The Archegos Lesson: Bring Risk Management to where it belongs

The biggest lesson from Archegos fiasco is that risk management function should not be a side-kick and should be manned by independent, non-partisan executives who will not bend come what may. While this can slow down the growth, at least the institution will survive to analyze. If not, the board meetings will only happen in corporate cemeteries!

While 99% of today’s news is centered around COVID-19 and its multiple waves across the world, on March 23, 2021 a hedge fund blow-up rattled US and global markets thanks to the little known name called Archegos s (a Greek word, which means “someone who leads the way”). Based in New York, Archegos family office is a hedge fund owned and managed by Bill Hwang, an US immigrant from South Korea. After working with Tiger management (of Robertson fame) Bill Hwang went on to found his own hedge fund to manage his wealth in 2013 with a capital of $200 mn. He managed a long-short portfolio (mainly long), which comprised technology stocks focused on Asian geography. The initial success of Archegos was mainly on star-studded technology names like Amazon, Linkedln, and Netflix. Emboldened by its success, Bill moved to take bets on lesser known technology names like ViacomCBS, Farfetch, Iqiyi, Vipstop, etc. Over time, his successful bets enabled him to grow his firm from $200 mn to $20 bn without the attendant limelight normally associated with such star managers. The fact that Bill remained a lowprofile little-known hedge fund manager speaks volumes about his modus operandi which I explain in the following paragraphs.

Archegos built a portfolio of mainly Asian technology stocks through Total Return Swaps (TRS) with prime brokers. In this arrangement, the prime broker buys the designated stocks (called portfolio) and swaps the return of the portfolio with Archegos for a fee. Technically, the portfolio risk is assumed by Archegos while prime brokers make money through the fees but end up holding the stocks in their books. Additionally, the prime broker also lends money to Archegos to lever up the portfolio and earns interest on this leverage. Archegos dealt with several reputed prime brokers including Morgan Stanley, Goldman Sachs, Credit Suisse, Nomura, Wells Fargo, Deutsche Bank and Mitsubishi.

Where things went wrong?

So, what went wrong? As they say, the party can last as long as the music is playing. In leveraged bets, everyone makes money when the underlying stock price keeps moving up. Technically in that situation, the portfolio value moves up where the investment bank will hand over the profit to Archegos in return for a fixed fee. The increasing value of the portfolio positions Archegos even more favourably now to borrow more and lever up even further. However, the real fun starts when the opposite happens. When the underlying stock price tanks, the exposed investment bank will now demand more collateral from Archegos. If not provided, then it will resort to margin call by selling the underlying stocks and reducing its exposure. This triggers a price fall.

