Impact of Oil Price Volatility on GCC economies, markets and businesses

Closely intertwined with economic growth, oil has been vulnerable to global growth outlook. The recent collapse in oil prices caused by demand destruction on account of COVID -19 was exacerbated by the OPEC+ disagreement, pushing prices down to historically low levels. In the current dynamic scenario, where the world is controlled by COVID-19, while news on OPEC+ agreement, stimulus etc. causes some increase in prices, news on extension of lockdowns and filling up of oil storage causes a steep fall in oil prices. These movements have caused increased oil price volatility.

Oil price volatility is measured by the Oil Price Volatility Index(OVX) (The OVX or “Oil VIX,” measures the market’s expectation of 30-day volatility of crude oil prices based on options on the United States Oil Fund LP. USO is an exchange-traded fund intended to reflect, as closely as possible, the spot price of West Texas Intermediate light, sweet crude oil, less USO expenses). Though the OVX measures volatility in price changes in WTI, as both WTI and Brent crude are driven by similar market sentiments and follow similar trajectory, the volatility index is considered to represent volatility of oil in general.

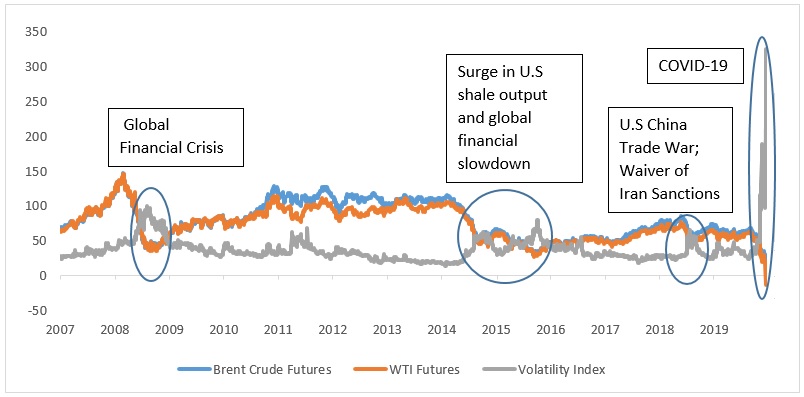

Figure : Trajectory of Brent Crude Futures, WTI Futures and Oil Volatility Index

Source: Refinitiv; Oil Volatility Index introduced in May 2007.

- Kuwait has the highest reserves among GCC countries, relative to its GDP at 542%.

- Saudi Arabia is expected to enjoy the highest credit growth at 5.3% in 2020.

- UAE could continue to enjoy surplus trade position in 2020.

Learn more

The oil volatility index reached a value of 325, its highest level since its inception in 2007 on 21st April 2020. This indicates oil price could swing in either direction by 20% in a day (Daily Volatility = Index Value/ Square root (365)). This spike was on the back of the WTI crude oil turning negative, as storage facilities neared their full capacity and producers paid buyers to take the oil off the facilities.

While there have been spikes in volatility during low oil price years of 2008 and 2014-16, the current spike has dwarfed them. Volatility is generally known to be higher when the market in the bear run, and the same has panned out in the oil markets too. Higher volatility signals higher riskiness of an asset and negative sentiments.

As nations where oil is a major source of revenue, these are more vulnerable to the volatility in oil prices. As coronavirus continues with no end in sight, in addition to lower oil prices, their uncertainty of their direction or magnitude of fall adds to the woes of GCC. We take look at the impact of oil price volatility on economies, markets and businesses.

GCC Economies

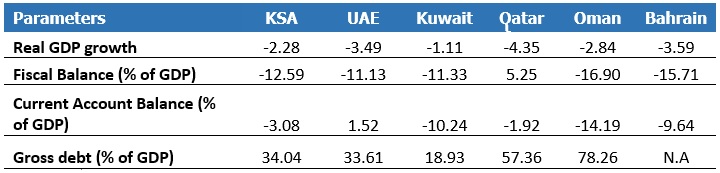

Citing lower oil prices and COVID-19, IMF has projected Gulf Cooperation Council’s growth to shrink 2.7% in 2020, compared with its October 2019’s forecast of 2.5% growth for the same period. As governments dole out stimulus to contain COVID-19 impact amidst lower oil prices, their borrowing needs would increase. Saudi Arabia has said its total debt could reach 220 billion riyals (USD 58 billion) in 2020. Given the expected economic contraction and increased borrowing, the government debt as percentage of GDP is expected to increase.

