Do GCC Banks have adequate capital buffers?

The term liquidity is defined as the banks’ ability to fund rising assets and to meet its obligations on time. Therefore, when banks are unable to perform the primary tasks of funding assets and paying its obligations, it faces liquidity risk. Effective liquidity management is important to promote macro-financial stability. In the GCC countries, fixed exchange rate regimes provide reliable nominal anchors, but when combined with open capital accounts, they result in limited independence of monetary policy. At the same time, high dependence on revenues from the hydrocarbon sector has retained the vulnerability of the region to liquidity swings driven by oil prices. Additionally, this can also affect the implementation of monetary policy by intensifying the credit and asset price cycles. This highlights the importance of a well-defined framework aimed at forecasting liquidity and ensuring timely absorption or injection of liquidity by central banks.

Basel guidelines refer to a broad set of supervisory standards formulated by a group of 27 central banks known as the Basel Committee on Banking Supervision (BCBS). The set of agreement by the BCBS, which mainly focuses on the risks to banks and the financial system are called the Basel accord. The purpose of the accord is to ensure that financial institutions have enough capital buffer to meet financial obligations and absorb unexpected losses. In 1988, BCBS introduced capital measurement system called Basel 1 focusing on credit risk and capital & structure of asset risk weights for banks. In 2004, Basel II guidelines were published, as a refined and reformed version of Basel I accord. In 2010, Basel III guidelines were released in response to the financial crisis of 2008 as there was a need to further strengthen the banking system across the globe especially in the developed economics where banks were under-capitalized, over-leveraged and had a greater reliance on short-term funding (Moneycontrol). Under Basel III, a bank’s tier 1 and tier 2-capital ratio must be a minimum of 8% of its risk-weighted holdings. The ratios represent high quality sources of capital, which banks and other financial institutions are required to maintain, in order to be hedged against bankruptcy. The minimum capital adequacy ratio, including the capital conservation buffer under Basel III, is 10.5%. (Investopedia)

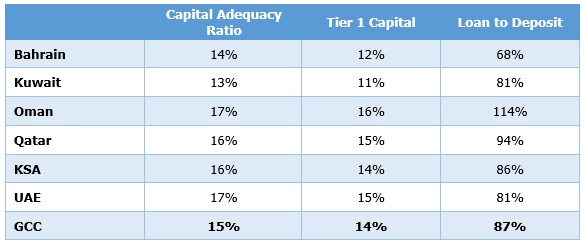

GCC Banks Liquidity Ratios (year-end 2018)

Source: Reuters; *Includes only listed banks from the GCC region.

Overall, GCC banks are in a good position to meet the enhanced capital requirements as laid down by Basel III. Majority of banks in the GCC have strong capital adequacy ratios with the average ratio for the region at around 15%. Oman and UAE have the highest capital adequacy ratio at 17%. Moreover, the core tier 1 capital of banks from all the gulf countries average at around 14% which is greater than the required 8% under Basel III. GCC banks have also maintained a healthy loan to deposit ratio of approximately 87% as of yearend 2018. In Oman however, we see a loan to deposit ratio of greater than 100% meaning the bank will not have significant reserves available for unexpected contingencies. Growth in lending by Oman’s conventional banks have outpaced growth in deposits increasing the average loan to deposit ratio to 114%. This has been predominantly led by a significant slowdown in the growth in deposits after oil revenue began falling in late 2014.

GCC banks largely fund themselves through customer deposits, which are short term in nature, as the proportion of long-term facilities to total funding is limited. However, the liquidity mismatch in GCC’s banking sector liquidity has improved substantially in recent months thanks to a higher average oil prices, sovereign debt issuances and modest loan growth. While improving oil prices have generated higher government revenues, these are still far from fiscal break-even for most GCC governments. Gulf debt markets are not as deep or varied as developed markets, and therefore, domestic banks have a limited choice of liquid instruments that can be used locally (Gulfbusiness). GCC governments have therefore started to tap into international markets, which has supported liquidity conditions in these markets as part of the international debt proceeds were deposited in the banking system. GCC bond and sukuk issuance surged by USD 32bn in Q1 2019, raising outstanding debt in the region to USD 478bn (Saudi Gazette).

Given the significant role of governments in liquidity creation in the GCC region, a strong collaboration with the ministries of finance, including the exchange of information on government cash flows, will be of immense importance in this respect. GCC central banks need to make use of the full range of liquidity management instruments at its disposal in times of liquidity tightening. Instruments require a thorough review to ensure their terms and pricing are well articulated and encourage interbank market participation. Increased reliance on open-market operations will help encourage the development of interbank markets and allow for an active liquidity management on the part of central banks in the region. Moreover, developing liquidity-forecasting tools will be of key importance in adequately assessing the scope, timing and magnitude of liquidity management operations required to deal with potential liquidity risk among banks (IMF).

This article has also featured in the recently published Monthly Market Review for the month of September. To know more about more the developments in the GCC أسواق المال, click here: Monthly Market Review (September 2019).