MENA Markets end 2016 on a positive note

Egypt index was buoyed by the government’s recent decisions, notably the liberalization of the Egyptian pound exchange rate to foreign currencies. Market capitalization of listed companies witnessed a 42 percent leap exceeding USD 33.1billion, the highest in 8 years since the global financial crisis in 2008. Market turnovers posted during the year was the highest in seven years, as the traded values rose over 55 per cent higher over 2015.

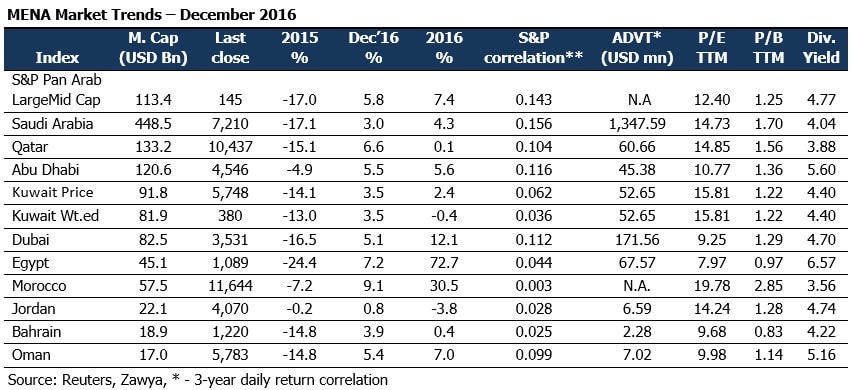

MENA markets liquidity continued its downward momentum in December, with volumes decreasing by 20 per cent and value traded by 4.8 per cent. All MENA markets, barring Saudi Arabia, witnessed fall in market liquidity in December, with Abu Dhabi and Egypt leading the charge. Overall MENA liquidity for the year was down 34 per cent compared to previous year’s turnover of USD 551bn. In terms of valuation, P/E of Morocco (19.8x), Kuwait (15.8x), and Qatar (14.8x) markets were the premium markets in the MENA region, while the markets of Egypt (8.0x), Dubai (9.2x), and Bahrain (9.7x) were the discount markets.

Blue Chips also had a positive month, with Saudi Electric and DP World (UAE) ending the month at the top of the pile, gaining 16.7 per cent and 12.7 per cent, respectively. SABIC (KSA) lagged behind the rest of the blue chips, falling by 3.4 per cent. Saudi Electric was also the best performing stock in 2016, rising over 42 per cent, and was followed by Ooredoo (Qatar, 36 per cent) and Industries Qatar (30 per cent). The Saudi Electricity Company announced the launch of 16 innovative projects to start 2017 that aim to enhance power efficiency in the Kingdom.

Saudi 2017 Budget

As part of its long-term plan to end its economy’s dependence on oil, Saudi Arabia unveiled its budget for 2017. Saudi Arabia plans to increase spending in 2017 to stimulate economic growth after austerity measures helped shrink its budget deficit, as the kingdom continues to by boost private sector activity. Deficit for 2016 has shrunk to USD 79.2bn, lower than what the government and most analysts had predicted, down 33 per cent from a record USD 97.6bn the previous year. It expects to run a deficit of USD 53bn in 2017, about 7.7 per cent of 2017 GDP estimates, and hopes to balance its finances by 2020.

The government plans to spend USD 237bn in 2017, an 8 per cent increase from 2016The Kingdom is expected to spend USD 71.4bn on National Transformation Plan through 2020; of which USD 11.2bn is allocated in 2017. Oil-income contributed to 62.3 per cent of government revenues in 2016, down from 73 per cent in 2015. Non-oil revenues are expected to total USD 53bn in 2016, still far from the target the government set in June of USD 141bn by 2020. The 2017 deficit will continue to be financed by issuing debt and drawing from reserves.

Oil Market Review

Brent crude rose 12.6 per cent to close the year 2016 at USD 56.28 per barrel, having nearly doubled since the low witnessed in January 2016. Prices shot up due to the expectation that production cut from major oil producers will curb oversupply in the market. OPEC and non-OPEC producers agreed to reduce crude oil production by 1.8 million bpd for six months from January 2017.