-

[gtranslate]

- Login

November 2020

GCC Banking Mergers: A second wave imminent?

Price : $250

Industry Research Report

Pages : 36

Executive Summary

“The GCC banking sector, which has been dormant in terms of major M&A activity over the past two decades, has seen a sudden surge in M&A related announcements since 2017. Another wave of banking mergers in the GCC is likely to be triggered in 2020 as the coronavirus crisis has severely altered the global economic landscape. The dual challenge of low oil prices and the slowdown in economic activity will hit the profitability of GCC banks due to shrinking net interest margins and deteriorating asset quality.

Although mergers theoretically provide several benefits to the merging banks, the banking industry, and the economy, history suggests that not all mergers end up being successful from the shareholder perspective. Analysing some of the major GCC banking mergers in the past throws light in this regard and provides valuable insights on what to expect from upcoming mergers.

Key Highlights

- Another wave of banking mergers in the GCC is likely to be triggered as the COVID-19 crisis has severely altered the global economic landscape. The dual challenge of low oil prices and the slowdown in economic activity will hit the profitability of GCC banks due to shrinking net interest margins and deteriorating asset quality.

- Although mergers theoretically provide several benefits to the merging banks, the banking industry, and the economy, history suggests that not all mergers end up being successful from the shareholder perspective.

- Analysing some of the major GCC banking mergers in the past provides valuable insights on what to expect from upcoming mergers.

Key Questions

- Do mergers in the GCC banking sector create value for their shareholders?

- Will COVID-19 trigger a second merger wave in the GCC banking industry?

- What were the key mergers in the GCC region in the past two decades? Did they succeed?

Why purchase the report?

- The report analyses whether previous banking mergers in the GCC have created value for the shareholders.

- The report will benefit anyone who seeks to study the impact of mergers on the performance of GCC banks.

- Considering the expectations of further consolidation in the GCC banking industry post-COVID-19, the report provides insights on how key mergers in the past have fared.

- It would also provide direction on what to expect from the upcoming mergers.

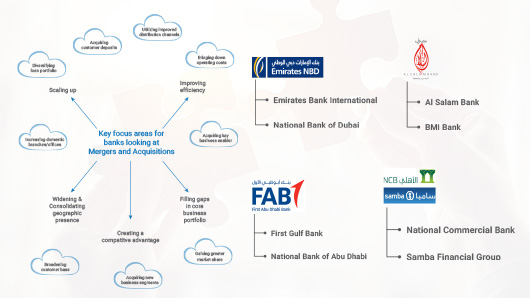

- The report extensively covers the mergers of Emirates NBD, Al Salam Bank, First Abu Dhabi Bank and National Commercial Bank + Samba.

Table of Content

- Overview

- Why do banks opt for mergers and acquisitions?

- GCC Banking Merger Wave

- Case Studies

- Conclusion

- Appendix

Key Questions Addressed in this report

This report can add value to

Customize this report

Why Custom Research?

- Research and intelligence to suit your business requirements

- Informed decision making

What are Benefits of Customization?

- To-the-point, long or short research reports could be requested

- Reports are exclusively prepared for you

You Ask We Deliver

- Over a decade Marmore has successfully navigated this space of customized research to serve its clients and cater to their unique requirements.

- Our customized research support spans sector research, equity and credit investment notes, modelling, valuation, investment screening, periodical etc.

- We offer clients with intelligence and insights on unexplored and under-researched areas that help stakeholders take well-informed business and investment decisions.

- Our offerings marries the challenges of cost, time, scope & data availability to generate actionable outcomes that are specific to our clients’ needs.

FAQ

Who prepared this report?Experienced and qualified team of Marmore MENA Intelligence has prepared this report. Since its inception, Marmore has published over 1000 research reports and covered more than 25 varied industries and policy segments; all focused primarily on the GCC economies.

How exhaustive is this report?

The report spans 36 pages

Do you have updates?

No. This is a one off report.

Can I only download certain sections of the report?

No. The report can be downloaded in full length only

Can we ask questions?

Yes, by all means. You can write your queries to us at enquiry@e-marmore.com

Executive Summary

Table of Content

Key Questions Addressed in this report

This report can add value to

Customize this report

FAQ

Related Reports

April 2018

February 2019

July 2021