شهد مؤشر أسهم كويت 15 ارتفاعًا قياسيًا

Instead of analyzing the index we are going to analyze performance on a stock level and measure the divergence from the recorded all-time highs (ATH) of the respective stocks since fundamentally sound stocks (good top and bottom line growth, sound management etc.) consistently establish new ATH’s reflecting growth and opportunities. While stagnant companies may struggle to re-conquer their ATH’s and can thus test investor patience (Japan for e.g.).

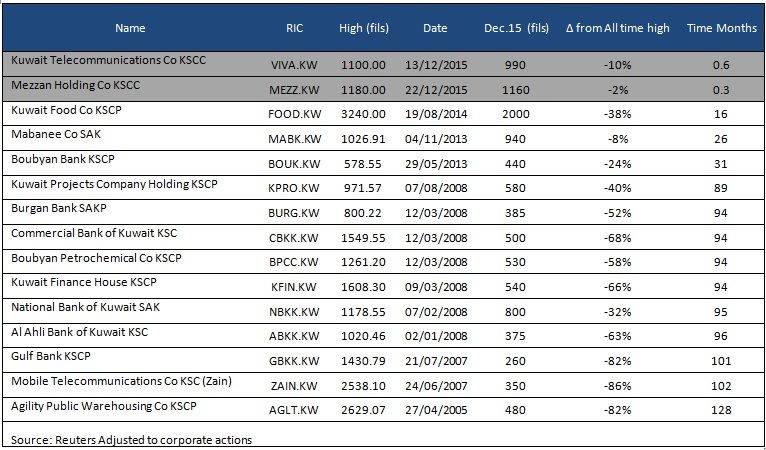

Looking at Kuwait 15 Index constituents, the only positive news comes from the newly added stocks Mezzan (listed in 2015) and VIVA (listed in 2014). For VIVA the difference between the all-time high and 2015 closing price was -10% and the last ATH occurred 18 days before the year ended in 2015 while Mezzan holding lost only 2% from its ATH which occurred 9 days before the year ended. Although the two stocks feature in our note on account of being a part of the Kuwait 15 Index, we will exclude them from analysis due to its recent listings.

Looking at the list above[2] only one company (Kuwait Food) achieved its ATH in the last 2 years and only 2 companies posted their all-time 3 years back (Mabanee and Boubyan bank). Looking at Mabanee we can see that the stock is hovering 8% below its all-time high, while Boubyan Bank is trading 24% below its all-time high. Apart from the 3 companies mentioned above, 8 companies in the Kuwait 15 index posted their all-time highs between 7 and 9 years ago and they are trading in a range of -86% to -44% of their all-time high prices.

Looking at the table above we could clearly see the impact of market mania during the bull market of 2004-2008, 10 out of 15 companies in the index reached their all-time high during this period. During market bubbles investors usually believe that stocks can only go up, thus we see stocks reaching all-time highs without being backed by strong fundamentals. That said the companies on the list are among the largest in the Kuwait stock exchange and are operational in nature compared to small capitalized companies and an uptick in the economic environment will most likely enhance growth.

The top loser in terms of number of years in our study is Agility; the company posted its all-time high in 2005, almost 11 years ago, and is currently trading 82% below its all-time high and needs to gain 448% just to catch up with its ATH. The top loser in terms of gap between the ATH and current prices is Zain. At the end of 2015, Zain traded 86% below its all-time high of KWD2.538 which means that for it to close the gap, the price of Zain’s stock must increase by 625%!

It is important for bellwether stocks to touch new highs and not languish on old glory. Stocks touch new highs primarily on performance though speculation cannot be ruled out. While speculation can set the fire, the continuance depends on fundamental performance. Being part of Kuwait 15, these stocks enjoy high liquidity and patronage from institutional investors as well. They are well covered by analysts (relative to the whole market). While constructing a portfolio/investment strategy, it is important to note whether stocks are touching new highs. It is better to avoid stocks that came away a long mile from their historic highs and shows no signs of getting there. While these stocks will still be part of index funds or ETF’s, they need not be part of an active portfolio strategy.