The Impact of VAT on Key Kuwaiti Sectors

This article was originally published in Kuwait Times.

Decrease in oil prices have led the member countries of GCC in search for alternative means of revenue. One way was to introduce a common tax called Value Added Tax (VAT) in the region. On July 09, 2017 two members of GCC, Saudi Arabia and UAE ratified the VAT framework agreement for the introduction of VAT in the region. With a tax rate of 5%, it will be applicable in the entire region with certain goods and services to be treated as zero rated (Zero Rated: The government does not tax sales of goods and services, but allow to claim credit on input tax of those goods.) or VAT exempt. (VAT Exempt: The government does not tax sales of goods and services and also does not allow to claim credit on input tax of those goods.)

With the taxation being implemented on January, 2018 in these two countries, other members are following suit to implement it by 2019. As draft regulations for VAT in Kuwait have not been declared, through this note, we will try to determine the impact of VAT on certain key sectors of Kuwait.

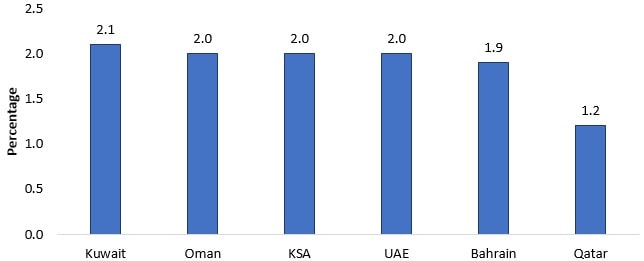

Graph: Estimated VAT Revenue (% of GDP in 2018)

Source: National Bank of Abu Dhabi

Transportation & Logistics

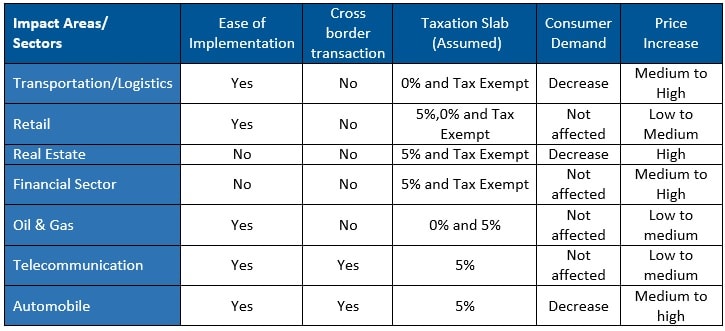

As per the VAT framework, commercial transportation service for passengers and goods from Kuwait to international countries and other GCC countries will be subjected to VAT and will be treated as zero-rated. Kuwait has the option for charging tax on domestic commercial transportation of travelling passengers (which includes air travel and road travel) and goods which if implemented will make them costlier within the country. While it will be easy to implement the tax on the final price of the services provided, overall cost might increase. This may be due to the introduction of tax to fuel prices and other services related to transportation. VAT might have minimum impact on travellers due to small increase in price. As for transportation of goods, price hike will likely increase the price in the supply chain of a company. This will impact profitability and increase the cost of doing business. Due to 0% VAT, inflation will not impact international transportation of passengers and goods. As for domestic services, there is an expected spike in inflation if VAT is levied which is expected to smoothen over time.

Retail Sector

This sector will see the biggest impact as VAT would be levied on all consumer goods and products. The stores will be charged an input VAT for which an output VAT will be calculated and included in the final price for the customers. Although easy to implement at store level, factors such as discounts which are given to the customers will have to be considered which might impact the output and input VAT calculation. Implementation of VAT will cost the stores time and resources (like modification in IT systems). With many global retail stores eying for a piece in the growing industry, this might lead to decreasing price margins to offset the impact of VAT in order to attract customers. Customer demand will depend on the price-demand elasticity of the goods. Everyday consumable products which are highly inelastic will face the least impact while there might be a decrease in demand for luxury items. The industry will not be affected by cross border transactions and will be among the biggest revenue source for the government.

Real Estate

According to the VAT agreement, Kuwait has the choice of opting for either a 5% or a 0% VAT in both residential as well as commercial properties. In certain projects the implementation of tax can be exempted It can follow the implementation process of both KSA and UAE, where residential properties are exempted or zero rated and commercial properties are taxed at 5% with certain cases being exempt (e.g. NGO, building used for charitable purpose). As such, the owners of commercial properties can charge the VAT to the customers as an addition to their rent, resulting in rental inflation.

