Bitcoins – What’s the story now?

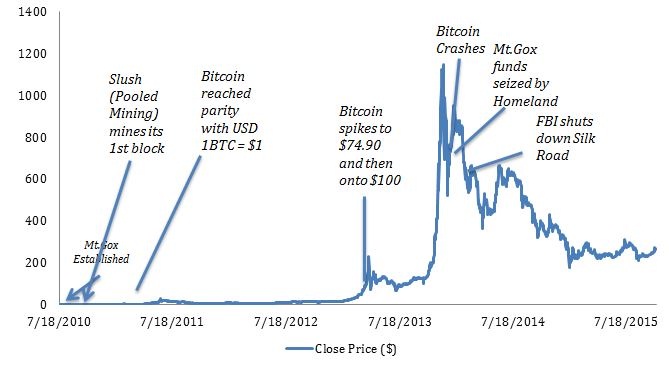

Last year we had published a report (Disruptive Technology: Bitcoins) on the emerging technology of bitcoins. At the time of writing that report, the value of one bitcoin had reached an all-time high of $979 against the US dollar and was touted as an important tool in the future of finance. However, one year down the line, things are not looking bright for bitcoins. It started with the closure of Mt.Gox; one of the biggest bitcoin exchanges and was followed by closure of many other bitcoin exchanges (big and small). Canadian bitcoin exchange (Cavirtex), California based Butter coin (backed by Google), London based Yacuna are some of the major bitcoin exchanges to shut down in recent times. Shutting down of the exchanges is not without its consequences as investors and stakeholders lost their money entirely and expensive lawsuits followed. In this blog, we look at major events that have happened in the world of bitcoins during the past one year.

Bitcoin vs USD – Prices

Source: Coin Desk

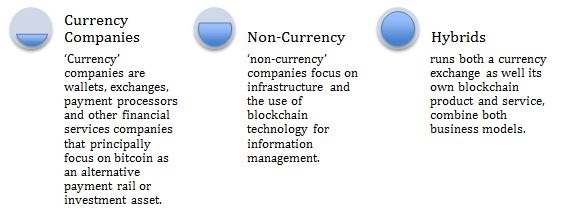

Splitting in two (more like three)

We in our earlier report (Disruptive Technology: Bitcoins) had highlighted the underlying technology of bitcoin – “Block chain” technology. Block chain is a public record of all the transactions that happen in the bitcoin world. Each block records a certain number of transactions and once the blocks are exhausted the transactions are recorded onto a new block. Each computer (called “nodes”) receives a copy of the bitcoin transactions that have taken place. All the transactions that take place in the bitcoin network get disseminated to the users of the network. These transactions are then confirmed (usually within 10 mins) through a process called mining which ensures chronological order of transactions, neutrality of network and allows computers to reach a consensus on the transactions.

In recent times there has been a dramatic shift in focus from bitcoin’s use as an alternative currency and store of value to the possibilities surrounding the underlying distributed ledger technology, or blockchain. Big companies in the market are trying to adopt and tap the potential of the technology for non-currency based transactions. Investment in block chain technology has caught the interest of Wall Street with some of the biggest players in the finance and financial technologies space having invested in this technology. Visa, NASDAQ, Citi and few others have invested $30 million in Chain.com, a blockchain developer platform that serves an enterprise market. With the $30 million funding that the company has risen, in addition to the $13.5 funding that it already has in the bank, the company predicts healthy revenues and turning profitable next year.

In this investment and other investments that surround the block chain technology, attempts have been made to bring some key qualities of block chains- such as transparency, security and cost-effectiveness to main stream financial transactions. This distributed ledger technology is expected to bring a whole series of changes to the existing legacy systems. Investors see a huge potential for such technologies in the future when most of the assets would be digital. When asked about the investment in the company, Visa’s executive vice president said that they are looking for investments in technology outside of point of sale (an area that it already has tight control on) and in new areas such as business-to-business spending or business-to-government spending which is a much larger pie and it’s an area in which Visa have very little penetration.

Investments in block chain by major banks are not only confined to the US, across the Atlantic, Barclays bank has invested in two block chain startups – Wave and Chain analysis. Barclays has been most vocal about its investment in this space in the past few months (as of Oct 2015).In addition to the strong verbal support Barclays bank has also opened two block chain labs in its old bank branches.

Even bitcoin startups have announced new blockchain initiatives. For instance, US exchange itBit revealed its bank chain product, and Ripple announced its Interledger initiative to connect various distributed ledgers. Reduction in volume of bitcoins as well as lukewarm response for bitcoin payments has forced the hands of bitcoin companies to innovate or perish. More bitcoin companies are expected to follow suit.

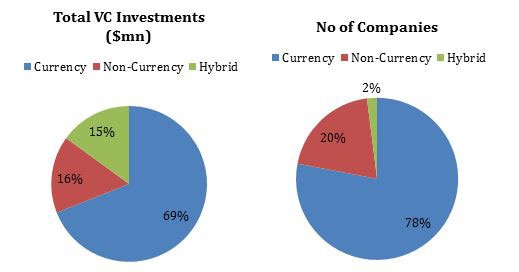

Investments slowdown

Source: CoinDesk

Total bitcoin venture capital increased 11% to $921m in Q3 2015. While all-time bitcoin investment is on track to surpass $1bn in 2015, there has been a slowdown in the pace of investment.

While it is still unclear at this stage if there is any particularly noteworthy reason behind the observed slowdown in investment; it may reflect something significant such as the venture capital community’s concerns over the speed of adoption, or something insignificant like seasonal factors. Bankruptcies and increasing competition in exchanges and bitcoin mining has forced its hands at consolidation in the sector.

M&A in Bitcoin technologies

Source: CoinDesk

Payment processor and wallet startups have seen little-to-no venture capital investment over the last several quarters possibly due to sluggish global economy.

Bitcoin’s failure to gain significant traction as a medium of exchange for non-illicit transactions is playing spoil sport for the payment processing sector. For example, BitPay, which is one of the most well-financed startups in the space, announced significant staff cuts and that it will no longer offer its ‘free and unlimited’ introductory service to new merchants looking to accept bitcoin as payment.

Challenges associated with the adoption of new payment methods are not unique to bitcoin. For example, Apple Pay, Google Wallet and a number of other payment services have failed to achieve critical mass required to sustain its early momentum and gain wider use despite the tremendous publicity surrounding the announcement of such payment services.

Bitcoin community split into two

Bitcoin transactions are packaged into blocks before being recorded on bitcoin’s permanent ledger. Developers disagree over what the maximum size of those blocks should be. On one hand, smaller means more security, but on the other hand bigger means that bitcoin technology can more easily scale into wider adoption and non-currency applications. While this might sound very technical, some users of bitcoins suggest that increasing the block size could possibly render bitcoins worthless adding an additional layer of risk.

In addition to this, there are also other issues to consider for Bitcoins such as Regulation (Banking sector which currently looks like its only savior is a heavily regulated one and is in opposite spectrum of bitcoins which is unregulated and decentralized), Public adoption (Key to long term success)as well as reduced funding. Lean business models and frugality are the order of the day for bitcoin companies in 2016.