COVID-19 may force GCC companies to cut dividend payout

Dividend payments have been an important tool to get investors to buy shares of companies as dividends provide a return on investment even during periods when the markets are down. GCC Companies listed on stock exchanges have provided consistent dividends in recent years. Due to Covid-19, many GCC Companies may be forced to cut dividend payouts due to fall in earnings and need to preserve cash. We examine the impact on dividends due to the pandemic and its ramifications for the stock market.

Dividend Payouts have been high for GCC stock markets.

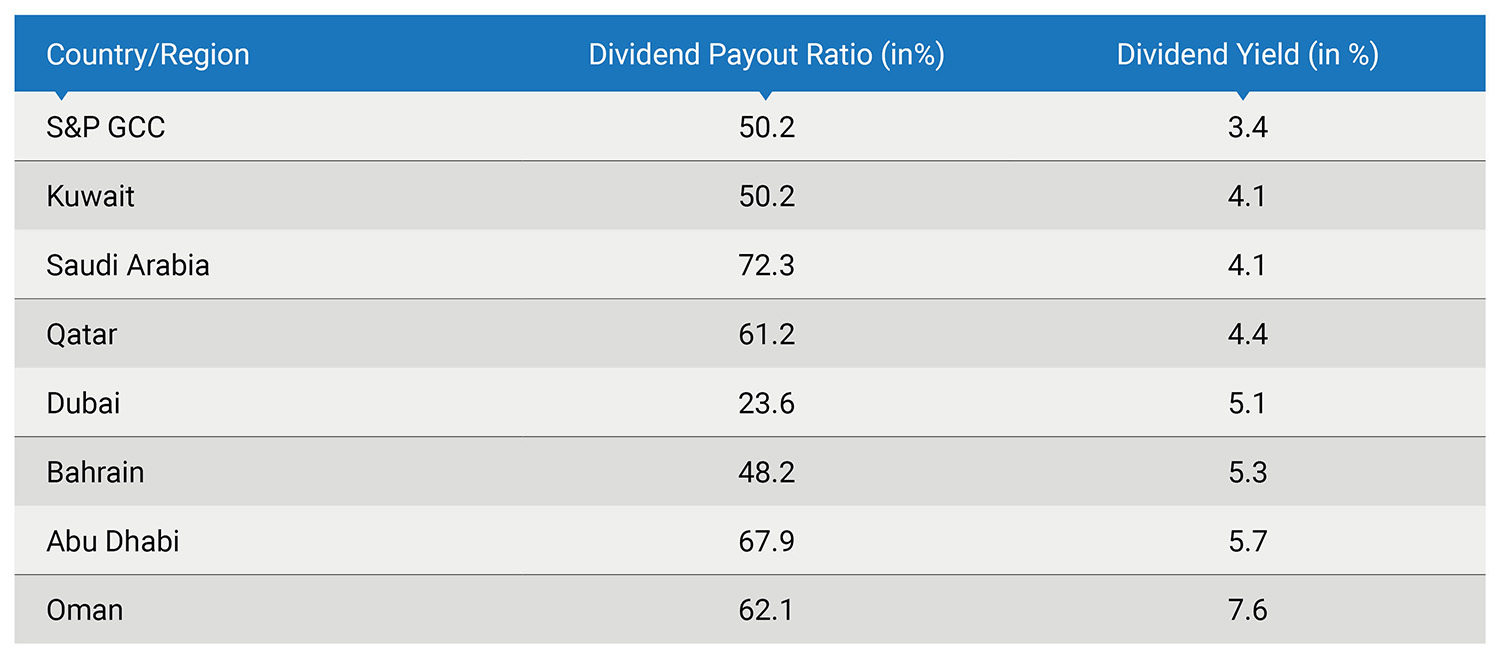

Exhibit 1: Dividend payout ratios and yields of GCC Stock market indices

Source: Refinitiv; Note: Dividend Payout Ratio is the ratio of dividends paid and net income

Source: Refinitiv; Note: Dividend Payout Ratio is the ratio of dividends paid and net income

As seen from the exhibit above, companies listed on GCC stock indices tend to have high dividend payout ratios at more than 50% for many GCC indices. One of the reasons is that GCC governments hold a significant stake in these companies and dividend payments contribute to government revenues. High dividend payouts have been crucial to get GCC and foreign investors to invest in the GCC stock markets. Therefore, any news of dividend cuts could lead to a selloff in the markets.

Speculation of dividend cuts triggered a selloff in Kuwaiti Banks

Kuwaiti Banks listed on the Boursa Kuwait fell between 5-10% on June 10 following news reports that implied that the Kuwaiti Banking Association (KBA) had asked their members not to pay cash dividends for FY2020. The Central Bank of Kuwait had previously announced Covid-19 combatting measures as part of its Regulatory Stimulus Package, including reduction of the Capital Adequacy Ratio floor by 2.5% and more relaxed liquidity requirements. If a bank makes use of these concessions, according to Basel III rules it will have to forego paying cash dividends. Speculation on whether Kuwaiti banks would opt for the concessions and the need to forgo paying dividends led to a selloff. The banks later clarified that a final decision regarding the 2020 dividend will be made at the year-end, based on financial performance, the extent to whether the bank has made use of the above central bank concessions, the recommendation of the Board of Directors and the wishes of the shareholders. The Capital Markets Authority then cancelled the trades made on June 10 since the KBA was not authorized to issue the communication. Still, the incident shows the importance of dividends to investors.