Implementation of VAT would impact mostly construction companies and developers. These companies are likely to struggle to implement the taxation, as companies might be unable to claim refund on input VAT related to construction of projects which might be exempted, leading to loss. Moreover, in case of under-progress project, estimating the applicable VAT could be a challenge, if the procurement was done, prior to the implementation and invoices are due until-after VAT implementation. Implementation of VAT might increase the initial cost of constructing the property which will lead to increase in the selling price. Certain companies will want to wait out the entire transition period before starting any new projects so as to avoid confusion of paying VAT while existing projects under construction might be delayed. As for the customers, there might be a temporary decrease in demand for owning as well as renting properties due to increased cost. The industry will not be affected by cross border transactions.

Financial Services

Implementation of VAT in the financial sector might be complicated. Firstly, most financial services come as bundled products. Bundled services are the combination of many services into one service. Such products may have both taxable and non-taxable services which might create difficulties to implement VAT (e.g. for portfolio management, managing fee are taxable while margins earned on derivatives is not taxed) (https://www.rsm.global/kuwait/insights/vat-newsletters/vat-newsletter-impact-vat-financial-services) Secondly, certain services taken by financial institutions such as IT services from others will be subjected to VAT, but the same cannot be allocated directly to the cost of financial products. This might lead to loss in terms of not being able to claim full deduction on VAT.

Kuwait might follow the global standards of taxing fee based products (e.g. management fees, commissions) while exempting margin based products (e.g. interest). With lower interest rates, fee based products are becoming more popular among the banks. VAT might slow down the demand of these products with banks having two options to follow. They may either increase the prices of the services, charge them to the customers to have the same level of profit or they may include VAT deduction as part of their spending which might reduce profitability but retain customers. The banks might go with the first option as customers will be willing to pay the extra cost with not much impact in demand. No tax is implemented on cross border services.

Oil & Gas

With 50% of Kuwait’s GDP, 95% of exports and 90% of government (https://www.export.gov/article?id=Kuwait-Oil-and-Gas) revenue is contributed by oil, implementation of VAT in this sector will be crucial to the government. The implementation will be standard and will mostly follow the process already existing in UAE and Saudi Arabia. Companies associated with projects like exploration and production of oil and gas, export and oil related services along with products like petrol will come under the VAT purview. Exploration and production along with export will be treated as zero rated under the VAT framework agreement whereas any services and products associated with oil and gas can be subjected to the standard 5% tax slab. This will increase the final fuel prices and companies associated with long term projects will see a significant change in their cash flow. But it is expected to have zero to minimum effect on the consumer demand as oil and gas are seen as a necessary commodity but will definitely increase the cost of living and doing business.

Information & Telecommunication

Kuwait has one of the highest mobile penetration rate in the world, reaching 232% in 2015. The country also boasts of the highest ARPU (average revenue per user) within the GCC and will contribute to the tax revenues in a major way with the introduction of VAT. The telecomm market is mainly oligopolistic and is divided among three companies, Zain (market share – 38%), VIVA (market share – 35%) and Ooredoo (market share – 30%). Kuwait can implement the 5% VAT slab on the sector with the tax being implemented for local as well as international services. Following the standard rules of implementation, there will be a price rise and it will affect service providers the most. While this may not affect the consumer demand, there are chances of price wars among the companies in order to retain customers in face of increased cost.

Automobile

This industry will see impact on pre as well as post VAT implementation. While VAT implementation will be easy, it will affect the entire supply chain in the industry as well as demand. With pre implementation phase it can be seen that there will be an increase in demand due to low prices. This will come with challenges (increasing working capital constraints, strain to keep up the demand) and opportunities (increased advertising revenue for media houses for ad placement, improvement in supply chain). Post implementation, there will be a decrease in demand. Every part in the supply chain (importer, distributer, dealer) will come under VAT and it may increase the complexity of VAT calculation and claim. Associated services like financing and registration of the vehicle will also become costlier. The customers will be most affected with the price rise and there will be an import VAT for cross border supply.

Table: Impact Areas on Sectors

Conclusion

VAT is most likely going to increase the inflation rate in Kuwait. Introduction of VAT is likely to increase the rate to 3.75% from the predicted 2.5% at the year-end of 2018. (IMF) While real estate, transportation and automobile will see a decrease in demand, retail, financial sector, oil & gas and telecom might not see much changes. Real estate is expected to see the maximum increase in cost while retail might see a low to medium increase in price. Although some sectors will find it difficult to implement VAT, going forward, it might become easier.