GCC Region M&A Activity – Q2 2015

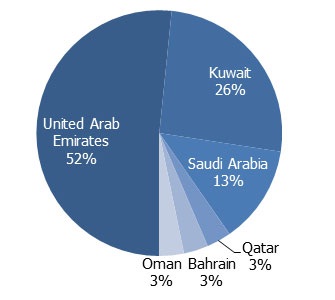

At the end of Q2 2015, GCC region witnessed 31 completed M&A deals (Markaz GCC M&A Report – Q2 2015). Though the number of transactions completed increased by 11% in Q1 2015, there was a decline by 9% compared to the same period in 2014. In continuation to the trend observed in the earlier periods, UAE and Saudi Arabia consistently dominate the M&A space in the region. UAE and Saudi Arabia collectively accounted for 65% of the transactions of the total 31 transactions completed during the Q2 2015. Compared to the performance at the end of Q2 2014, the number of deals completed nose-dived by 83% for Qatar from 6 to 1 at the end of Q2 2015 and UAE witnessed the sharpest increase of 45% from 11 deals to 16 during the same period. Bahrain, Qatar and Oman closed one deal each at the end of Q2 2015, a respective 50% drop for these regions from Q2 2014. However, the number of closed deals at 8 remained unchanged for Kuwait during the same assessment period.

Kuwait’s M&A market showcased a significant increase in the number of deals closed from 2 at the end of Q1 2015 to 8 at Q2 2015. The UAE markets too witnessed a marginal increase by 2 deals amounting 16 closed deals at the end of Q2 2015 compared to the previous quarter. Bahrain and Oman markets M&A closed deals remained consistent at 1 each at Q2 2015 compared to Q1 2015. However, Saudi Arabia deal count decreased to 4 compared to 8 during the same periods.

GCC M&A Transactions – Geographical Distribution by Number of Transactions (Q2 2015)

Source: S&P Capital IQ, Markaz Analysis

GCC Deals in Pipeline/Announced

Based on the data compiled by Markaz from S&P capital IQ, the GCC region fares well in terms of announced pipeline transactions at the end of Q2 2015 compared to Q1 2014. The region has an announced 22 transactions in the pipeline; an increase of 70% compared to 13 deals at the end of Q1 2014. The UAE and Saudi Arabia account for 82% of the total announced transactions. Whereas, Oman and Qatar with 2 deals each make up the remainder 18%. The deals in pipeline are highest for UAE at 13.

GCC Deals Closed – Cross-border/Domestic

The domestic acquisition of the UAE based Dragon Oil’s 46% by Emirates National Oil Company (ENOC) is the largest in terms of deal value (USD 2,644mn) amongst the deals in the pipeline at the end of Q2 2015. ENOC, which already holds 54 percent of Dubai-based Dragon, with this acquisition, will gain control over wells in Turkmenistan and exploration projects from Algeria to Iraq. Amongst the M&A deals closed during Q2 2015, the domestic acquisition of UAE based Reem Al Bawadi Group by Marka for USD 86mn and cross-border acquisition of Saudi based Radium Residential Compound by Kuwait and Qatar based Warba Bank, The First Investor and Tanween for USD 80mn were the large value deals.

The cross-border deals with regards to the Non-GCC buyers targeting GCC based companies dropped by 43% to 4 deals in Q2 2015 compared to 7 during Q2 2014. Though UAE, Bahrain and Kuwait had 6, 1 and 1 respectively inbound deals with foreign acquirers during Q1 2015, only UAE continued to attract foreign buyers at the end of Q2 2015 completing 4 deals. Aukett Swanke Group’s acquisition of 80% stake in the UAE based architecture, interior design and engineering company, John R Harris & Partners Ltd for a total USD 1mn was one of the largest cross-border deals involving a Non-GCC acquirer closed during Q2 2015.

GCC M&A Deals Closed – By Sector

GCC acquirers accounted for 71% of the total number of transactions during Q2 2015 and 61% during Q1 2015. Foreign acquirers accounted for 13% of the total number of transactions during Q2 2015 compared to 29% during Q1 2015.The Consumer Discretionary, Financials, Industrials, and Real Estate sectors witnessed the highest number of transactions accounting for 71% of the total transactions during Q2 2015. Energy, Information Technology, and Materials sectors each accounted for 6% of the total number of transactions during Q2 2015.

