KSA Stock Market Outlook 2016

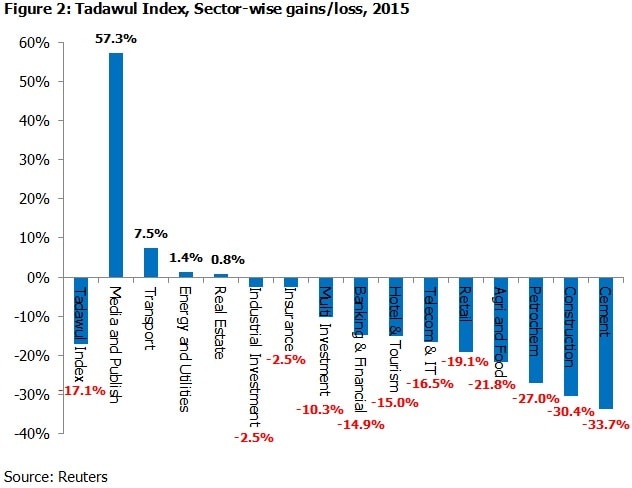

Majority of the sectors underperformed during 2015, with Media & Publication, Transport, Energy and Utilities and Real Estate being the exceptions. According to Marmore’s KSA stock market outlook 2016, Saudi construction and cement were the worst hit sectors as they lost 34% and 30% respectively. The decline in banking sector index by 14.9% during 2015 establishes the challenges in the form of liquidity tightening, as a consequence of low oil prices and increased government borrowings that will impact the banking sector.

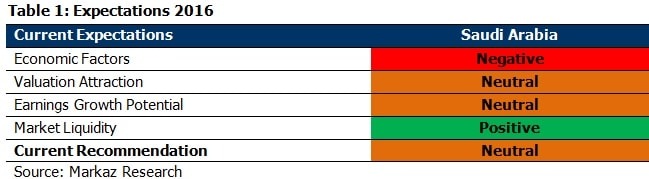

Going forward, we evaluate the attractiveness of the KSA stock market based on four-factor model.

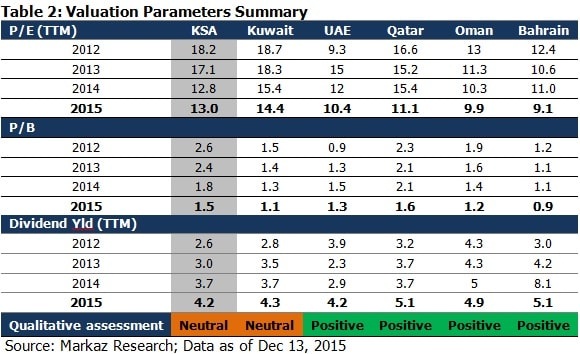

1. Valuation: Neutral

On a standalone basis, KSA, with a P/E ratio of 13x appears to trade at elevated valuation levels, given that MSCI emerging markets constituents UAE and Qatar were trading at a lower premium. On P/B basis, KSA market is the second expensive among all GCC nations after Qatar. Dividend yield for KSA stands at 4.2%.

2. Corporate Earnings: Negative

The continued expected lower oil price in 2016 is expected to exert further pressure on corporate earnings. Lower credit offtake and increasing cost of funds due to liquidity squeeze is expected to impact the bank earnings. The large petrochemical segment of KSA is expected to contract due to lower price realization of its products, resulting in almost 15% decline in earnings for companies operating in the commodities segment in 2016 compared to 2015. The lower anticipated growth rate is likely to translate into flat growth rate for real estate sector and result in contraction of the construction related sectors.

3. Economy: Neutral

Saudi Arabia’s GDP is projected to grow at 3.4% in 2015, a drop from previous year growth of 3.5%. The GDP growth is expected to slow down to 2.2% in 2016. Non-hydrocarbon sector growth is expected to be the slowest at 3.8% during 2016 and this is the least growth level in the last five years. The current account deficit is estimated to increase to 4.7% of GDP in 2016 and fiscal deficit during 2016 is expected to reduce compared to 2015 levels. The inflation in KSA is expected to be at 2.3% in 2016 by IMF.

4. Market Liquidity: Positive

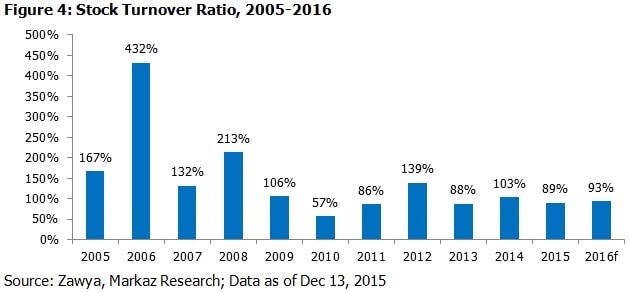

Aggregate value traded of equities in KSA reached a value of USD 461.6bn in 2015. This represents a 15% lower value from the value traded registered in 2014. The drop in value traded can be attributed to lean trading triggered by the negative investor sentiment due to lower oil prices. However, this is expected to marginally increase to 93% of market cap during 2016.

The trading activity on Tadawul is dominated by the retail investors with the institutional investors contributing only 9% of trading volume on Tadawul exchange. However, with the relaxation of rules with regards to foreign investment in Tadawul, this institutional investment can be expected to grow. The stock market turnover ratio for KSA has been consistenly high compared to the other GCC markets. The KSA market liquidity is expected to remain high during 2016 as well.

Concluding Remarks

Based on the four force analysis, the 2016 outlook for KSA is “Neutral”. Due to its strong reserves and low levels of debt, KSA will manage to weather low oil price era without significant troubles. However, this would certainly slow the economic engines to a certain extent which will be reflected in the corporate earning during 2016. The low investor confidence will reflect in the valuation of the stocks. However, KSA will continue to be a highly liquid market in the region and participation of Qualified Foreign Institutional Investors (QFIIs) will complement the existing liquidity status of the market.