MENA markets tumble in line with oil

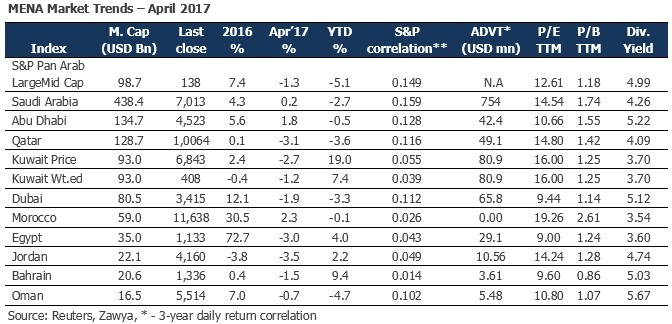

Value traded and volumes in March reflected a mixed market mood, with volume traded, dropping by 22% while the turnover in the market increased by 34.6%. All MENA markets, barring Saudi Arabia and Dubai, witnessed increase in turnover in March. Dubai and Abu Dhabi witnessed the maximum fall in liquidity with volume declining by 41% and 40% respectively. In terms of valuation, P/E of Morocco (19.18x), Kuwait (16.2x), and Qatar (15.06x) markets were at premium, 8while the markets of Dubai (9.39x), Egypt (9.4x), and Bahrain (10.06x) were the discount markets in the MENA region.

Many blue chips were in the red in April, while few companies such as National Bank of Abu Dhabi (NBAD) gained. The post-merger listing of NBAD and investors focus on specific stocks in the real estate and banking sector pushed the share prices of NBAD up by 7.8%. Mashraf Al Rayan’s stocks increased by 5.1% following positive earnings growth reported in Q1 2017 and increasing revenue from core operations. SABIC’s stocks gained 2.1% last month, as analyst expectations on the petrochemical sector remained positive. Petrochemical companies are expected to benefit from the higher prices of end products resulting in better earnings compared to the previous quarters. Industries Qatar and Kuwait Finance House were the stragglers, down by 11.7%, 7.3% and 7.2% respectively. Selling pressures in Qatar stock exchange especially in the large cap segment by GCC institutions dragged down the prices of many blue chips in Qatar.

GCC Projects on an uptick in Q1 2017, Saudi Arabia lags behind

Project awards in GCC reverted back in the first quarter of 2017 after remaining sluggish in 2016. Value of projects in GCC increased by 22.6% in Q1 2017 compared to the last quarter of 2016 while the increase was 16.1% on a year-on year basis. UAE was the star among GCC nations in terms of increase in projects’ spending, though the largest economy in the region, Saudi Arabia failed to cash in on the momentum. It was the only GCC country to report a fall in projects value by 29.3% in Q1 2017 (QoQ). The value of UAE projects awarded surged by 42.6% quarter on quarter in the first quarter of 2017, with both Dubai and Abu Dhabi seeing significant increase.

Oil and gas projects value expanded by 18.5% in Q1 2017 (QoQ), Kuwait being the forerunner followed by UAE in oil, while Oman topped in terms of investments in gas projects during the period. Kuwait has surpassed Qatar in the first quarter of 2017 becoming the third largest nation in the region in terms of value of projects being executed. However, concerns remain in Kuwait over the increasing delays and re-tendering of many big-ticket projects especially in utilities sector.

Oil Market Review

Brent crude declined by 2.08% in April 2017 declining to USD 51.73 compared to USD 52.83 at the end of March 2017. Concerns over increasing supply from U.S shale producers and Libya’s restart of production in Sharara oil field rattled the oil markets further in April. The confidence provided by OPEC’s commitments has not been sufficient to curtail the fall in oil prices.