KSA Insurance: Is it ripe for consolidation?

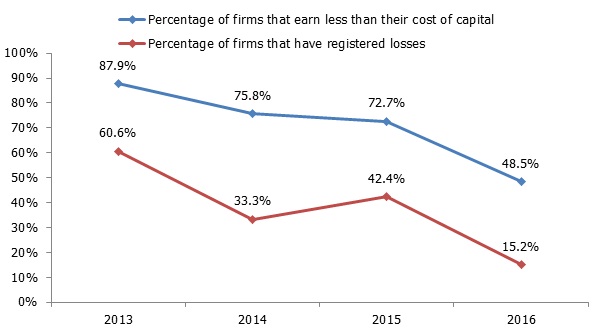

In Saudi Arabia, there are more than 35 companies that are licensed to provide insurance services, further there are 150+ companies that offer insurance support services and allied activities. Together, they generated business, as measured by gross written premium, worth USD 9.9bn last year. However, the profitability of the sector remains low and inadequate. Almost half of the companies reported losses and even among those that reported profits, less than half of them were able to earn higher returns than their capital costs. Thus, effectively, three-fourths of the companies were depleting their capital.

Figure: Percentage of firms that register losses and those which earn less than their capital costs

Source: Reuters, Marmore Research

While certain insurance players especially those who are backed by international players such as Allianz Saudi Fransi Cooperative Insurance Company (Allianz), AXA Cooperative Insurance company (AXA) Bupa Arabia (Bupa), Metlife AIG-ANB Cooperative insurance (Metlife) and those which are subsidiaries of Saudi Arabian banks – Al Rajhi company for cooperative insurance (Al Rajhi), SABB Takaful company (SABB) have deep pockets to tide over the situation, smaller players are bound to struggle for their survival.

Lower profit levels in the sector are attributed to the high expense ratio (expenses associated with acquiring, underwriting and servicing premiums by net premiums earned) of the firms. The sector is largely fragmented and as a result, high commissions are being paid to brokers to gain business volumes. Further, the presence of large number of player’s increases competition and often premiums are priced so low, that the loss ratio increases (difference between premium earned and claims settled). Together, for most companies’ loss and expense ratio (also known as, combined ratio) exceeds 100% implying an underwriting loss and unprofitable business.

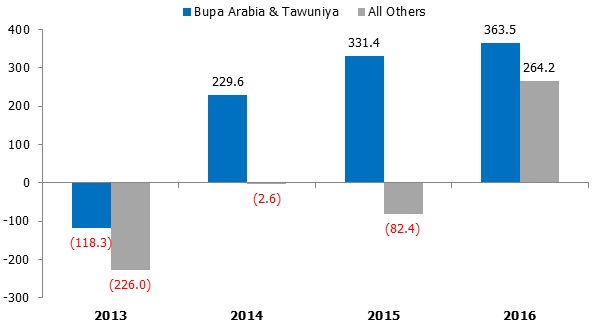

Interestingly, despite the presence of large number of players, insurance industry in Saudi Arabia is characterized by high degree of concentration with the top five players accounting for over 60% of market share. The rest who run smaller operations compete fiercely to win the remaining share, exerting pressure on all participants in the sector. With most insurance players being publicly listed the need to perform and deliver is enormous. Larger insurance players enjoy higher economies of scale which enable them to profitably undercut their smaller rivals, while smaller players struggle to establish their feet in the competitive but promising landscape.

Figure: Net Profits of Saudi Insurance Companies (USD mn)

