هل يمكن للمستشارين الآليين أن ينجحوا في دول مجلس التعاون الخليجي؟

Potential in the GCC region

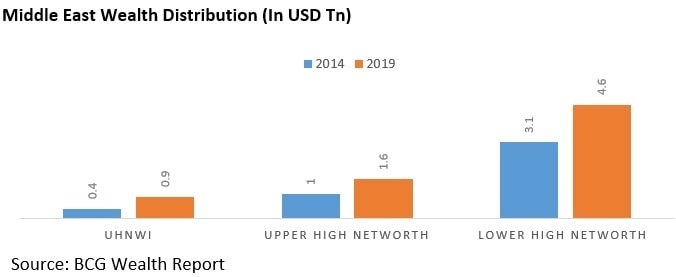

According to BCG’s 2015 Global wealth report, private Wealth in Middle East and Africa(MEA) region increased by more than 7% to surpass $8 trn in 2014. It is expected to maintain similar levels of growth till 2019 and is expected to increase to $13 tn by then. Saudi Arabia and UAE are expected to be the two major markets with total private wealth of $2 tn and $1 tn respectively. Middle East and Africa’s wealth accounts for 5% of the global wealth in 2014 which is expected to increase to 6% by 2019. The growth and distribution of private wealth in the Middle East and GCC region does not bode well for the robo-advisory services in the region.

Privacy of wealth is also of paramount importance in the region as a result of which private banking has been the most preferred route for investors in the region. Western private bankers command about 70% of the assets as of June 2015 with regional banks developing their own private banking offerings. It is only recently that HNIs in the region have preferred to keep both their assets and business home. Owing to the huge scale of wealth that these HNWIs and UHNWIs have, their investment requirements are far more demanding than that of retail investors. Issues that these investors have to overcome for their global portfolios include – taxation, international regulation (Money laundering, KYC norms), estate planning etc. which the automated robot advisory services are ill-equipped to handle.

Ultra High Net worth Individuals and upper High net worth individuals combined account for 73% of the wealth in the GCC region according to Strategy&. These investors typically have complex investment requirements that is spread over continents and countries which is one of the reason why they choose private banking. Private banking offers them discretion and secrecy in their transactions. While we can certainly rule-out the possibility of robo-adviors gaining enough knowledge to service these individuals the lower high net worth and the mass affluent segment can prove to be a an ideal market for the technology. Individuals in these segments mostly would have some sort of investment advisory relationship with the regional banks which can be explored and built on.

For instance a regional bank tying up with globally recognised robo-advisory services can turn around the rules of the game very quickly in the GCC market few years down the line. While the thought of robo-advisory completely taking over one’s investments is a remote possibility, it can be mellowed down via a hybrid model. The hybrid model involves automated recommendations which are then supplemented by a more personal advice from a finance professional. This segment which balances the best of both worlds is expected to grow to $16.3tn worldwide over the next nine years globally (2025).

While the prospects for a hybrid model seems very attractive there are still areas which needs to be re-visited often which includes regulations that would govern the product and how it is being sold to the customers. Robo-advisory is not expected to take over the market anytime soon; however a sizeable portion of the wealth managers will have to adapt to it in the years to come.

A flurry of deals

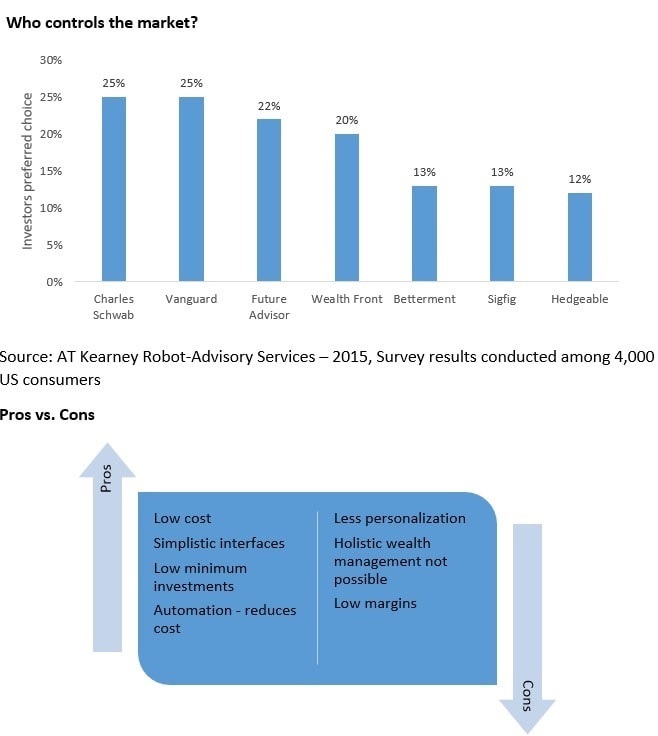

Robot advisory is currently in a nascent stage but it is expanding fast which has piqued the interest of the top banks and brokerages across the globe. Currently over 200 robo-advice platforms now exist in the US and activity is also picking up in Europe where there has been a series of deals that have been completed recently. Prominent ones include Schroders’ acquiring a stake in Nutmeg and Aberdeen Asset Management buying Parmenion Capital partners. Across the Atlantic, Fidelity investments announced partnership with Betterment and LearnVest. Vanguard for its part is adding a hybrid model to its offerings that allows for human contact if necessary. Consensus among the players in the industry is that robo-advisory would result in a seismic shift in the wealth management industry. However critics of the technology are quick to point out that there are areas, such as holistic financial planning, inheritance, retirement and tax advice, where human advisors are absolute necessity.

Will traditional advisors go out of favour?

Robot-advisors do threaten the traditional advisors however they are expected to remain relevant for decades to come as years of human experience is something that is hard to replicate. For instance High Net worth individuals and large institutional investors still prefer the touch of human advisors to guide them on a multitude issues such as Investment laws, wealth management and inheritance. Understanding the laws and regulations of different countries and continents is of paramount importance that concerns the client which is expected to remain in the hands of human advisors. While HNIs could toy with the idea of allocating a part of their portfolio to robo-advisory it could take many decades before computers can learn to replicate the services of the human advisors completely. Robot-advisory services instead is expected to bring in small investors (read millennial, tech-savvy) into the picture.