تداعيات الأزمة الصينية على اقتصادات وأسواق دول مجلس التعاون الخليجي

According to a report published by Marmore (Is China Stalling?), the ensuing volatility in global markets was exacerbated by fears of rapid economic slowdown in China – the largest economy in the world (PPP terms), which stoked fears of impending global recession and led to a massive sell-off.

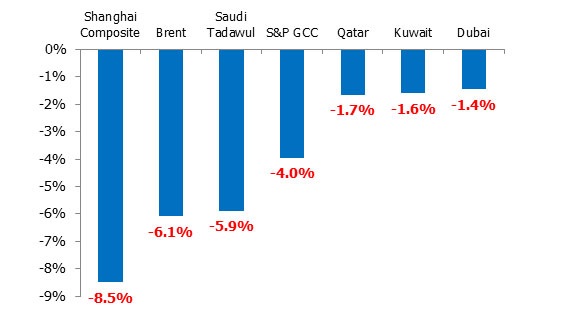

Figure 1: Black Monday (August 24, 2015)

Source: Reuters

China, which now accounts for almost 15% of global economic growth, was perceived as an important global growth driver. Economists opined Chinese growth to lend support to world economy. Chinese influence on world economy steadily rose in the past two decades. Through its various trade links it has firmly established as a country with significant systemic influence on the world economy.

However, the recent episode of uncertainty over the economic trajectory of China due to lack of relevant indicators – to gauge the state of economy in a timely manner, has fuelled wide spread speculation regarding its health. Given the larger role it plays in the global scheme of things, the impact was felt on oil markets and the GCC equity markets (see above figure).

Chinese Economy in Transition

Since the global financial crisis, China had been reliant on cheaper credit fuelled investments and exports-led model of growth. However, this led to rapid rise in debt levels and created vulnerabilities in fiscal (government debt-to-GDP), real estate (excess housing supply), financial (shadow banking) and corporate (high credit-to-GDP) sectors leading to increasing pressure on financial system and declining investment efficiency.

Credit-to-GDP ratio remains high in China as measured by Bank of International Settlements (BIS) credit gap measure. The increase was fuelled by corporate sector, particularly in real estate and State Owned Enterprises (SOEs).

Table 1: Credit to Private Sector (as percent of GDP)

| Category | 2003 | 2008 | 2014 |

| Private Credit | 106.7 | 99.8 | 150.0 |

| – Corporate | 88.9 | 81,7 | 113.6 |

| – Households | 17.8 | 18.0 | 36.4 |

Source: CEIC, IMF staff estimates

Implicit guarantees extended to SOEs through perceived state backing had led them to benefit from preferential access to credit. Such preferential financing of SOEs often crowd out private sector lending. Further, support lent to inefficient and unviable SOE drags investment efficiency of the system.

In China, residential real estate investment accounts for more than two-thirds of total real estate investment. High level of investment in real estate sector had led to build up of excessive inventories and an oversupply situation, which are often dubbed as ‘Ghost Cities/Towns’ due to lack of inhabitants. Such a situation is widely prevalent in tier-3 and tier-4 cities which account for over 50% of real estate investments. It is estimated that they currently have unsold supply of around three years of sales.

In order to address them and establish growth on a more sustainable basis, Chinese authorities have been engineering a managed slowdown. The economic growth is now oriented towards domestic consumption with a primary focus on services sector rather than the traditional industrial or manufacturing sectors.

Much faith was placed on the governmental authorities to effectively engineer the daunting economic transition. As of 2014, activity in tertiary sector such as services contributed approx. 48% of GDP, much higher than the c.43% share of secondary sector such as manufacturing and construction signifying steady progress in the rebalancing act.

Impact on GCC Economies

Perceived slowdown of China could stoke fears of recession. It has been 7 years since the outbreak of global financial crisis and the policy makers, who have relied on monetary tools, have no options to fall back on in the event of another economic crisis.

In such an environment of economic uncertainty and prevailing lower oil price environment, GCC governments could reassess their expenditure programs. Subsidies could be curtailed and taxes could be proposed to garner additional revenue.

As the GCC currencies are pegged to dollar, yuan devaluation could make investments into GCC a bit expensive. This could have an effect on tourism as well. Chinese were among the top spenders in Dubai Shopping Festival.

China is the second largest importer globally after the U.S. To gauge the direct impact on GCC countries, we analysed the trade linkages with GCC countries.

| الدولة | Exports to China (as % of total exports) |

Imports from China (as % of total imports) |

| Oman | 36.0% | 5.4% |

| Saudi Arabia | 19.0% | 15.0% |

| Kuwait | 12.0% | 12.0% |

| Qatar | 6.4% | 7.4% |

| UAE | 5.9% | 17.0% |

| Bahrain | 2.8% | 16.0% |

Source: MIT Economics Observatory; Data as of latest available

China accounts for c.30% of Australian exports while c.18% of total exports of Japan and Brazil head to China. U.S exports to China amounts to c.10% of total U.S exports.

Among GCC countries, Oman is most vulnerable as its exports to China account for almost 36% of its entire exports. Exports from Saudi Arabia & Kuwait have sizeable exposures to China at 19% and 12% respectively.

Slowdown in China would affect their trade level in the form of reduced exports and by reducing commodity prices due to fall in demand.

Impact on GCC Stock Markets

On August 24, 2015 now dubbed as ‘Black Monday’ Shanghai market lost 8.5% of its market capitalization which sent the global equities into a tailspin. On concerns of slowing economic growth in the largest economy (by PPP terms) and on talks of impending recession, crude lost 6.1%. GCC countries, being main exporters of crude, fell in line with the fall in crude oil price.

The greatest impact among GCC markets were felt in Saudi Arabia as Tadawul index collapsed 5.9% and the prevailing negative sentiments dragged other regional indices, as well.