- Kuwait has the highest reserves among GCC countries, relative to its GDP at 542%.

- Saudi Arabia is expected to enjoy the highest credit growth at 5.3% in 2020.

- UAE could continue to enjoy surplus trade position in 2020.

Earnings impact is likely to constraint dividend paying capability

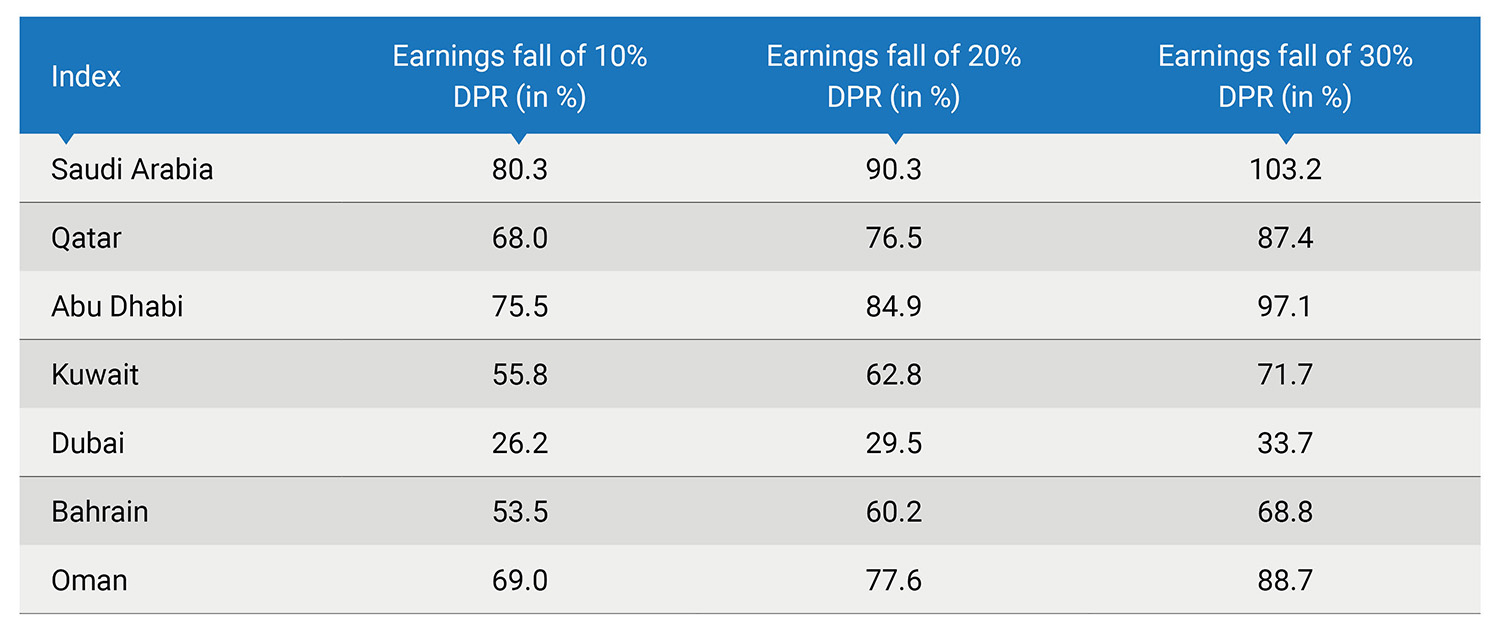

The IMF has estimated that all GCC Countries would see contraction in GDP for 2020. Measures to contain the spread of coronavirus and the ensuing lockdown and curfew measures is bound to impact the earnings of companies. Based on our analysis, a 20 to 30 percent fall in income levels, would severely impact the dividend paying capability of firms in Saudi Arabia, Abu Dhabi, Qatar and Oman. While those in Kuwait and Bahrain would be impacted as well. Companies in Dubai due to their low pay out ratios could weather the fall in earnings and could maintain the dividends.

Exhibit 2: Estimated Dividend Payout Ratio (DPR) under different scenarios

Source: Marmore Research

Source: Marmore Research

GCC Sectors most likely to cut dividends

Banks and Financial stocks constitute a significant portion of GCC Indices with financials comprising 52% of S&P GCC Composite index. Due to Covid-19 and the need to conserve liquidity, many central banks have already placed restrictions on 2019 dividend distributions. And the IMF has also called for banks to not pay cash dividends to preserve capital in the banking system and also prevent weaker institutions from being stigmatised. In light of this, dividend cuts are to be expected for GCC banks though a final decision will be probably be taken on a bank-to-bank basis based on the extent of increase in bad loans leading to reduction in capital ratios. The possibility of dividend cuts also explains why even the strongest Banks and Financial institutions have seen big falls in share prices.

