هيكلة الأسهم ذات الفئة المزدوجة: الحل لإدراج الشركات العائلية في البورصة

Dual Class Share (DCS) structure is a governance structure that provides certain shareholders with voting power or other related rights that is disproportionate to their shareholding. Typically, one share provides one vote; in case of dual class share structure, one class of shares offer one vote, while shares in another class could carry multiple voting rights or absolutely no voting rights. For example, Alphabet Inc. (parent company of Google) has different class of shares: class A ordinary shares that is traded on Nasdaq has one vote per share; and class B shares which is not publicly traded has 10 votes per share. This way, the founders who owned 92.5% of the class B shares, represented approximately 58.5% of voting rights and maintained control over the firm.

Historically, dual-class shares rose in popularity to thwart corporate threats. Dual class shares were used by UK companies in the 1960s to protect themselves from hostile takeovers. Similarly, the start of corporate raiders during 1980’s in the US led New York Stock Exchange (NYSE) to reintroduce the structure.

Proponents of dual-class share structures say US newspaper businesses that floated their ventures in the second half of the 20th century majorly utilized the structure to protect editorial integrity from outside shareholder pressure. The ability to focus on building long-term value without worrying about short-term pressures from market is touted as a major advantage in dual class share structures.

In recent times, Silicon Valley entrepreneurs have embraced this structure when they intend to float their business, to prevent investors from interfering in the way they run their business. Initial Public Offerings (IPOs) in technology sector, Google, Facebook and LinkedIn have all had dual share structures; entrepreneurs argue that it would enable them to bring their ideas to the capital markets at an early stage, and simultaneously allow the companies to plan for the long term.

Presently, U.S (NYSE & NASDAQ), Canada & Sweden stock exchanges allow for dual class share structure. In U.K, ‘premium segment’ listing doesn’t permit while ‘standard segment’ listing allows multiple voting structures. Other stock exchange such as Singapore is reconsidering its earlier ban on dual class shares to win IPO businesses from its rival Hong Kong. Hong Kong lost out on an opportunity to list Alibaba in its exchange due to its existing ban on dual class stocks.

Closer to home, we could extend the argument to family businesses in GCC region which could benefit from introduction of multiple share structures in capital markets. Dual class shares would provide the necessary impetus for family businesses in the region to float their businesses; additionally it would also permit different dividend policies for different classes of shareholder thus enabling them to retain control over management and capital. Apart from traditional, family-run businesses, dual share structure would also incentivize start-up companies to consider Kuwait Stock Exchange as a potential listing venue. Greater flexibility in raising and managing capital would provide the market participants with wider range of investment opportunities. As a result, Kuwait Stock Exchange could become a comprehensive, vibrant and dynamic market that could draw both traditional family businesses as well as modern start-ups.

However, not all is rosy and dual share structure has its fair share of opponents. The founders of Snapchat in its recent IPO sold shares that were devoid of voting rights – a first among IPOs in the US. Founders of Google and Facebook have concentrated control by creating different classes of stock, but none have a class structure that has no votes at all. Many passive funds that track indices would be forced to own them, when they are included in major stock indices. These funds have raised an alarm and California pension fund, CalPERS dubbed the move as a banana republic approach to corporate governance.

Opponents of dual class share structure claim that lack of one-share-one-vote would prevent investors from acting as stewards of the company, and also dilute the management performance as there would neither the incentive to perform nor the fear of takeover by rival firm. They further fear that risks of expropriation – owners trying to extract excess private benefits, such as excessive remuneration for themselves to the agony of non-controlling shareholders, could also be exacerbated.

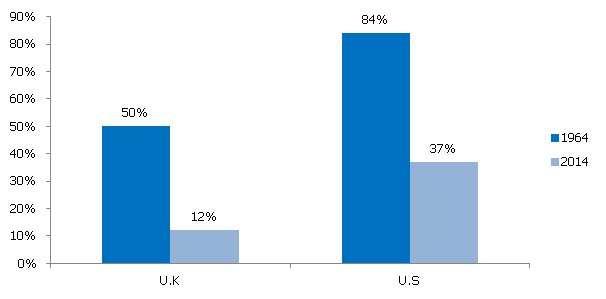

Poor management accountability could also arise from changing ownership structure. Activist investors, who could monitor, engage and hold the management accountable are short in supply. According to research, among OECD nations, structure of listed firms has moved away from direct ownership to intermediary ownership by professional asset managers, such as mutual funds, pension funds, hedge funds, Exchange Traded Funds (ETFs) amongst others. Moreover, new class of investors such as high-frequency traders and short sellers have no incentive to engage with management or exercise their voting rights.

Figure: Change in direct stock ownership levels over 50 years

Source: OECD – Institutional Investors as Owners: Who are they and what do they do?

Meanwhile, various ideas for broadening the share types while protecting investors are being evaluated such as, setting limits on proportion of voting and non-voting shares, restricting issuance of new dual class structure shares post-listing, mandatory conversion of shares after certain time period or including a sunset clause so that they expire after a set period of time.

There is a need to revive and rejuvenate the Kuwait capital markets, especially after a series of delisting and tepid market performance. In this context, introduction and adoption of dual class share structure could be a progressive step for Kuwait capital markets and to position itself as a leading capital raising venue in the region. Family businesses that intend to publicly list but wouldn’t like to cede control in running their company, should be given a choice to do so.