How Inflationary is VAT in the GCC?

The residents of Saudi Arabia and the UAE, who had long enjoyed a tax-free existence, were finally subject to a Value Added Tax of 5% on goods and services, from Jan 1st 2018. The introduction of VAT, which is seen as one of the biggest policy shifts in recent times across the region, is expected to bring in additional revenue to the respective governments. VAT being a consumption based tax, will have implications on customer spending as well as inflation. As of 2018, Saudi Arabia and UAE are the only GCC countries to implement VAT, with the others aiming to follow suit in 2019.

Considering that interest rates and economic growth have a bigger influence on inflation, there is little doubt that the short-term effects of VAT on prices, will pose challenges to both consumers and businesses. The additional expenses incurred due to the addition of VAT are likely to have a bigger impact on high value purchases than day-to-day expenditures.

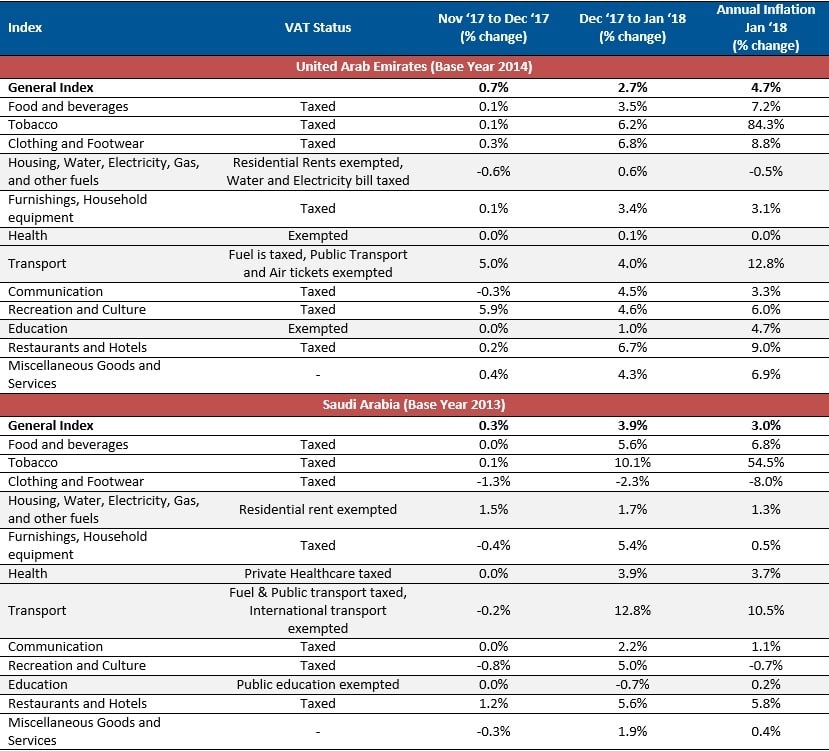

After the inception of VAT, both Saudi Arabia and the UAE witnessed a sharp rise in inflation for the month of January 2018. Annual inflation for January 2018 spiked to 3.0% and 4.7% for Saudi Arabia and the UAE respectively. Compared to the prices of December 2017 significant changes were seen in prices of Clothing & Footwear, Restaurants & Hotels, Transport and Tobacco. Notably, the annual inflation on tobacco products was more than 50%. However, this was due to the implementation of a 100% sin tax in both countries for tobacco products. Inflation on transport was also higher owing to the subsidy cuts in fuel.

Taking the case of UAE, the effect on inflation in January 2018 could’ve been worse if not for the weak real estate market which resulted in a decline of residential rents. Lower rents therefore helped offset some of the inflation effect as housing and utilities form a significant chunk of the price basket. For Saudi Arabia, the change in base year for consumer price calculation from 2008 to 2013, helped bring down its inflation figures.

Change in Consumer Price Index – Jan 2018

Source: SAMA Monthly Statistics, Federal Competitiveness and Statistics authority, Marmore Research

In the UAE, housing, healthcare and education costs did not see a major change as they were exempted from VAT. Despite public transport and air travel not falling under the purview of VAT, transport costs rose by 4% in Jan 2018 compared to the previous month due to the taxation on fuel. The case was similar in Saudi Arabia where housing and education were not affected. Cost of apparels including clothing and footwear fell by 2.3% between Dec ’17 and Jan ’18 despite being taxed, as they were being heavily discounted due to the slump in sales.

While the introduction of VAT has effected a push up in inflation for January, its impact is expected to fade over time. Japan, which increased its VAT from 5% to 8% during April 2014, witnessed an immediate impact on its inflation rates which surged to 3.7% in May 2014. However, the rates eased off to 0.5% after 12 months. Evidences from other global cases also suggest likewise.

Although 5% VAT is lower compared to several other countries worldwide, it sets a precedent that governments in the GCC are willing to adopt subsidy cuts and levy taxes in order to strengthen their finances. The introduction of VAT would nudge consumers to spend more responsibly and change their spending patterns. Prices of products would also come down in order to match the demand eventually leading to a decrease in inflation.