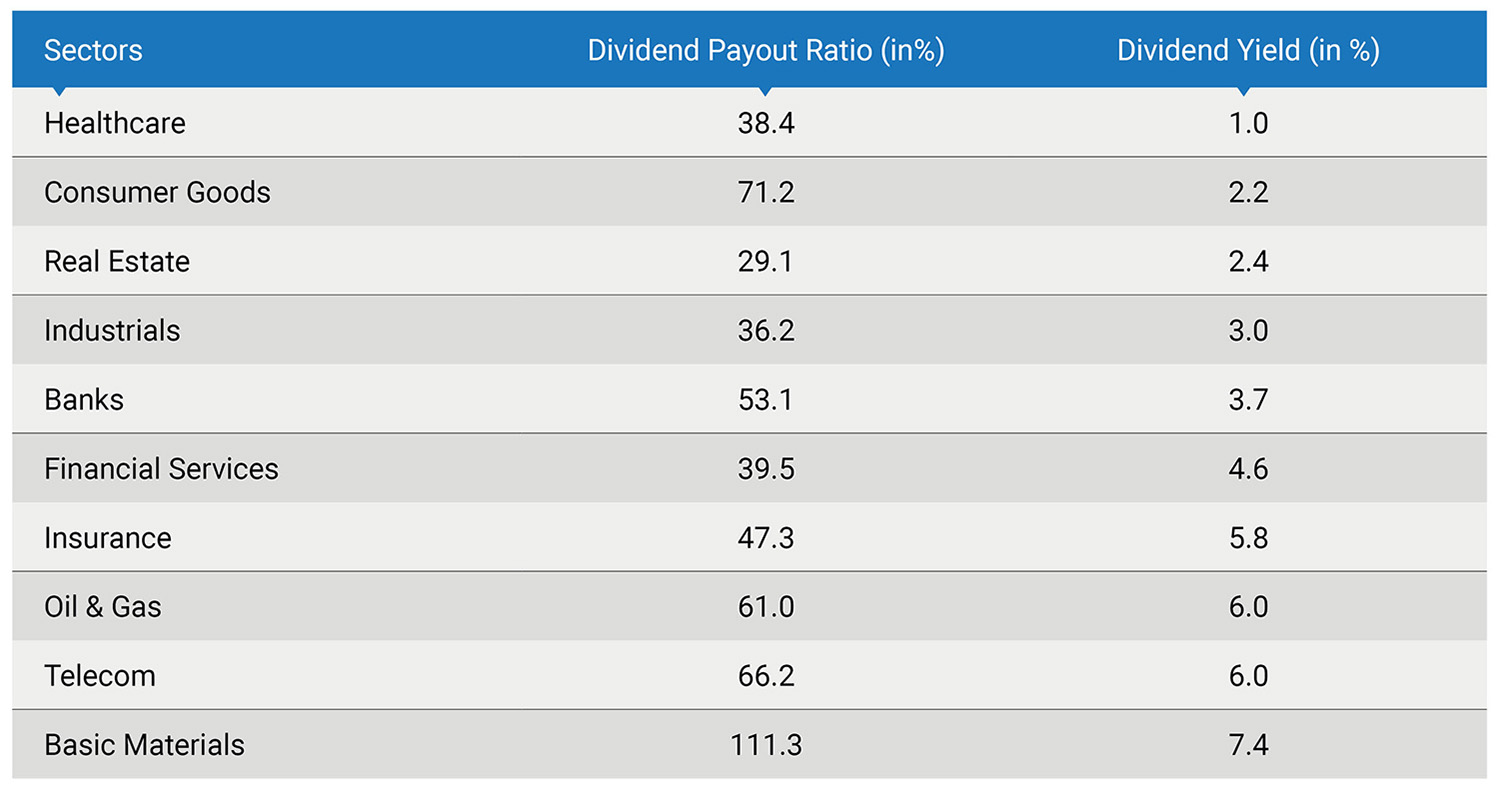

Exhibit 3: Sector wise Dividend payout ratios and Yields for Kuwait

Source: Refinitiv

Source: Refinitiv

Kuwaiti Companies in Basic Materials sector have a dividend payout ratio above 100% indicating that they have been paying dividends using cash from their reserves in addition to the cash from profits. Other sectors like Oil & Gas, Basic materials & Industrials together constitute 25% of S&P GCC Composite. Covid-19 and the oil price crash will result in significant earnings fall for these sectors and certain cuts in dividends. This leaves defensive stocks as the most likely to keep their dividend payout rates. The crisis might even result in these sectors reporting more profits and increase in dividends. However, since they comprise a small part of GCC stock markets, the impact is likely to be minimal.

Conclusion

As the second quarter ends and GCC companies start reporting their results, a clearer picture on dividends is likely to emerge. As seen from the example of Basic materials sector in Kuwait, dividend policy was not necessarily dependant on profits and more on satisfying shareholders. However, due to the liquidity crunch caused by Covid-19, companies with adequate cash balances and banks with healthier capital ratios are likely to maintain dividends, which will give them an advantage compared to the market as a whole.