Kuwait and GCC Blue Chip Earnings

Kuwait Earnings

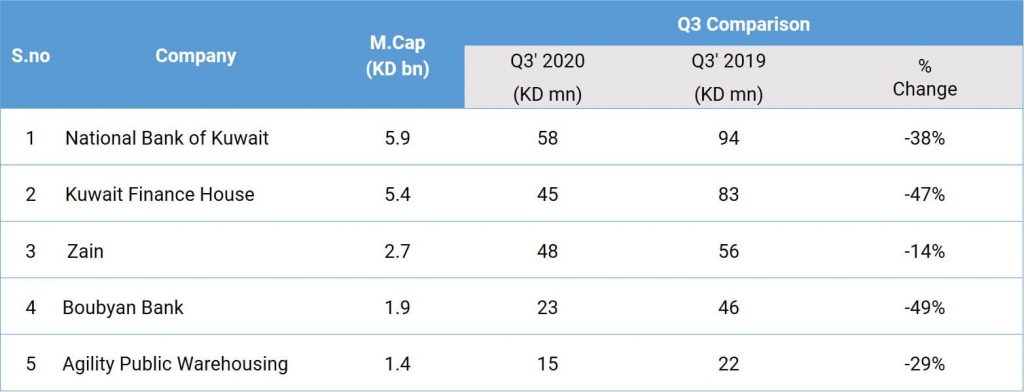

November saw a number of blue chip companies in Kuwait and GCC declare their financial results for the third quarter (Q3) of 2020. The earnings of Kuwaiti blue chip companies saw a decrease in Q3-2020 compared to that of the same period in 2019 as seen from the exhibit below.

Exhibit 1: Q3 earnings of top 5 Kuwaiti companies by Market Capitalisation

Source: Boursa Kuwait; Reuters; Data as of November 29, 2020

Commentary:

National Bank of Kuwait: Net Profit fell year on year(y-o-y) due to higher loan loss provisioning(LLP) which doubled to KD 81 million in Q3-2020.

Kuwait Finance House: Net Profit fell y-o-y due to higher LLP which increased to KD 59.7 million in Q3-2020 from KD 45 million in Q3-2019.

Zain: Q3-2020 net profits fell y-o-y due to decrease in revenue by 5% y-o-y as a result of the pandemic. However, expenses remained flat leading to the fall in net profits.

Boubyan Bank: Net Profits fell y-o-y due to higher LLP which increased to KD 46 million in Q3-2020 from KD 18 million in Q3-2019.

Agility Public Warehousing: Net Profit fell y-o-y due to 9% decrease in total revenues while expenses fell by a smaller amount. The Infrastructure segment saw a fall in revenues by 12% to KD 292 million in Q3-2020 due to COVID-19 impact.

GCC Blue Chip Earnings

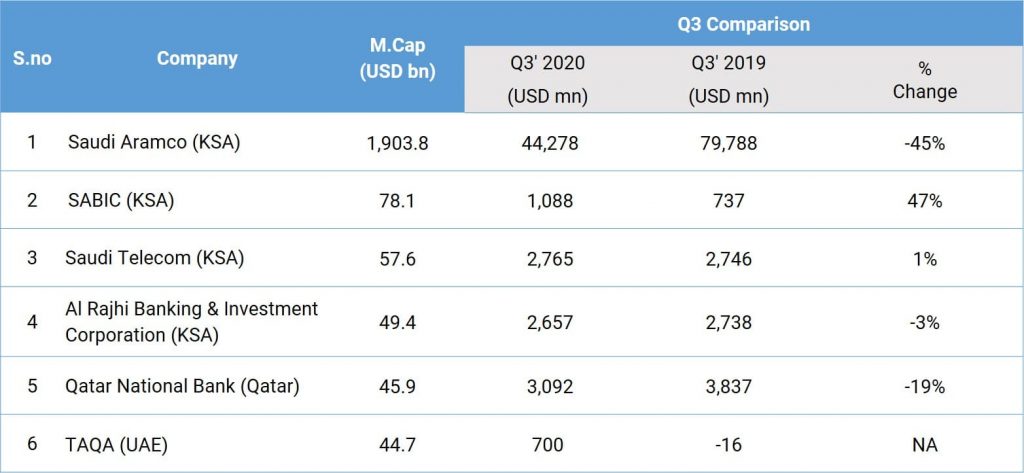

Some of the GCC Blue chips reported strong results in Q3. Out of the top 6 GCC companies with the largest market capitalisation, three of them reported increases in y-o-y profits in Q3-2020 over Q3-2019 while three reported decreases.

Exhibit 2: Q3 earnings of top 6 GCC companies by Market Capitalisation

Source: Tadawul, Reuters; Data as of November 29, 2020

Commentary:

Saudi Aramco (KSA): Q3-2020 net profits fell due to lower oil prices in Q3-2020 compared to that of 2019. However, they were nearly double that of Q2-2020 as the global economies recover from the COVID-19 crisis.

SABIC (KSA): Net profits were 47% higher than the year ago period due to revenues increasing by 19% due to a reversal of impairment provisions in certain financial assets in the quarter of about USD 184 million. The company had declared losses in the three previous quarters due to COVID-19 hit and oversupply in the petrochemicals space.

Saudi Telecom (KSA): Net profits increased y-o-y due to revenue increasing by 5.4% while cost of revenues decreased by 4.5%.

Al Rajhi Banking & Investment Corporation (KSA): Net profits decreased slightly y-o-y due to a 39.9% increase in credit impairment charges to USD 124 million.

Qatar National Bank (Qatar): Net profits decreased since LLP increased to USD 520 million in Q3-2020 against USD 160 million last year.

The article is an excerpt from our “Global & GCC أسواق المال Review: November 2020” report. Read more