ما الذي ندفع مقابله؟ – لماذا ينجذب المستثمرون لأسهم شركات التكنولوجيا الأمريكية؟

| YTD Performance | Apple | Amazon | Netflix | Microsoft | S&P 500 | ||

| 2017 | 26% | 20% | 21% | 16% | 16% | 8% | 6% |

Source: Reuters; Returns as of July 30, 2017

Trading at a premium would be an understatement to refer to FAANG stocks as they trade at stratospheric valuations (price to earnings ratio). Analysing all possibilities, we could for sure say one thing, what is driving the valuation is the frenzied investor behaviour of paying too much today for earnings that are likely to accrue in the distant future. So, what are we paying for? – Investor irrationality.

History tells us that investors have similar investment patterns in the past when it comes to US tech stocks. This kind of overexcited investing in tech stocks was the root cause of the catastrophic collapse of the stock markets after the dotcom bubble in 1999. التكنولوجيا itself seemed to be an impressive business plan for the investors those days. Hence, these tech companies also spent more money on marketing their company to investors. However, markets turned to reality sooner, leading to the crash right at the start of the millennium. Poor financial management, lack of profit generating activities and no vision for the future business pushed investors to realize that tech companies can no longer be their exquisite investments. Many tech firms delisted, closed their offices and some even went bankrupt. In 1999, there were more than 200 companies that filed for an IPO in NASDAQ and vanished after the markets crashed in 2001.

P/E ratio of US tech stocks & Stock Returns (10 year CAGR)

| Company | Trailing P/E ( As of 30th July 2017) | Stock returns (5 year CAGR) |

| Netflix | 370.68 | 87% |

| Amazon | 200.12 | 34% |

| 42.95 | 51% | |

| 32.93 | 25% | |

| Apple | 18.46 | 11% |

Source: Reuters

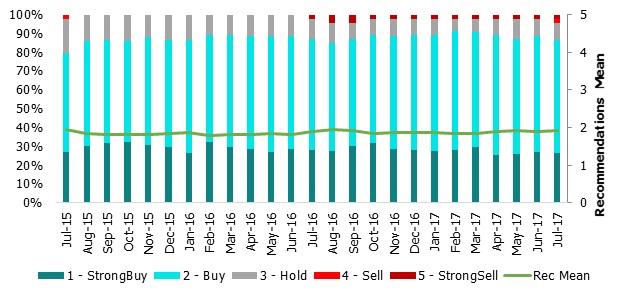

Recommendations of Analyst covering Amazon

Source: Reuters

Analysts who have either given a strong buy/buy recommendation for Amazon estimate that 92% of the price paid is for earnings that would be reaped after 2020(The Economist). In a decade, it is estimated that Amazon would trade at a PE of 10x. Amazon’s customer base is expected to reach 788 mn by 2025 generating a revenue of USD 3 trillion (almost the size of India’s GDP). Amazon’s valuations can be only justified by the exponential growth in its revenue, never with the earnings the company has made in the past nor with that anticipated for the future. التكنولوجيا is an arena where ten years is too large a time horizon. 10 years before, products that were pioneers in use are no more existent today. With iPhone having being introduced, Apple was forced to kill its one master innovation, the iPod. Nobody thought of cloud hosting and the widespread use of internet two decades before. Technological breakthroughs generally disrupt the existing business models and can change the landscape of a sector/ companies that were till then operating quite successfully. This threatens the basis of estimating earnings for the future, especially in the longer term.

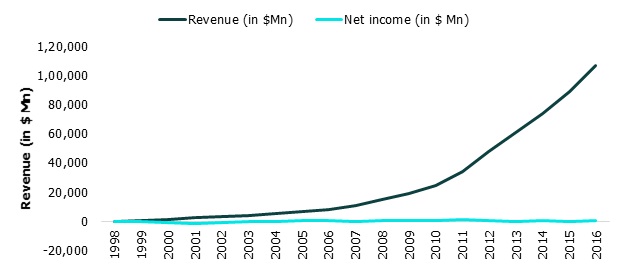

Figure: Revenue and Net income of Amazon (in $ MN), 1998-2016

Source: Reuters

Net income has never moved in line with the revenues of the company, rather stayed divergent for almost 25 years. The chart above conveys the business model of Amazon, their focus has been to drive down prices and gain market share, which they have quite successfully done in the past three decades. Investors still believe that Amazon is in its nascent stages, and it could turn around to make profits and generate returns for the shareholders. This can happen only if the utopian dream of creating a monopolistic retail and web services market comes true. What would happen if Amazon increases the price of its services when it feels there are no more competitors? This strategy of cannibalising market share by reducing price has never worked out in the long term. The prospect of future earnings cannot happen just by holding market share. For now, Silicon Valley majors seem to have lost ground of their unique proposition – ‘Innovation’, which was at the heart of their organizations when they were incubated.

Similar stories seem to appear on many walls of Silicon Valley. Google and Facebook depend on their advertising revenue to a larger extent. When there is another technological innovation threatening their business, these tech giants have engaged in acquisitions at unimaginable valuations. The large tech companies are unable to innovate new income generating activities in-house, and with a huge cash reserve they have all decided to look for inorganic growth. The classic example would be the acquisition of Whatsapp by Facebook after facing tough competition from Google. The private messenger service ‘Whatsapp’ was valued at USD 19 Bn and acquired by Facebook in 2014. Apple has acquired more than 20 companies in the last two years. It is a qualm if these firms could run for years like these, without innovating in house and focus on profit making activities. التكنولوجيا has too many competitors to acquire and to enter into price wars.

Snapchat’s IPO listing defeats it all, where the loss making company offered no voting rights to investors and the prospectus stated that it has no intention of paying cash dividends for the foreseeable future. The prospectus states that the company expects operating losses to continue in the future and may never achieve or maintain profitability in the coming years. The company is yet valued at $18.5bn. This displays the passivity of investors towards tech investing, owing which US tech companies afford to lack corporate governance, claim to make losses, deny rights to shareholders, and yet attract investments.

Majors in the Silicon Valley, Apple, Microsoft and Google have been more attractive in terms of their valuations compared to companies such as Amazon, Netflix and Facebook. Product and service line diversification of Microsoft and Apple have generated consistent profits for these companies, unlike in case of the others. Not all tech stocks run similar risks and are not equally overvalued. However, a majority of them, especially those struggling to generate profits are stocks that thrive on the promise of glorious tomorrow.

All said and done, Amazon is just a classic case of fundamentally weak but an overvalued stock. The situation may not be indicating another bubble in the stock markets as in 1999, though nothing much has changed about the way investors have picked companies. In the long run, disconnect between the revenues and the ability to generate profits is a risk that many tech companies have embedded in their business models. Investors have unfortunately failed to take notice of the same.

Bottom line for investors – ‘Look for bottom line numbers before investing’.