Innovation using offsets

Offsets, in defense and civil trade, are essentially compensations that a procuring government or buyer seeks from the seller for the purchase of goods and/or services. A practice that originated in the 1950s, offsets have grown in stature over the years and is now evident in about 120 countries around the world, from a mere 20 from approximately 25 years ago.

According to Marmore’s report on GCC Offsets, there are broadly two classes of offset programmes, i.e., Direct Offsets (DOs) and Indirect Offsets (IOs). DOs are usually in the form of coproduction, subcontracting, etc.; while IOs involve measures such as investments or skills training programmes that are sponsored by the obligor.

Offsets can provide significant opportunities to foster innovation. For instance, South Korea’s assessment parameters, in terms of bidders for its F-X III fighter programme, weighted offsets and technology-transfer at 17% of the total evaluation score; while acquisition costs accounted for only 15%. In search for economic competitive advantage through the processes of the knowledge economy, nations are increasingly expected to turn to offsets for technology transfer of advanced manufacturing skills. An example includes the recent move by India towards finalising a DOs policy that will mandate foreign contractors to establish manufacturing bases in India as part of the nation’s 'Make in India' campaign.

Despite the apparently conflicting interests of the sellers and procurers in the defense offsets industry, a focus on a ‘win-win’ approach can unlock mutual value. Offsets, if used strategically, can allow a procuring country to develop progress towards expertise in sophisticated manufacturing and allied services, leading to economic transformation in terms of capabilities over a period of time. A case in point is South Korea, which through its Defense Reform Plan 2020 (enacted in 2005), focused attention on a self-reliant defense manufacturing posture through enhancing indigenous capabilities and raising defense R&D spend.

Using a sophisticated policy framework to direct offsets has allowed South Korea to develop the nation’s private defense industry aggressively. The country’s few large industrial conglomerates (chaebols), like Samsung and Hyundai, have profited from technologies transfer in terms of arms production. This has allowed them to develop diversified industrial manufacturing capabilities, allowing them to spread their business enterprises throughout many parts of the world via multiple innovations in areas like smartphones, automobiles, construction of refineries, etc. However, developing expansive manufacturing expertise and fostering an ecosystem of innovation requires a policy of a determined step-by-step development plan on the part of the procuring countries.

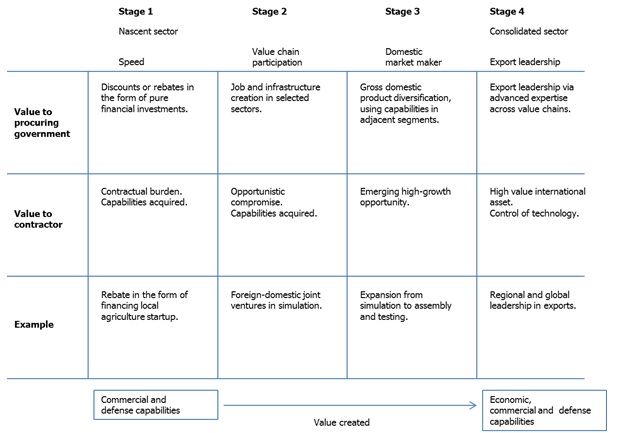

Figure: The Step-by-step Development of Offset Programs

Source: Vats et al. 2013

Offset arrangements can allow local supply chains to take shape in procuring countries. For instance, in June 2015, Brazil announced that it would receive $9.1 billion in the form of offset arrangements as part of Brazil purchasing the Saab (Sweden) Gripen NG fighter planes. Several Brazilian companies (such as Akaer, Embraer, etc.) will receive the offsets. For instance, Akaer will support development of structural components and composite materials for the Gripen NG fighter planes purchase programme; while another Brazilian company, called Mectron, will hold the mandate for integrating weapon systems. Also, reports indicated that a total of 250 Brazilian scientists, engineers, and technicians could be sent to Sweden for training purposes, and for enhancing their knowledge of fighter aircraft technologies. These developments, together, could provide for Brazil a strong ecosystem for developing its own aviation technologies cluster.

For many countries in the GCC, offsets are an effective platform for furthering efforts on job creation, technology transfer and training for nationals. The Tawazun Economic Council, which oversees the UAE’s offset programme, was instrumental in Boeing (the U.S.-based plane manufacturer) joining hands with the UAE-based Tawazun Precision Industries (TPI) for commencing the construction of a new metallic parts treatment facility, in Abu Dhabi, in June 2015. The programme will infuse a new aerospace manufacturing capability in the UAE, and will be the first such industrial capacity in the GCC region.

There are other successful case studies from the UAE in terms of innovation and economic diversification through offsets. In June 2015, it was announced that Strata, a Mubadala-owned company that is based in Al Ain (the UAE), will manufacture parts worth $80 million for Airbus in 2015 as part of offset agreements. It is expected that Strata will go on to manufacture composite parts for the A350 and A320 by 2020. Many analysts are pointing out that the defense industry is allowing the UAE to develop a sophisticated industrial base through the medium of offsets. Tactical and strategic use of offsets is allowing UAE companies to perform in various fields such as vehicle manufacturing, repair and overhaul, geospatial mapping, etc. The Enigma Armoured Modular Fighting Vehicle, which was unveiled in February 2015, by the Abu Dhabi-based Emirates Defense Technology (EDT) is a case in point.

In order for offsets to support thriving of innovation, a complete ecosystem of private and public sector institutions is needed. The ecosystem should allow synergies and networks to develop between various elements like technology acquisition, application oriented R&D, passionate and skilled workforce, favorable regulations, strong intellectual property regime, etc. Also, the offset policy should be clearly tailored to national circumstances. For instance, not all countries will require a very robust defense industry due to a relaxed security environment, in which case offsets can be directed into non-defense related industrial sectors more readily. This means that a procuring country’s offset policy should be clear about defining the sectors of focus in a precise manner, concentrated efforts in areas where the country already has or can build credible competitive advantage that is sustainable.

According to experts and analysts, the world has entered into the age of the “fourth industrial revolution” (Industry 4.0). The first industrial revolution was sparked by introduction of machines in the 18th century. The arrival of electricity stimulated mass production, creating the second industrial revolution during the early part of the 20th century. The 1970s saw the third wave of industrialization through automation. Currently, the pervasiveness of the internet, mobile devices and cloud computing, have aligned to disrupt and revolutionize manufacturing. Offsets can be used to leverage the trend of Industry 4.0 in terms of innovating in areas that show promise as the technologies of the present and the future.