COVID-19: GCC has mostly resorted to monetary measures

The COVID-19 led health and economic crisis has pushed many governments around the world to respond with a wide armor of fiscal and monetary actions that far exceed the measures taken in the past when the Global Financial Crisis happened in 2009. The measures were announced in a quick and concerted manner across the developed countries, emerging countries, and less developed countries. GCC countries also acted with alacrity in providing stimulus measures:

- to meet the COVID-19 Impact that hit them with lower global Oil prices,

- economic output fall in various sectors of the non-oil economy consequent to lockdowns imposed on citizen movements and production and service facilities to limit the spread of the virus; and

- lower trade resulting from COVID-19 impact on the economies of their trade partners.

Types of stimulus measures provided by economies world over

The economic stimulus measures across the globe comprised of monetary policy measures like interest rate cuts, Central Bank liquidity support, Central Bank swap lines, and Central Bank asset purchase programs of both Government securities as well as corporate bond purchases by the United States. Financial policy stimulus measures were easing banks’ capital buffers, capital adequacy ratios, liquidity requirements, risk weights for some asset categories and provisioning requirements. Stimulus actions also included direct cash transfers to citizens in lower income categories and financial reliefs for borrowers in the form of postponement/ moratorium for instalments and interest, restructuring of loans and credit guarantees support. Lastly, the measures included administrative/ regulatory measures like extending deadlines for compliances and submissions of tax and other government payments, waiver of various types of government and bank fees etc.

Size of COVID-19 stimulus measures across the World

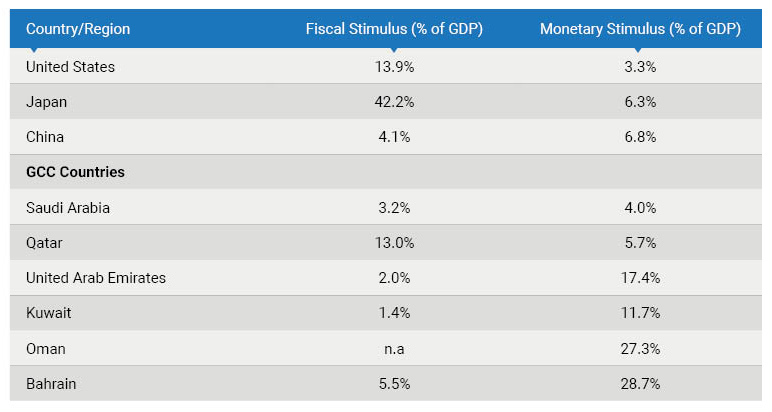

The total global monetary and fiscal measures to fight COVID-19 Impact are estimated at USD 20.4 trillion comprising Central Bank liquidity injection of USD 10.4 trillion and government fiscal stimulus of USD 10.0 trillion. These stimulus measures provided by major countries are as shown in the table below:

Exhibit: Stimulus measures to tackle COVID-19 crisis

Source: IMF; Ceyhun Elgin (Columbia Economic Professor); Note: السياسة measures as of June 25, 2020

GCC countries mainly provided monetary stimulus restrained by budgetary deficits

The GCC countries are impacted internally by economic lockdown to counter COVID-19 as well as by the external impact from COVID-19 influence global economies that led to sharp fall in oil Prices. Consequently, the GCC economies are expected to face large budgetary deficits in 2020. However, this may not be new to GCC countries, which faced a similar crisis though of somewhat lesser proportion in 2009 and 2016 when oil prices plummeted. To stave off a hit to their non-oil sectors to the extent manageable they announced a string of measures in the form of fiscal stimulus, monetary stimulus, cash supports, and regulatory measures targeted at the non-oil sectors.

- Kuwait has the highest reserves among GCC countries, relative to its GDP at 542%.

- Saudi Arabia is expected to enjoy the highest credit growth at 5.3% in 2020.

- UAE could continue to enjoy surplus trade position in 2020.

Bulk of GCC countries stimulus is through monetary measures

The GCC countries have provided large monetary stimulus packages in the form of Central Bank interest rate cuts by almost all the countries and liquidity support to its banks in the form of reduction in liquidity ratios, capital adequacy ratios and risk weights for some category of assets like MSMEs and higher lending ratios to their important non-oil sectors like real estate.

Saudi Arabian Monetary agency (SAMA) provided USD 13.3 billion support to banks for funding the private sector particularly SMEs. In addition, SAMA is supporting banks to defer loan instalments by three months. Central Bank of UAE has provided monetary stimulus of USD 70 billion (17.4 % of GDP) to the banks and credit guarantees and allowed deferral of loan instalments until end 2020. Qatar Central Bank is providing support for extending loan instalment deferral to borrowers for six months. Central Bank of Kuwait has provided Monetary stimulus in the form of lower Liquidity ratio and lower Capital Adequacy Ratio to release funds (estimated at around USD 16 billion) to fund deferral of loan instalments for individuals and for affected borrowers for six months, subsidized funding for SMEs and extend additional loans to borrowers. Central Bank of Oman has extended Liquidity support of USD 20.3 billion (27.3% of GDP) to the banks which will fund the deferral of loan instalments for borrowers for six months and extend additional lending to borrowers. Central Bank of Bahrain has extended Liquidity measures of USD 9.8 billion (28.7% of GDP) to meet funding for deferral of loan instalments for borrowers for six months and provide new loans.

Other stimulus measures provided by GCC countries

Saudi Arabia provided other measures like wage benefits to companies, utility subsidies, and suspension of some government taxes and fees. UAE also announced electrical and water subsidies, among others. Kuwait set up a USD 31 million fund to combat COVID-19. Qatar is providing exemption of rent payments and utility payments and salaries to quarantined migrant labor. Oman has waived port and airfreight charges and rent payments in industrial zones. Bahrain waived electricity and water bills for Bahraini individuals and companies, social benefits to low income Bahraini families and payments to unemployed Bahrainis in the private sector.

Overall, their strained budgetary position may explain GCC countries’ comparatively much smaller size of COVID-19 fiscal stimulus measures.