Kuwait and GCC Markets Give up some of the gains in August

According to our recently released Monthly Market Review for the month of August, the positive momentum that prevailed in the recent months among GCC indices has halted during the month as the investors booked their profits. Turmoil in Turkey and pull out of much and long awaited IPO of Saudi Aramco contributed to the negative sentiment.

Kuwait all share index lost 0.7% for the month. Despite the losses registered in this month, Saudi Arabian and Kuwait indices’ returns for the year remained healthy at 10.0% and 4.5%, respectively. Among Kuwait’s blue chip companies, Zain was the leading decliner, down by 1.9% during the month while Boubyan Bank share price moved upwards, gaining 2.5% in August. The decline in Zain stock was due to investors partially booking profits after it posted strong financials earlier during the month. The average traded value of Kuwait All Share index dipped by ~21% in the month of August to USD 69.25Mn as compared to previous month. The liquidity was affected mainly due to subdued trading due to summer month lull.

The S&P GCC index a comprehensive benchmark that covers stocks from all GCC countries, was down 2.5% for the month, reducing the overall gains for the year to 9.6%. During the month of August, Saudi Arabia’s Tadawul index lost 4.2% as selling pressure from foreign investors intensified. Abu Dhabi index was the best performer in the region for the month, gaining 2.6% and pushing its YTD returns to 13.4%. This was in sharp contrast to the Dubai market, which lost 3.9% for the month, extending its losses to 15.7% for the year. In terms of YTD performance, Qatar index delivered 16.0% since the beginning of the year making it the best performing market across emerging and developed markets globally. Qatar markets continued to remain strong post Moody’s decision to change the country’s sovereign outlook from negative to stable.

Ezdan Holdings and First Abu Dhabi Bank and were the top performers among GCC blue chip companies, rising by 14.4% and 8.8% during the month respectively. The First Abu Dhabi Bank posted strong financials during the first half of 2018. The group’s net profit rose by 10% yoy to AED 6.1Bn (USD 1.16b). The biggest lender in the UAE is also expected to have its weighting in the MSCI Emerging Markets Index doubled to almost 0.2% in November. Ezdan Holding Group too saw a surge in profits by 52.5% in Q2 2018 as compared to same period last year. Ezdan’s net profits amounted to QAR 320.11Mn (USD 88.4Mn) in the period between April to June.

MSCI EM index also remained under selling pressure, as investors’ appetite remained weak due to global uncertainties like EM currency depreciation against USD, trade war concerns, etc. MSCI EM index closed 2.9% down. On the other hand, MSCI World index ended the month on a positive note, registering 1.0% gain for the month.

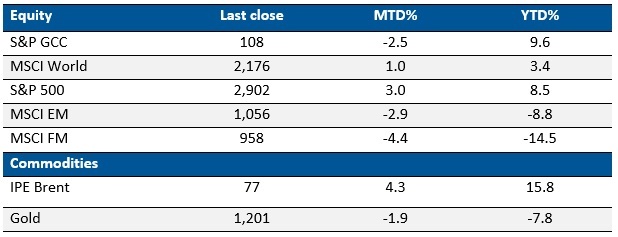

Global Market Trends – Aug 2018

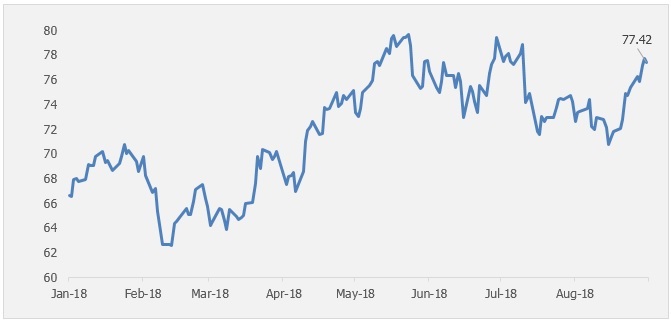

Oil Market Review

Oil prices showed a sharp recovery towards the end of the month, thereby leading to a positive return of 4.3% during the month, increasing the YTD gains to 15.8%. Oil prices hovered around the USD 70 per barrel mark during the month as the fears on trade tension that could crimp global economic growth and increase financial vulnerability intensified. However, it ended the month on a positive note closing at USD 77.4 per barrel as the Unipec of China affirmed that it would resume purchasing of U.S crude oil from October combined with higher than anticipated production cut by OPEC led coalition. OPEC has anticipated oil demand growth to increase by 1.64 mb/d in 2018 with demand growth mainly coming from non-OECD nations such as China and India. Non-OPEC oil supply in 2018 is expected to average 59.62 mb/d, representing an increase of 2.08 mb/d y-o-y. Non-OPEC oil supply in 2019 is projected to reach an average of 61.75 mb/d.

Brent Crude price in USD per barrel

Source: Reuters

MENA Market Trends

Saudi Aramco IPO dilemma

Saudi Arabia has been planning to float its national oil company Saudi Aramco on the equity market for the past two years. According to media reports, Saudi Arabia has put the IPO on hold. The public listing that brings along increased scrutiny and disclosure requirements is cited as one of the main reason behind putting the IPO on hold. Recovery of oil price, which has now more than doubled since its low in 2016 and successful issuance of bonds to raise capital from international markets has enabled KSA to better manage its finances. Further, the oil giant has hinted towards a proposed stake in local petrochemicals maker Saudi Basic Industries Corp. (SABIC). This could imply Saudi Arabia’s sovereign fund may look to borrow up to USD 11Bn from international banks with a spread of 75 basis points over LIBOR.