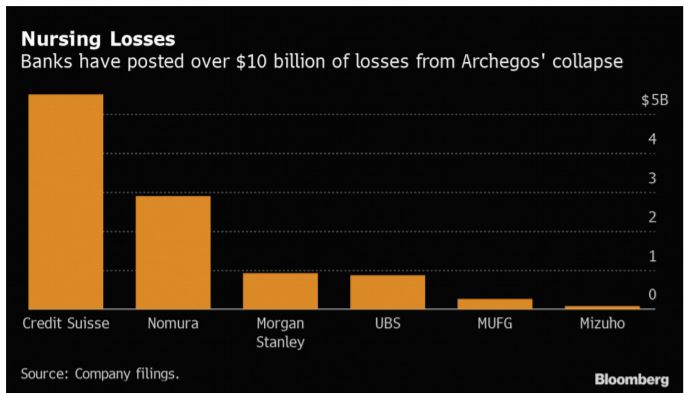

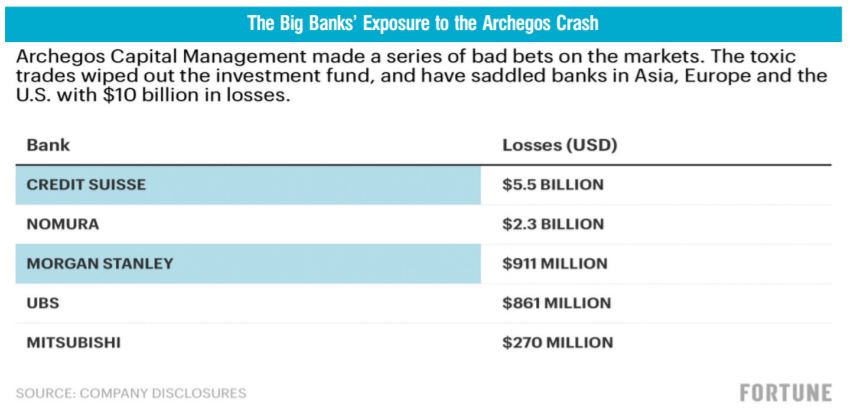

In this particular case study of Archegos, the exposure to ViacomCBS turned sour. After experiencing a tripling in price of the stock, the company decided to tap the market for additional funding in the form of stocks and convertible bonds mainly to shore up liquidity and face intense competition. While the company thought that it is a smart move since it is raising equity at elevated valuation, the market thought otherwise. The stock price of ViacomCBS tanked 9% on March 23rd and 23% on March 24th. Since Archegos has a concentrated portfolio, it triggered panic among the lenders who rushed to sell the portfolio which further reduced the value of all the underlying stocks. Finally, some investment banks escaped with little losses, while Credit Suisse and Nomura were left licking $4.7 billion and $2 billion in losses respectively. Also, Archegos as a firm crumbled to the floor and what was a $20 billion liquid empire came to naughts in about 2 days.

There are several interesting risk management lessons from this Archegos saga.

-

- Use of Leverage: Hedge funds love to make money through leverage especially in times like these where rates are near zero. Leverage is a double-edged sword where it can amplify both profits and losses. Archegos started with a normal leverage of 2x and when it tasted success, kept increasing the leverage and before the blow up the leverage stood at a massive 5x. Well governed hedge funds and institutions will have internal checks and balances that will limit the leverage in anticipation of troubles. However, Archegos being a single man company, did not enjoy that luxury.

- Use of Derivative Products: Archegos did not directly own the underlying stocks but instead owned them indirectly through the prime brokers through the swaps described earlier. In this method, it can escape regulatory scrutiny as regulators cannot find out the positions being built up by Archegos. Also, Archegos can work with several prime brokers at the same time. While each prime broker can have his exposure worked out, they will not have a composite view of Archegos total exposure to a particular stock.

- Lending is a risky business: From the prime brokers point of view, lending is a juicy business as they are covered by the underlying stocks as collateral and can always demand more (margins) when needed. However, this works well for small changes in stock prices. However, for large and abrupt changes in stock price (especially on the down side) lending can be a serious business if proper due diligence is ignored while lending.

- Concentrated portfolios can be dangerous: Archegos ran a highly concentrated portfolio both at a stock level and at sector level. Ignoring the benefits of portfolio diversification can cause serious problems in sudden market meltdowns. Running a concentrated portfolio that too on a levered basis will need very high levels of stock research and ability to withstand long periods of “against the wind” scenarios. In hedge funds run by a single person like Archegos, both these factors can be missing.

- Swimming with Sharks: Prime brokers, in spite of their big names, end up dealing with firms like Archegos where risk management is thrown out of the window. Unless risk management is at the central of such investment bank’s business model, swimming with sharks will not be pleasant all the time and can end very badly. Most of the big prime brokers cited in this article embraced Archegos as a client in spite of SEC slapping fines on Bill when he was with Tiger. It is anybody’s guess how this was completely ignored in the risk management due diligence.

- Don’t wait for the client to decide: Upto what point one can wait to trigger a margin call is a subjective question especially when dealing with stocks that has manageable interim volatility. When several prime brokers are involved in lending to the same client for the same stock, a steep fall in the underlying stock price will put them in a situation where if one pulls the trigger, the whole ship can fall. Before pulling the trigger, prime brokers normally consult the client to see if additional comfort can be obtained in the form of higher collateral or margin money. In most of such situations, the client instead of putting up with additional collateral, will try and argue about the correctness of his call and punctuate the need to maintain patience. This can be a recipe for disaster. The biggest risk management lesson here is not to wait for the client’s decision.

Risk management back in focus

Investment management business is fiercely competitive and the first casualty of this is the risk management. Risk management is a critical function for both the hedge funds and the lending institutions. In many institutions, the unfortunate truth is that risk management is seen more as an irksome middlemen function preventing the business from growing. Some institutions veer around this problem by assigning ex-business heads to lead the risk management function so that they can have a ‘friendly’ attitude to investing decisions like enrolling risky clients or endorsing risky transactions. Needless to say, risk management function should not be a side-kick and should be manned by independent, nonpartisan executives who will not bend come what may. While this can slow down the growth, at least the institution will survive to analyze. If not, the board meetings will only happen in corporate cemeteries!