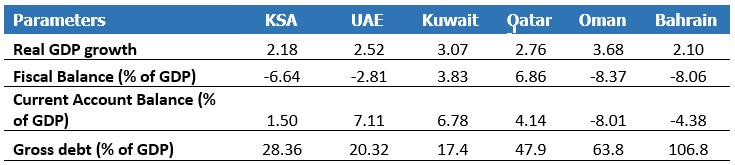

Table 1: October 2019 Forecasts for 2020 (Oil Price Assumption: USD 57.94 per barrel)

Source: IMF

Source: IMF

Table 2: April 2020 Forecasts for 2020 (Oil Price Assumption: USD 35.61 per barrel)

Source: IMF

Source: IMF

Given their dependence on oil, its volatility makes the outlook for the region uncertain and increases its perceived risk. This uncertainty affects many aspects of the GCC economies from economic growth prospects and fiscal policy to debt levels and sovereign rating.

To reduce their oil dependence, GCC countries try to increase their non-oil revenue and boost non-oil sector growth. Oil volatility makes this move difficult. Boosting non-oil sector growth requires higher investment in these sectors. Volatility in oil prices hinders the planning and execution of the projects in these sectors, as their implementation is usually over long time frame. Lower oil prices and the accompanying volatility, while highlighting the urgency of fiscal reforms like levying taxes and reducing subsidies, also restrict the room available for those reforms.

Oil price assumption is an important linchpin of GCC governments’ budget. Volatility makes the budgeting process uncertain. For example, budgeting assuming oil price at USD 50 per barrel is easier than assuming oil price to be in a range of USD 20 – 80 per barrel (CFR – Oil Volatility). It also destabilizes fiscal policy and the governments are caught unawares. Lower oil prices and stimulus to cushion COVID-19’s impact are increasing governments’ borrowing requirements. While countries like Saudi Arabia are issuing sovereign bonds, Kuwait has not been able to do so as it is yet to pass the public debt law.

While governments’ borrowing needs and debt levels increase, oil volatility would influence the risk perception of lending to these countries. Saudi Arabia’s 5-year credit default swap (CDS) spreads reaching 233 bps and rating downgrade of Kuwait by S&P are a few recent examples of this increased risk perception.

There has been volatility in the oil markets in the past and every time there has been a call for action. The current crisis only indicates the sheer magnitude to which volatility could spike and oil prices could fall, re-iterating the need for moving away from an oil-based economy.

GCC Markets

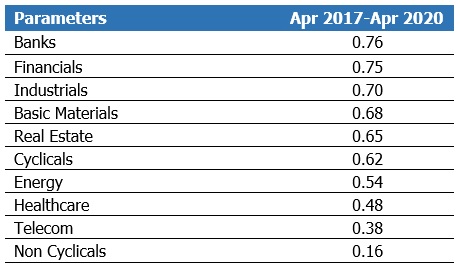

GCC capital markets are prone to oil price movements. In 2014-16 oil price crash, the S&P GCC index had dropped by about 43% when the volatility index had peaked. In the current volatility spike, the markets have dropped by 23%. The 3-year correlation between monthly returns of sector index and oil price is significant for almost all sectors other than healthcare, telecom and non-cyclicals.

Table 3: Correlation between Sector Index and Oil Price Monthly Returns

Source: Refinitiv, Marmore Research;

Source: Refinitiv, Marmore Research;

GCC Businesses

From oil majors to petrochemical industry to banking, oil volatility affects businesses across sectors. As an indicator of risk, high oil volatility prompts a conservative and cautious approach. Oil majors are affected because of uncertainty in their revenue streams. This causes them to reduce operating costs and capital expenditure. An example would be Kuwait Petroleum Corporation and Saudi Aramco’s announcement of spending cuts in the face of recent volatility. GCC Petrochemicals focus on basic petrochemicals and are highly correlated with oil prices (PwC). Hence oil price volatility would impact GCC petrochemicals too in terms of uncertain revenue streams. In addition to spending cuts, uncertainty in revenue arising from oil volatility would affect debt repayments, raising new debt and makes capital structure choices difficult.

As government spending on non-oil sector reduces, their growth would also be stunted. This would affect sectors like construction and real estate as their demand decreases. As businesses reduce spending and cut down on investment and expansion plans, banks’ credit growth would also be affected. As companies see decrease in revenues, banks’ provisioning might also increase in anticipation of deterioration in asset quality.

Conclusion

Be it the Global Financial Crisis, slowdown in global growth, trade wars or COVID-19, oil is one of the first commodities to take a hit. Given the uncertainty of these events, it seems like volatility of oil is here to stay. Measures such as taxation, subsidy reduction and boost to non-oil growth would help GCC move away from oil-based economy. But until GCC moves considerably towards a non-oil economy, in addition to oil price levels, given the recent sharp movements, its volatile nature might make its own place in decision making.