The “Seesaw” Game of Saudi Liquidity

This article was originally published in Forbes Middle East.

The advantages of the U.S dollar peg for Saudi Arabia have been multi-fold. It has resulted in stable export revenues, reduced transactions costs and a simple yet disciplined macroeconomic policy. This peg is especially important for Saudi Arabia as despite certain measures to diversify, their economy is dependent on oil and gas and connected activities.

The oil price plunged in mid-2014, and the currency peg has been under pressure since then. The sharp drop in the price of crude oil has brought about abatement in the realized revenues by the world’s top oil exporter.

Currency peg taking the burden of falling oil prices

Source: Reuters

This has resulted in a downfall of the money influx, driving the government to tap into its domestic balances, and execute an assortment of measures such as reduction of subsidies and introduction of VAT to help make up for the shortfall in revenues and support the domestic currency. The fiscal surplus of SAR 374 bn (2012) deteriorated into a deficit of SAR 362 bn (2015). The government budget followed suit, tumbling from a surplus of USD 88bn in 2012 to a deficit in 2016.

The government’s foreign reserves took toll, resulting in liquidation of about one-third of foreign reserve assets (from May 2014 to 2017). Subsequently, the government tapped into the domestic debt market following which the private sector borrowing took a hit, due to tight liquidity conditions. The bank claims on private sector grew at a much slower rate of 7.7% between 2013-16 as compared to 13.5% in the four year period prior to that. Retail lending was subdued as well. The SAIBOR-LIBOR spread widened from 0.7% in 2013 to 1.032% in 2017. The (bank) deposit growth, which averaged about 12.6% (YoY) from 2011 to 2014, plummeted to just about 1% since 2015 (1.8% in 2015, 0.8% in 2016).

The oil prices rebounded in 2016, and the government deposited more funds in the banks compared to the withdrawals. Following the liquidity shortage in the financial systems, Saudi Arabian Monetary Authority (SAMA) increased the Loan-to-Deposit ratio from 85% to 90%, adding another SAR 35 billion to the local banks. The liquidity conditions further improved when the administration raised additional USD 17.5bn in an international issue of bond. In late 2016, the government settled SAR 40 bn in arrears to the contractors, further alleviating the liquidity crunch.

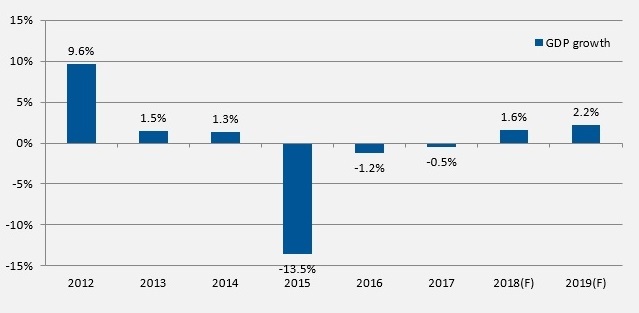

Cut to 2018, the oil prices have increased; yet, the economic environment in Saudi Arabia is anaemic (see the graph below), due to the decreased private sector lending and the oil revenue, which is expected to increase even more. The U.S Fed rates are on the rise due to the growing confidence in economic expansion, lowering unemployment, weakening dollar, widening fiscal deficit rising national debt and recent reductions in the income tax.

The economy of Saudi Arabia is yet to recover from the oil shock

Source: Saudi Arabian Monetary Authority; IMF

M2 Growth (YoY) percentage

Source: Saudi Arabian Monetary Authority

Saudi Arabia has been toiling with rising U.S. rates, trying to balance GDP growth with the impending capital flight. This again, puts immense pressure on the currency peg.

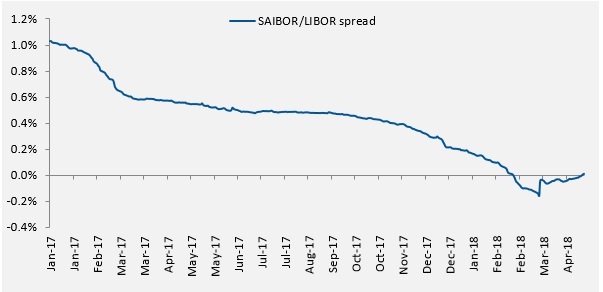

Saudi Arabia raised its repo rate in March 2018, after SAIBOR fell below LIBOR, posing a risk of capital flight. LIBOR soaring above SAIBOR implies dollar denominated investments returns are higher compared to the investments made in Saudi riyal. Capital would be more attractive in the U.S, leading to a phenomenon commonly known as capital flight. Consequently, a scarcity of dollar in the domestic markets will tend to cause depreciation in the domestic currency, eventually leading to depreciation of Saudi riyal. In an attempt to maintain the USD-SAR peg, SAMA would have to sell the U.S dollars from its reserves and buy riyal in the open market – one of the costs associated with currency pegs. It is no surprise that the domestic exchange rate had been facing downward pressure. The domestic repurchase rates were therefore raised ahead of the U.S Fed rate hike. Consequently, the SAIBOR/LIBOR spread has shrunk to 1 basis point from 19 basis points earlier this month. However, the currency peg limitations and illiquid markets mean the gap could widen again, leaving the central bank with some difficult choices.

3M-SAIBOR, LIBOR spread

Source: Reuters; ICE

If LIBOR continues to rise, then SAMA has to either:

- raise its repo rate, or

- restrict liquidity, allowing SAIBOR to climb

In an attempt for SAIBOR to overshoot the LIBOR, the Saudi Arabian Monetary Authority, has allowed some deposits placed with commercial banks in 2016 to mature without rolling them over. Tapping into the excess liquidity would let the interbank rate take care of the capital flight problem, without furthering the worries of chasing the tail of the interest rate hikes in the United States. Given the expectations of rising oil revenues, curbing some of the excess liquidity is a seemingly easy move for the central bank in an attempt to ease the pressure on the currency peg.

In hindsight, raising rates and/or restricting liquidity have been difficult choices for SAMA due to the economic backdrop in Saudi Arabia. Raising repurchase rates would have impacted the GDP growth while liquidity restrictions would put pressure on the currency peg, causing drainage of the foreign exchange reserves. However, rising oil prices augurs well for SAMA. The foreign exchange reserves have started to replenish (continuous growth for last three months).

The U.S interest rates will be increasing two more times this year. The ability to realise oil and non-oil revenues and the government debt will govern the ability of the SAMA to handle the interbank rates and the resulting liquidity challenges. One thing is certain though – pressures on liquidity and the exchange rate are there to stay this year.