تقديم تمويل 2,0 للشركات الصغيرة والمتوسطة في دول مجلس التعاون الخليجي

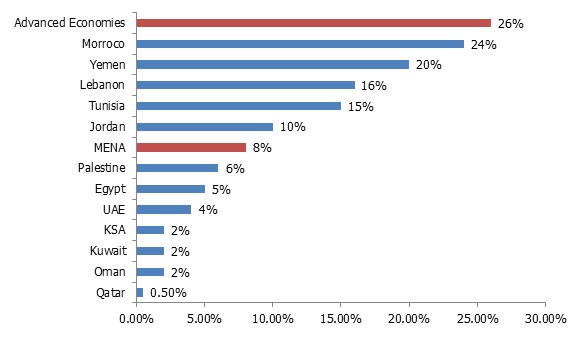

Traditionally in the Middle East and North Africa (Mena), SMEs have found it difficult to access funding from banks. In the GCC countries, the share of SME loans in total bank loans has tended to be around 2%, as the following graphic illustrates.

Figure: Share of SME Loans in Total Loans (%)

Source: Union of Arab Banks Survey, 2011

Entrepreneurs in the GCC, with respect to receiving bank loans, are known to face time-consuming documentation, daunting penalties on early repayments, shorter repayment periods, higher interest rates in comparison with large corporate borrowers, etc . Banks, on the other hand, contend that higher premiums and extensive documentation are required as steps towards protecting riskier lending propositions, along with the fact that there is added pressure on liquidity due to lower oil prices. The reluctance of banks to lend to SMEs in the GCC portend that there is space for innovative funding practices like international funding for GCC SMEs and through domestic venture capital funds. Several countries in the advanced economies bracket have already developed venture fund models such as limited partnerships and limited liability companies. This has been noted by analysts as conducive to maintaining a viable balance between regulatory protection and encouraging entrepreneurship. Given the drive towards innovation in many of the countries in the Mena region, it is time to explore innovative financing mechanisms, as well, such as institutionalized funding sources for SMEs focused on innovation.

There are signs of innovative financing mechanisms being adopted within the GCC. In September 2014, Dubai SME, the agency of Dubai’s Department of Economic Development (DED) that is tasked with developing the SME sector, launched the Equity Investment Initiative (EII). The EII targets capital infusion into the SME sector through equity participation of venture capitalists, angel investors, private equity firms etc. It has also been reported that Dubai SME is compiling a domestic directory of angel equity investors focused on SMEs. The effort is part of a survey on SME equity funding needs.

There are some global examples that the GCC can adopt. One example is the InnovFin initiative of the EU. InnovFin is a joint initiative by the European Investment Bank (EIB) and the European Investment Fund (EIF), in cooperation with the European Commission (EC). The InnovFin SME Venture Capital offers equity finance for research and innovation through selected intermediaries like investment funds, venture capital funds or vehicles that support co-investment facilities for Business Angels. Non-institutional participation, in the form of opening up SMEs to investments in the stock exchanges could also be explored. For instance, India opened the SME segment platform in 2012, for listing SMEs in its main stock exchange. Public sector banks could also be encouraged to hold stocks in promising SMEs.

While courting private equity (PE) for SMEs, one problem that could come up is that they might be more interested in companies from the tech sector or the digital environment. These might leave SMEs trying to focus on traditional manufacturing shortchanged. Lack of enough information about the company fundamentals, the promoters and lower returns could force PEs to look upon manufacturing SMEs unfavourably. Thus, the government could look into policies that may help SMEs that cannot attract much PE attention with better public financing options. The concept of the ‘Fund of Funds’ (FoF) can also help. Many observers comment that governments need not be adept in identifying promising SMEs. Thus, instead of directly funneling investments into companies, the government can invest into VCs that can in turn scout for viable and promising funding opportunities. One such example is The Dansk Vækstkapital (Danish Growth Capital) of Denmark, which is a partially public investment fund-of-funds that invests in small cap, mid cap, venture and mezzanine funds. The Dansk Vækstkapital only invests in funds and not directly into Danish companies. Businesses will have to apply for financing directly at financial institutions that take part in the Dansk Vækstkapital programme.

Crowdfunding is another concept that SMEs in the GCC may find very useful. The U.S. Small Business Administration defines crowdfunding as “[…] a collective cooperation of people who network and pool their money and resources together, usually via the Internet, to support efforts initiated by other organizations.” It need not just be other organizations, but it can also be individuals. Crowdfunding channels the enthusiasm of digital social networks to raise finances and pool resources for supporting a project important to members of the social network. It would be useful to look into the broad classifications of crowdfunding that currently exist.

Table: Crowdfunding Classification

| Classification | Description |

| Rewards-based | It is also referred to as “peer-to-peer investing”. In this model, participants pledge money online to back a start-up or some creative project, and they receive a reward in return. For instance, the right to purchase a product first when (and if) it reaches the market. |

| Equity | This format offers ownership in private enterprise with the possibility, albeit with no guarantee, of an investment payoff through an initial public offering (IPO), or through a potential merger or acquisition. |

| Peer-to-peer lending | This form attempts to match investors with individual borrowers who are looking for options to deal with personal debt issues, like credit card debt. Though this format started for small-sized loans, it is now expanding to cater to larger debt instruments like mortgages, too. |

| Donation-based | Funders donate to causes that they want to support, with no expectation of any compensation or return. |

Source: Pensco, Nordic Crowdfunding Alliance

GCC’s first crowdfunding plan is Aflamnah, a UAE-based platform that allows individuals from the Middle East region to raise funds for fresh ideas in areas like films, games, television, art, music, etc. It is crucial to not allow vacuums of legislations to develop around key aspects of crowdfunding once the overall official recognition is provided. Peer-to-peer lending is particularly ripe for adoption across the GCC, as many SMEs have expressed that having rapid access to capital, with minimized red tape, and at interest rates much lower than traditional banks is critical for the early stage phase.

Experiences from across the Mena region indicate that a number of SMEs, estimated at about 20%-25% of the total, prefer sharia-compliant products . Thus, better risk management protocols would strengthen lenders’ confidence to create more sharia-compliant financing options. Risk management frameworks that protect lender’s’ rights and address their concerns for transparent information could not only strengthen the evolution of Islamic finance with respect to SMEs, but allow traditional banks to develop more confidence in lending to SMEs, as well.