Revenue squeeze could spur Gulf bond issuance to new highs in 2021

International debt sales by sovereigns and corporates in the Gulf region topped a record USD 100billion issuance in 2020 as governments raised capital to cover their widening deficits and corporates latched upon the opportunity to strengthen their balance sheets amid low interest rates. Central banks opened up the liquidity taps to support the economy and investor frenzy for positive yielding instruments drove international debt issuance from the gulf region to record highs.

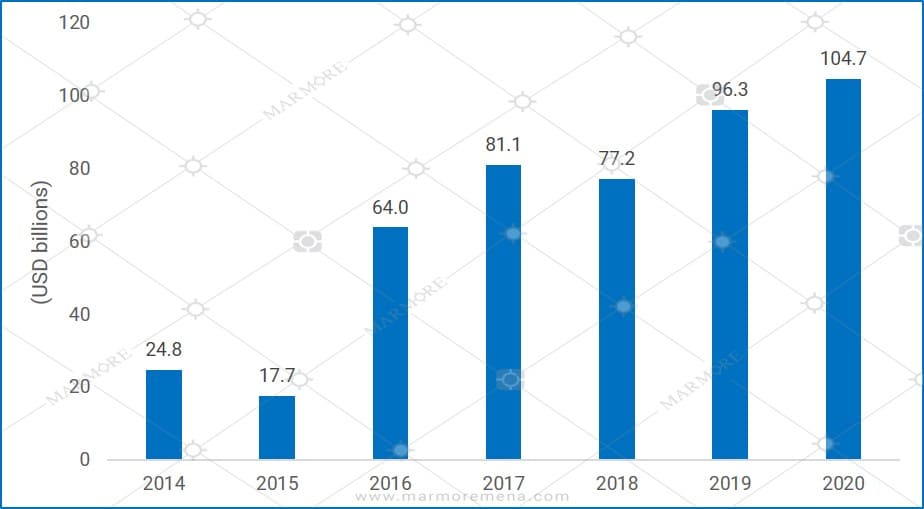

Exhibit: GCC borrowings topped USD 100billion in 2020 – A record high

Source: Bloomberg; Note: Includes both Sovereign and Corporate issuances.

The economic repercussions of the impact of novel Coronavirus and the subsequent breakdown of OPEC+ supply cut agreement is unprecedented for the gulf economies. The sudden freeze in economic activity globally due to various measures such as travel restrictions (curbs on flights, public transportations and taxis), closing of schools, universities, shopping malls, commercials establishments, and curfew imposition to prevent the spread of virus created a demand shock. Transportation sector that accounts for approx. 50 percent of global oil demand by end-use category remains affected by such measures that was implemented in various degrees across countries. Subsequently, oil markets faced with excess supply, and reduced demand tumbled to low price levels. Expectations for oil price recovery in 2021 remains modest and revenue shortfalls could persist. S&P ratings firm expects the situation to normalize only by 2023.

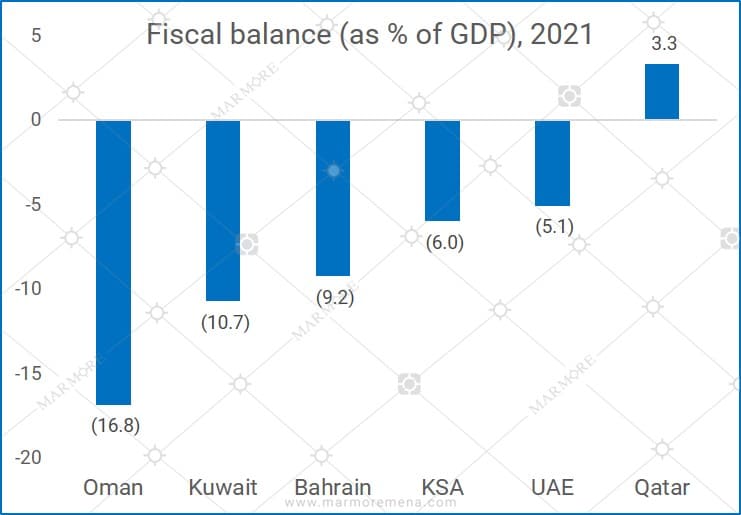

Exhibit: Deficits to persist for GCC countries in 2021

Source: IMF, October 2020

To balance the wide deficits and ensure continued spending amid fall in revenues, the governments could either dip into their accumulated fiscal reserves or issue additional debt. As the interest rates are at record lows and with many GCC countries having low debt compared to their emerging market peers, GCC sovereigns along with the regional corporates have tapped international debt markets for capital. As a result, the cumulative borrowings topped USD 100billion in 2020 – a record high for the GCC region.

Issuance to continue in 2021 as low oil prices squeezes government budget

In the first 26days of 2021, governments and companies worldwide raised USD 112.6billion of international bonds. The value raised is shy of all-time monthly record of USD 112.8billion set in January 2003 (Bond Radar data, Retrieved from FT). Two key factors have been in play for the ongoing bond rush. First, the coronavirus pandemic has dented the public finances and increased the borrowing needs for governments worldwide. Second, the rise in U.S. 10-year benchmark treasury yields above 1% has prompted issuers to lock-in rates at record bottom levels that may not last for long.

