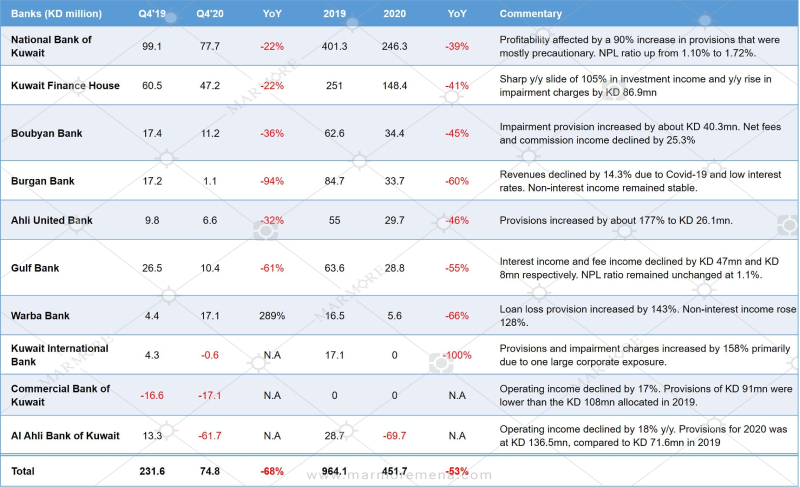

Kuwaiti banks – Earnings report 2020

All major Kuwaiti banks reported their financial results for the fourth quarter of 2020 and that of the whole year. As expected, all the banks reported a reduction in net profits for 2020 compared to that of 2019 mainly due to the increase in provisions and impairment charges for bad loans caused by COVID-19’s disruption to the economy.

Exhibit 1: Earnings scorecard – Kuwaiti banks

Source: Boursa Kuwait, Refinitiv, Corporate Disclosures

Kuwaiti Banks continue to clean up their balance sheets

With the exception of Commercial Bank of Kuwait, all banks saw an increase in provisions for 2020 compared to 2019. Loan loss provisions charged on the banks’ income statements reached about KD 852 million in 2020. The NPL ratio, which is the ratio of non-performing loans to total loans increased from 1.5% in 2019 to 2% in 2020, according to the Central Bank of Kuwait (CBK). As result, the Provision Coverage Ratio (PCR) that is the ratio of provisions to non-performing loans stood at 222% for 2020, falling from 271% in 2019 as NPLs rose faster than provisions. PCR despite coming down is still at a high level because Kuwaiti banks have been proactively providing provisions in the past few years.

Dividends slashed for 2020

The CBK had allowed banks to distribute cash dividends for FY2020, as they had not utilized their capital conservation buffers. However, only 4 Kuwaiti banks announced cash dividends for 2020 and all of them announced lower dividends compared to 2019. Most banks have maintained their bonus shares distribution.

Exhibit 2: Dividends declared by Kuwaiti banks

Source: Boursa Kuwait, Corporate Disclosures

Despite CBK giving the go ahead to pay dividends, many banks did not do so, in order to strengthen the balance sheet and improve liquidity. The decline in aggregate net profits by 53% in 2020 and the increase in provisions have also been a factor in lower dividend payments. However, the rebound in oil prices and the eventual normalising of the economy due to vaccinations may see a reduction in bad loans in 2021. This and the relatively strong balance sheets of Kuwaiti banks may see a return to normal dividend payments by banks in 2021, if earnings recovery materialises.

Downside risks for banks could be a downgrade of Kuwait’s sovereign ratings because of the failure to pass the debt law. Kuwait banks are closely linked to the government finances and are likely to see a downgrade if the sovereign rating is downgraded as it happened when Fitch ratings changed Kuwait’s outlook to ‘Negative’ last month. An increase in NPLs due to slower recovery in oil prices and a further rise in COVID-19 cases are other risks facing banks.

The article is an excerpt from our “GCC Capital Markets Monthly Review: February 2021” report. Read more