الخدمات المصرفية القطرية – مصارف ذات ميزة أكبر

Qatar banking sector overall accounts for 126% of the country’s nominal GDP in 2014 and banks’ credit to GDP stood at 87%. According to Marmore’s report on Qatar banking, the post-crisis growth in loans, deposits, assets and revenues (2009-2014) has been significantly lower than pre-crisis growth (2003-2008), but the overall size of the sector has increased. Qatar banks witnessed a credit growth of 15.5% in 2014, Loan Loss Provisions (LLPs) decreased by 7% with total provisions amounting to USD 0.65bn and provisions as percentage of total loans stood at 0.35%.

Table 1 : Qatar Banking Sector, Key Metrics

| Key Metrics | Pre-Crisis CAGR (2003-08) |

Post Crisis CAGR (2009-14) |

YoY 2014 |

| Loan | 52.5% | 22.4% | 15.6% |

| Deposits | 41.1% | 21.0% | 14.0% |

| Assets | 44.0% | 19.6% | 12.2% |

| Revenue | 48.7% | 16.2% | 10.4% |

| Net Income | 48.9% | 14.3% | 11.7% |

| Loan Loss Provisions (LLP) | 92.3% | 14.3% | -7.0% |

| LLP as a % of Loans | 0.01% | 0.41% | |

| Cost to Income Ratio | 30.0% | 26.8% | |

| Loan to Deposit Ratio | 71.3% | 85.0% | |

| RoA | 3.90% | 2.49% | |

| RoE | 22.60% | 16.84% |

Source: Reuters, Marmore Research

Note: LLP as a percentage of Loans, Loans to deposit ratio, Cost to Income Ratio, RoE and RoA are average for the respective periods.

All banks that were considered for anlaysis showed a positive growth in deposits during 2014 and Qatar National Bank occupies the top position in terms of loans, deposits and assets in 2014. The Qatar banking sector posted profits of USD 5.3bn in 2014, 11.7% higher than previous year. Qatar banks had a Return on Average Equity (RoAE) of 15.9% in 2014 and Return on Average Assets (RoAA) stood at 2.09%.

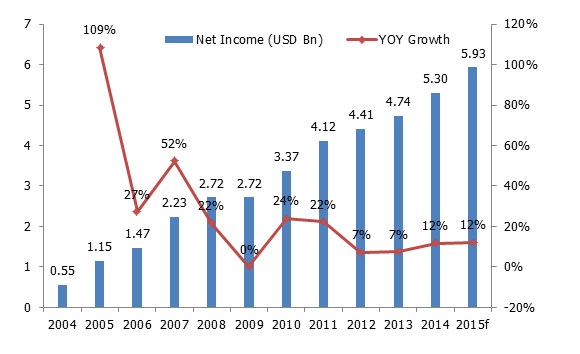

Net Income – Continous growth in profits

Figure 1: Net Income, Qatar Banking

Source: Reuters

Qatar banking sector has shown continuous growth in profits since 2010. The banking sector posted profits of USD 5.3bn recording a YoY growth of 11.7% in 2014. This is an improvement from the growth rate of 7.4% in 2013. Furthermore, loan loss provisions decreased and growth of interest and non-interest expenses slowed down, which contributed to the increase in net income of the banking sector.

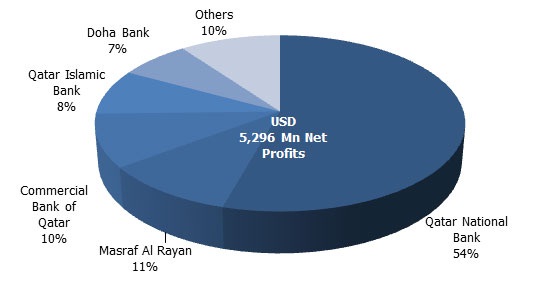

The highest contribution of net income to the Qatar banking sector was from Qatar National Bank, amounting to USD 2.87bn which accounts for 54% of the total. In 2014, out of the 8 banks under that were analysed, Doha Bank and Al Khaliji Commercial Bank saw the lowest net income growth of 3.1% and 2.2% respectively, which was lower than the industry average of 11.7%, despite their loan growth of 18.3% and 29.9% respectively which was above the industry average 15.6%. A further study reveals that for the Doha Bank, it was the 38% increase in the loan loss provision, 3.1% NPL and only 5% increase in the interest income that led to lower profits.

According to Marmore’s report on Qatar banking, 90% of the profits were concentrated in the top 5 banks making it an uphill task for new entrants to enter into the market.

Figure 2 : Concentration of the Qatar Banking profits with few banks (2014)

Source: Reuters

Loans – Qatar Islamic bank leads the pack in terms of growth numbers; Qatar National bank by absolute numbers After a sluggish loan growth between 2008 and 2010, credit growth picked up in 2011. In 2014, 16% growth was witnessed in loans. Loan growth in the Qatar banks started to recover in 2011 showing a loan growth of 33% from 15% in 2010. One of the major factors which drove loan growth in the Qatar banking sector in 2011 and 2012 was the increased lending to the public sector.

Qatar Islamic Bank reported a 30.4% YoY growth in net loans during 2014 against the industry credit growth of 15.6%. But in absolute terms the largest increase in loans amounting to USD 7.8bn is by Qatar National Bank which experienced a 9.1% loan growth, though lesser than the average of 15.6%.

Figure 3: Net Loans, Qatar Banking

Source: Reuters

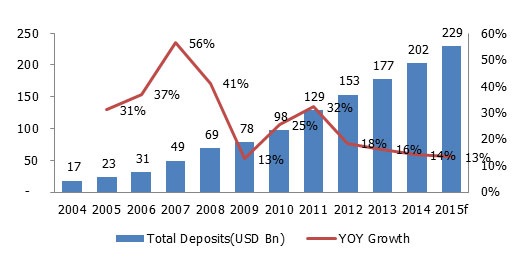

Deposits – Qatar national Bank takes up major share of deposits; Share of private deposits decline

Deposits in the Qatar banks show an increasing trend over the last decade. The year 2014 witnessed a 14% increase in deposits, total deposits aggregated to USD 202bn. All banks under our analysis showed a positive growth in deposits for 2014.

Figure 4: Total Deposits (USD bn), Qatar Banking

Source: Reuters

Major contributors of deposits in the sector was Qatar National Bank contributing 51% to the total sector deposits. It recorded a growth of 10.4% (YoY) in deposits amounting to USD 104bn. We estimate deposits to grow by 13.4% in 2015.

Table 1: Types of Deposits

| Year | Private Sector Deposits | Public Sector Deposits |

أخرى | Total | ||

| Demand | Savings & Time | |||||

| 2010 | 20% | 47% | 23% | 10% | 100% | |

| 2011 | 20% | 40% | 35% | 5% | 100% | |

| 2012 | 17% | 34% | 39% | 9% | 100% | |

| 2013 | 18% | 34% | 42% | 6% | 100% | |

| 2014 | 19% | 35% | 38% | 8% | 100% | |

| Avg 2010-14 | 19% | 38% | 35% | 8% | 100% | |

Source: Qatar Central Bank, Statistical Bulletin 2014

In the past 5 years, private sector deposits formed majority of the Qatar banks deposits averaging to 57% of total deposits, whereas government deposits were also close and averaged 35% of total deposits. Private sector deposits showed a decreasing trend from 2010. Time deposits have been almost twice the demand deposits ensuring stable funding.