For 2021, GCC governments have revised their budgets and expenditures in various degrees. Saudi Arabia has stated that it would spend an estimated SAR 990billion (USD 264bn) in 2021, 7% less than that of 2020. Similarly, Kuwait in its recent budget for FY 2022 (April 01, 2021- March 31, 2022) expects its deficit to be at KD 14billion (USD 46bn), which is 52% higher than the forecast made in the original budget for the fiscal year 2021. Oil production is expected to be lower at 2.4million barrels per day (mbpd) for Kuwait in FY 2022 as against 2.5mbpd in FY 2021 due to compliance with OPEC+ agreements.

In January 2021, Saudi Arabian government raised USD 5.5billion in dual-tranche bond sale with tenors of 12 and 40 years. Overall, it aims to increase its debt by SAR 83billion (USD 22billion) in 2021. Dubai tapped the international debt market after six years in September 2020. We could expect further issuance from the Emirate to shore up its finances.

In the case of Kuwait, parliamentary authorisation to issue or refinance debt expired in 2017. With reserves in General Reserve Fund (GRF) fast depleting, Kuwait is expected to secure approval for borrowing. Consequently, Kuwait could hit the international debt markets in 2021. For Bahrain and Oman, debt is crucial for their survival amid dwindling reserves and they would continue with issuance in 2021. Bahrain raised USD 2billion in the third week of January 2021 amid uncertainty over help from its neighbours who have their own financial woes to deal with.

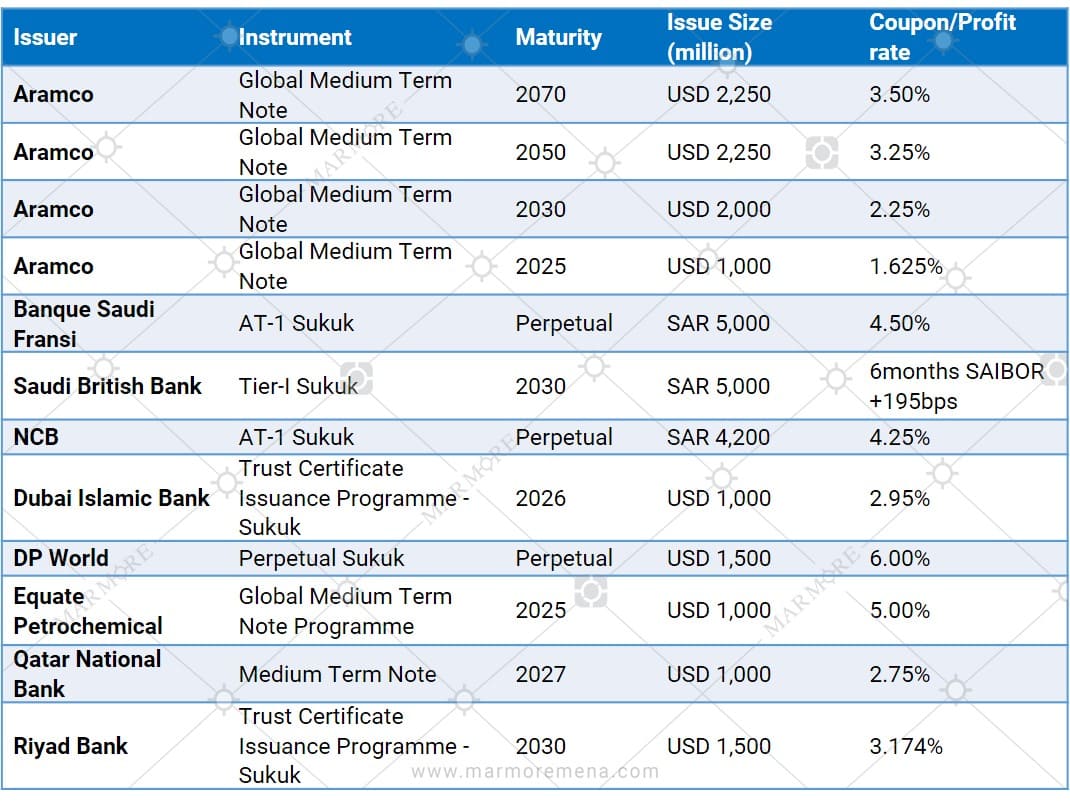

Corporates in the GCC region are not far behind. Financials and Government Related Entities (GREs) continue to be active and are shoring up capital to strengthen their balance sheets. National Commercial Bank (NCB) that is set to merge with Samba Financial Group sold USD 1.25billion tier-I sukuk at the lowest-yield, aided by strong investor demand, in the Gulf region. Aramco that raised USD 8billion in November 2020 in part to honour the dividend payments (USD 75billion per annum) could continue to do so in 2021, as well. Abu Dhabi National Oil Company (ADNOC) recently received a credit rating and could come up with debt issue this year.

Major corporate issuances in 2020

Source: The Gulf Bond and Sukuk Association