Source: Reuters, Marmore Research

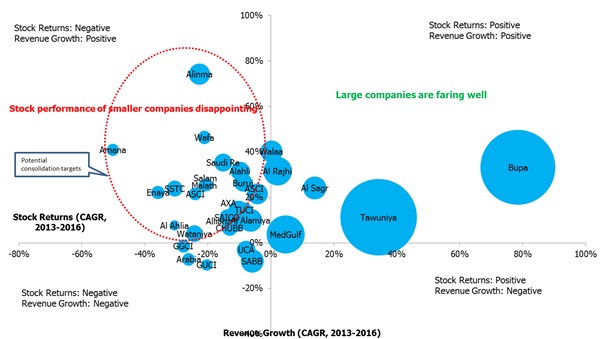

Smaller players in order to survive in the competitive market, where their profits are largely squeezed, could consider merging with one another and consolidate their operations. Though the talks of consolidation in Saudi Arabia insurance sector have been echoing for long, nothing ever materialized. The small players despite facing financial difficulties were reluctant to relinquish control over their businesses. Driven by the attractive growth potential, the sector commanded rich valuations even for the loss making smaller ones. This made acquisition of small players illogical at such lofty stock prices.

Figure: Potential targets for consolidation

Source: Reuters, Marmore Research

Note: Size represents market capitalization of the firm

In the past, faced with a similar situation in Saudi Arabian banking sector the regulator – Saudi Arabian Monetary Agency (SAMA) successfully oversaw the consolidation of the sector and reduced the number of players to just 12. Similarly, the insurance market regulator should come forth with policies that would encourage consolidation, prevent predatory pricing and restore healthy competition among the players.

In this regard, Saudi Arabian Monetary Agency (SAMA) recently introduced a regulatory change which required the players to implement actuarial pricing for their policies. In actuarial pricing system, premiums are calculated by actuaries based on loss and expense expectations, so as to deliver an underwriting profit in normal circumstances. The new rule was introduced to effectively end the practice of predatory pricing wherein the insurers were selling their policies at low premiums, which often led them to register losses.

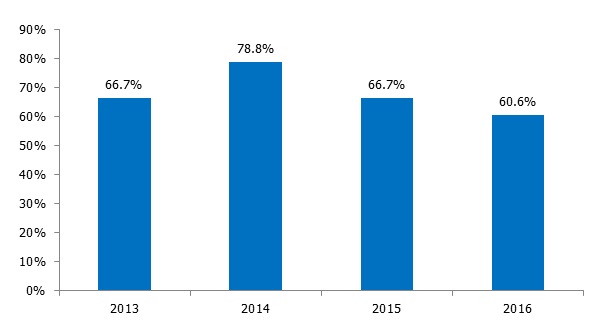

Figure: Percentage of KSA Insurance firms with negative yearly stock returns

Source: Reuters, Marmore Research

Stock market has taken cognizance of this fact; subsequently, the stock prices of insurers which have been struggling to make profits have been hit hard and witnessed declines by almost 50% in their value. This effectively lowered their valuations and makes them an attractive candidate for acquisition.

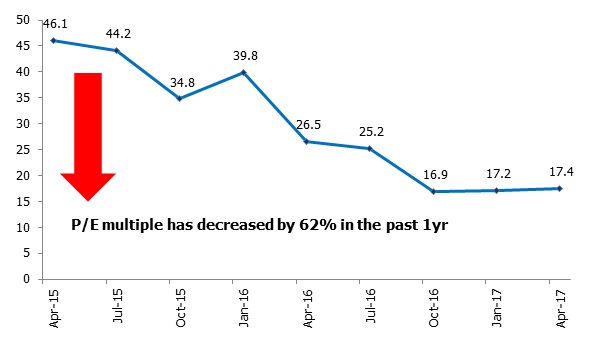

Figure: P/E of Saudi Arabia Insurance Sector

Source: Reuters, Marmore Research

Merger and Acquisitions’ (M&A’s) have been on the rise in Gulf region since the oil price fall. High profile mergers to realise economies of scale and save on operational costs were witnessed such as, IPIC & Mubadala and National Bank of Abu Dhabi and FGB. In March 2017, small insurance players in Saudi Arabia – Al Ahlia Cooperative Insurance and Gulf Union Cooperative Insurance had reported that initial talks for merger are on. Recently, Bloomberg reported that The Mediterranean & Gulf Insurance & Reinsurance Co, popularly known as MedGulf is evaluating options to sell its stake. We believe, the sector is in the cusp of consolidation with cheaper valuations, better regulatory environment and improvements in profitability.