أسواق المال الخليجية – زخم الحضور العالمي القوي!

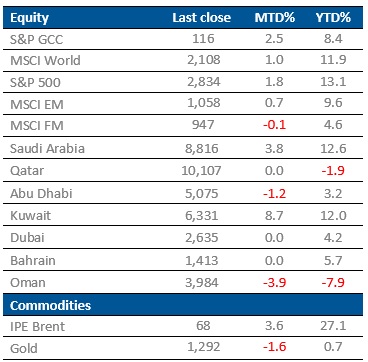

According to recently published Monthly Market Review for the month of March, performance of GCC equity markets improved with Kuwait being the top performer, followed by Saudi Arabia. Qatar remained flat while Oman and Dubai continued to retract. Globally, China‘s Shanghai index surged sharply, becoming the leading performer for the year as conducive policy environment, easing concerns pertaining to trade war and improving sentiments resulted in increased inflows. Emerging markets continued the strong momentum during the month of March, particularly India reported healthy gains.

GCC Markets: Kuwait and Saudi Arabia clock 12% YTD

Kuwait stock market accelerated in the month of March as it continued its positive trend for the third consecutive month this year. