real estate. Dubai and Abu Dhabi are particularly driving the contracting sector in UAE. Out of all the 860 projects ongoing as of April 2015 in the UAE region, 87% are Dubai and Abu Dhabi based.

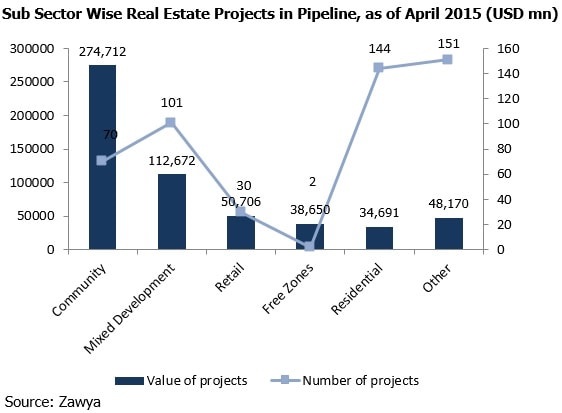

Real Estate development includes construction in the sub-sectors community development, retail, residential, free zones, leisure, entertainment and public buildings. As of 2015, there are 500 ongoing projects in the real estate sector while 110 projects are on hold. In the sub-sector category of real estate, community development is leading in terms of value while the maximum number of ongoing projects is in residential development.

The diversification plans of the government are promoting the growth in industries like travel & tourism, hospitality and, agro-chemicals thereby increasing the number and volume of projects in construction. The projects related to transport, infrastructure and hotels are in the pipeline as the number of international arrivals are increasing in UAE. Dubai has become the tourist hub in the whole GCC region. According to Marmore’s UAE Contracting report, the foreign spending in UAE was USD 22.6 billion at real prices in 2013 while the same statistic for Saudi Arabia and Qatar was USD 8.18 billion and USD 5.48 billion. The foreign spending in UAE was 55.8% of the total foreign spending in GCC in 2013 . Dubai Airport has already overtaken Heathrow as the busiest airport in the world. The increasing international tourists, GDP Per Capita, young population and the government spending are the key drivers of contracting sector in the UAE.

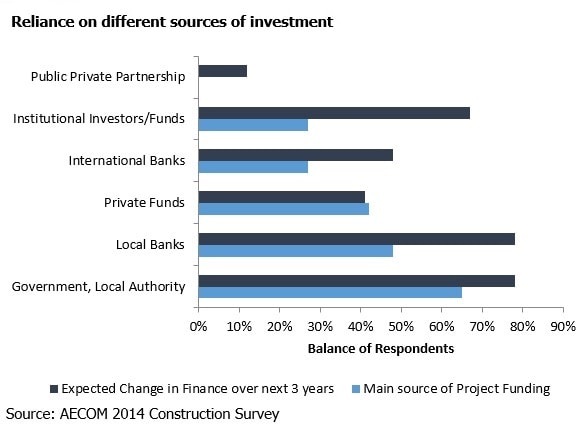

Most of the projects in construction sector are highly dependent on the government spending and government initiatives for social infrastructure. Any disruption in Government spending or Government policies can change the course of growth in the construction sector. Also, the lacking transparency in the policies, delay in project approval adds more uncertainty in the industry. One more challenge in this category is the diversification of the funds which are mostly public driven in construction sector. On the back of strong reserves and financial position, the government funds are able to help the construction sector. But, in future, in order to maintain the same growth pattern, the source of funds needs to be diversified.

Despite the growth in the contracting sector, there exist a number of challenges which may hinder the growth of sector. A positive outlook of the real-estate though encouraging, is also leading to rise in inflation levels. As a result, it might lead to a housing bubble. Other risks include heavy reliance on government spending and government initiated projects, low oil prices and the threats of Globalization. A proper monitoring of real-estate pricing levels should be done to keep the inflationary pressure in check.

However, despite the challenges, the future outlook of the construction sector remains positive in UAE. UAE is the most diversified economy in the GCC region. The increasing population, the government policies taken in favor of diversification and the most liberalized business environment among GCC countries will not only lead to increased foreign direct investment but also be a boon to the construction sector.