Never Scream Sell in GCC!

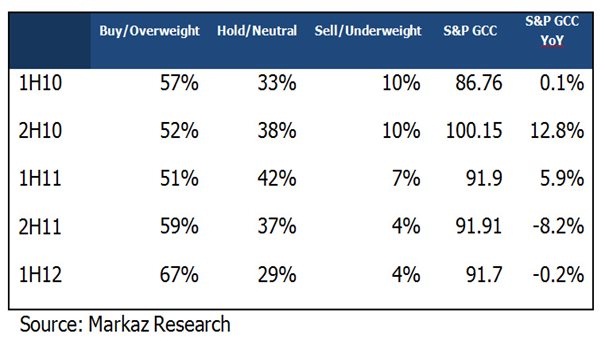

We have been regularly monitoring analysts’ recommendations in GCC and notice a weird trend. Most of the calls are either buy or hold. Look at the table below:

Table 1- Recommendations Vs the S&P GCC

Since 2010, analysts scream either a buy or hold nearly 90% of the time. In the 2.5 years of study, only during 2H 2010 the market turned reasonably positive validating the scream. In all the other cases, the market movement was totally in contrast to the scream, especially during 2H 2011 when markets tanked 8.2% while 96% of recommendations were either buy or hold. This applies even at stock specific levels. We produce below some instances where analysts steadfastly screamed buy regardless of sharp drop in share price and sideway movement for a long time.

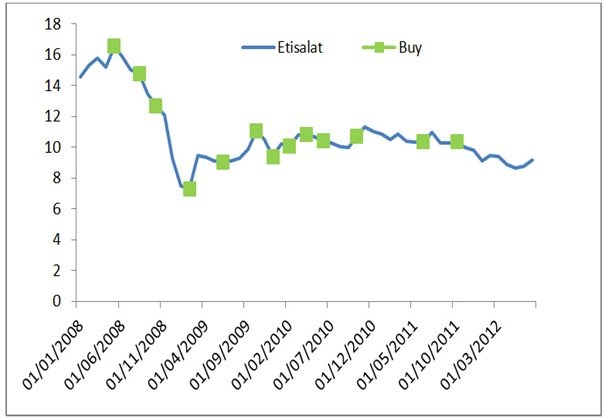

Etisalat is a classic example where analysts were screaming buy from Dhs 16 all the way to Dhs 6.5! Thereafter the stock moved sideways since the last 2 years and even then analysts still screamed buy all the way. Another good example would be First Gulf Bank.

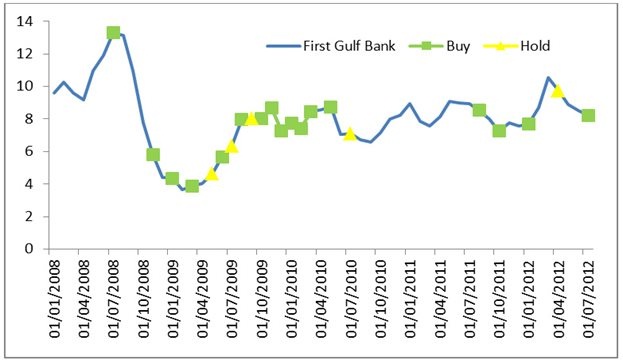

Analysts screamed buy when the stock was quoting at Dhs 13 and they continue to yell buy till the stock tanked to Dhs 4! After this episode, we notice a string of buy recommendations and some hold recommendations while the stock moved sideways for the last 2 years.

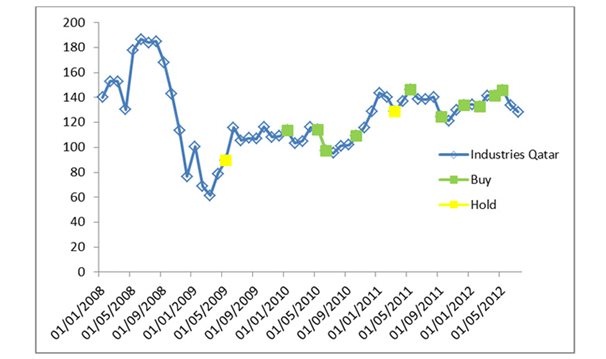

While we did not notice buy screams for Industries Qatar at the peak of the market in 2008, we noticed several hold and buy recommendations during the last few years when the stock performance was more or less flat.

So, the aggregate data presented in the tables above as well as stock level calls presented clearly point to one trend: analyst’s pre disposition to scream buy or hold rather than sell. We must say here that it is quite possible that we may have missed out on some recommendations especially those research notes that are proprietary and are not freely available for public viewing. In spite of this failing, we still believe that analysts are more prone to issue a buy/hold rating on a stock in GCC than sell.

It is interesting to understand the psychology behind this phenomenon which we espoused in our earlier blog and we feel they still stand the test. Here is our list of reasoning:

1. Buy recommendations can be acted upon even by new investors (suits the agenda of sell side brokers) while sell recommendations can only be acted by those who hold them (small universe)

2. Sell recommendations are almost always unpopular with companies and hence will not serve investment banking needs and other favours.

3. Sell recommendations are not acted upon as much as buy recommendations as it means accepting a mistake. (Behavioural finance!). It is difficult to take small loss than a poor but positive return.

4. Analysts are well served by companies they research when they give buy recommendation. They will have more access to information (extremely critical in GCC) next time around since they are in good books of the company.

5. In the GCC, absence of derivatives market makes it difficult to action sell recommendations except by portfolio managers. Even where derivatives market enables one to short, since the loss on short position tends to be unlimited, it has limited application (given the risk management pressure).

For these reasons, we believe GCC will be a “buyers” market for some time to come.