Sector-wise Classification of Deals – Q2 2015

| Sector | GCC Acquirers | Foreign Acquirers | Other* | Grand Total | % |

| Consumer Discretionary | 6 | 1 | 0 | 7 | 23 |

| Energy | 1 | 1 | 0 | 2 | 6 |

| Financials | 3 | 0 | 2 | 5 | 16 |

| Healthcare | 3 | 0 | 0 | 3 | 11 |

| Industrials | 3 | 2 | 0 | 5 | 16 |

| Information Technology | 2 | 0 | 0 | 2 | 6 |

| Materials | 0 | 0 | 2 | 2 | 6 |

| Real Estate | 4 | 0 | 1 | 5 | 16 |

| Grand Total | 22 | 4 | 5 | 31 | 100 |

Source: S&P Capital IQ, Markaz Analysis

GCC M&A Deals Country-Wise Scenario

Kuwait – During Q2 2015, Kuwait witnessed 4 M&A deals completed with 100% of the deals being domestic acquisitions. The acquisition of Al Mulla International Financing and Investment Company – Auto Finance Portfolio by Warba Bank for USD 66mn with a profit sharing arrangement was largest in terms of reported deals values closed during Q2 of 2015. Kuwait based Al Ahli Bank’s acquisition of 98.5 percent stake in Piraeus Bank's Egyptian unit for USD 150 million is a large value cross-border deal in pipeline for Kuwait. However, there aren’t any transactions in pipeline targeting companies based in Kuwait.

KSA – The closed transactions involved targets in Spain and Kuwait. Two of the announced transactions involved targets in Saudi Arabia while the third involved a target in Egypt. The 11% acquisition of International Acetyl Company and International Vinyl Acetate Company by Saudi International petrochemical Company for USD 100mn is the largest announced deal in terms of value.

UAE – UAE was home to some of the large value and the most geographically diversified M&A deals completed during Q2 2015. The Abu Dhabi Investment Authority’s 100% acquisition of China based Grand Hyatt Hong Kong Company and New World Harbourview Hotel Company for USD 975mn and US based Renaissance Raleigh North Hills Hotel for USD 80mn were two of the largest deals closed during Q2 2015. Apart, from the domestic acquisition of Dragon Oil by Emirates National Oil Company, UAE had an outbound acquisition of Canada based Fairview Container Terminal by DP World for USD 461mn in the pipeline. Almost 48% of closed deals involved targets outside the GCC, 48% were in the UAE, and 4% in GCC countries other than the UAE, showing the preference of investing outside the GCC region and at home.

Qatar – Qatar didn’t witness any inbound acquisitions during Q2 2015. Almost 72% of the closed deals were outbound acquisitions with China, Italy and United Kingdom as target countries. The 20% stake acquisition of China based HK Electric Investments for USD 1,194mn by Qatar Holding was the largest in terms of deals value amongst the closed transactions. The domestic M&A deals involving acquisition of 49% stake in International Acetyl Company and International Vinyl Acetate Company by Qatar Quality Foods for USD 1mn is the deal in pipeline for Qatar.

Bahrain – All of the transactions by Bahraini acquirers were closed and there are no transactions in pipeline. 1 of the closed transactions involved targets in Bahrain and the other 1 took place in GCC markets other than Bahrain. Bahraini acquirers did not engage in any transactions involving targets outside the GCC region. The outbound 100% acquisition of Saudi based Events Mall by Gulf Finance House for USD 48mn was the largest deal value closed during Q2 2015.

Oman – Oman is the only country amongst its GCC peers which had 100% outbound acquisitions during Q2 2015. On the contrary the two deals in the pipeline are domestic M&A deals. The 40% acquisition of Italy based Sigit S.p.A. for an undisclosed amount by Oman Investment Fund was the deal closed during Q2 2015.

Inbound M&A deals – Q2 2015

| Target Company | Target Company Country | Percent Sought | Deal Value (USDmn) | Buyer | Buyer Company Country |

| ABYAT | Kuwait | 35% | N/A | Abdul Kadir Al-Muhaidib & Sons Company | Saudi Arabia |

| Events Mall | Saudi Arabia | 48% | 100% | Gulf Finance House | Bahrain |

Source: S&P Capital IQ, Markaz Analysis

Overall, M&A activity in the GCC region during Q2 2015 improved compared to Q1 2015. However, it declined marginally compared to Q2 2014. The majority of the transactions completed were either outbound targeting companies in Non-GCC countries or domestic deals. The inbound M&A activity within the GCC region involved the two transactions discussed in table above. The 4 inbound deals closed during Q2 2015 involving Non-GCC acquirers were targeting companies based in the UAE. The UAE and Saudi Arabia are expected to continue to be the key players in the M&A in the region and are among world’s top 10 countries forecasted to experience the fastest M&A and IPO growth until 2020. The M&A activity in the UAE is expected to rise from USD 2.2bn in 2014 to USD 6.8bn in 2015. The forecast also shows that deal activity will stabilize from 2016 to 2020, albeit with a peak of around USD 5.7bn in 2018 . The M&A activity in Saudi Arabia is expected to raise from USD 747mn in 2014 to USD 2.9bn in 2015.