Online vs Offline war at GCCs doorstep

This fright has turned into a reality in many developed markets like US, where the accelerated shift of Americans shopping via internet has pushed several retail companies into bankruptcy. Approximately 8,640 stores with 147mn square feet of retailing space is expected to close down in US during 2017 (Source: Credit Suisse). The fact that number of stores expected to close in 2017, surpasses the level of closures after the financial crisis and dotcom bust, signifies the enormity of the threat the conventional retail industry faces from the e-commerce segment.

The current state of the US conventional retail segment prompts the need to address the following questions in the GCC context.

- Is this fear for real and can the GCC malls face a similar scenario in the near future?

- Does this present a great opportunity for the GCC retailer to transform and embrace technology to improve their business?

We delve into this incongruity and try to understand if online can really beat offline sales in the GCC as it is feared in the developed markets.

Size matters…

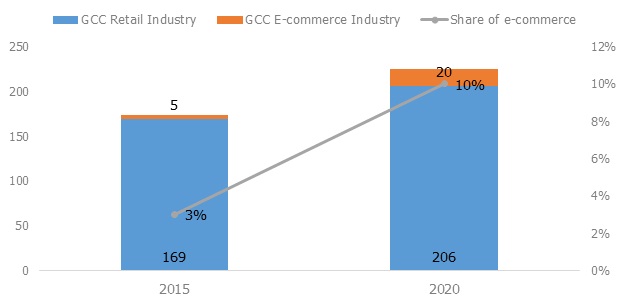

The GCC e-commerce industry is expected to grow at a CAGR of 30% to reach from USD 5bn in 2015 to USD 20bn at the end of 2020. While, the conventional retail market size in GCC is expected to be at USD 206 billion by 2020 registering a CAGR of 4% during the same period. Though the pace at which the regional e-commerce industry is expected to grow is commendable, it would only account for 10% of the entire regional retail sales. Given the size of the conventional retail industry in the region, it would take the e-commerce segment considerable duration before it poses a major threat. We believe there is enough space for both segments currently and physical stores have time to pull up their socks and think of ways to beat the online competition. The fear is not so near as generally perceived.

Figure: GCC Retail Market Size (in USD billions)

Source: A.T. Kearney, Marmore Research

Malls yet to reach saturation levels

The conventional segment in the region is still in its growth stage. Some of the factors that testify that the industry is yet to reach saturation are the steady supply of the retail real estate, lower concentration of the market, limited presence of international players and consumer spending.

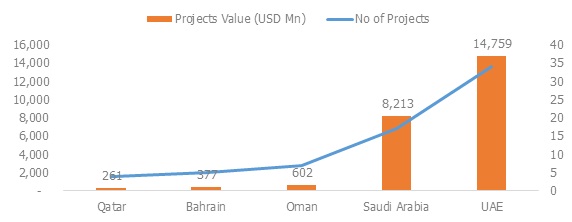

Figure: Ongoing Retail Projects Details

Source: Jones Lang LaSalle, Markaz Research

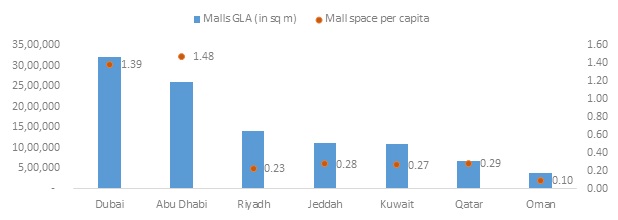

The numerous mall developments in the pipeline are a testament to immense opportunities in the sector. Unlike, the US market which witnessed dramatic overbuilding of stores resulting in excessive retail space, the retail space density in most of the GCC countries is still sparse. The GLA retail space per capita in US is around 2.3sq m (4.6 sq m, if small shopping centers and independent retailers are added)(Source: Forbes) as against 1.39sq m in Dubai and 1.48sq m in Abu Dhabi. These numbers indicate that there is still enough room for conventional retail space to grow.

Figure: Malls Gross Leasing Area (GLA) per Capita

Source: Jones Lang LaSalle, Markaz Research

Cultural Influence

The divergent cultural and climatic aspects of the GCC region from the US and European markets, emphasize the need to gauge the regional retail industry differently. Larger and well bonded families, regular outings, high per capita spending and lack of other entertainment avenues make malls an exciting place to be. Mall of Emirates is the seventh most productive shopping centre across the world earning USD 1,423 per square feet per annum (Source: International Council of Shopping Centers (ICSC)). Emaar Malls collectively had 125 million visitors during 2016, similar to annual footfall during 2015. While, Dubai Mall being the most visited shopping destination attracted over 80million visitors for third consecutive year since 2014 compared to 65 miilion visitors in 2012. This is higher than the total number of visitors to Niagara Falls & Central Park (NY) put together. Going to the mall is an integral part of the region’s culture. Malls offer a unique proposition of entertainment plus shopping and continue to be the choice of destination for shoppers as it offers a wholesome experience.

Table 6.3: Characteristics of Various Mall Type

| Mall Category | Features | Catchment Area | Visitors Frequency |

| Upscale Mall | Mid-Tier Malls | Global Audience across countries | Monthly / Quarterly |

| Mid-Tier Malls | Leisure Shopping | Nearby Regions | Monthly |

| Community Malls | Caters to the primary needs of consumer. | Adjacent Neighbourhoods | Daily / Weekly |

The other side of the story-challenges faced by online retailers

While the customers are gradually favouring online purchases there are region specific impediments to the growth. The biggest hurdle for the growth of E-commerce industry in the region is the lack of consumer trust and awareness. The GCC consumers are still wary of shopping online, fearing fraud, data security and privacy issues. Moreover, the e-commerce ecosystem such as digital banking distribution and logistical infrastructure is largely underdeveloped. The GCC banking industry is facing huge challenges in meeting customer expectations in digital experience, relatively few people have credit cards and online payment systems are in their infancy. The region still relies heavily on cash-on-delivery which makes an online shopping operation even more difficult to manage. Cash-on-delivery can result in problems with returns or undelivered items, and often means higher costs, making it an unattractive option.

To adapt or perish

For now e-commerce industry doesn’t pose considerable threat to the GCC region’s physical retail. However, if conventional retailers are too complacent and fail to react to the changing trend, they are likely to lose their market share as witnessed in developed markets. A viable option for the conventional retailers is to adopt to the hybrid retail model, which involves having both an online and offline store presence. Using a brick and click model, retailers can leverage upon their e-commerce sites by providing information about the latest products, sales, and deals in a physical store. This in return attracts customers to the physical store either to look at the product or to collect their purchased product. This way the hybrid model is a win-win arrangement for both the conventional retailers and the customers.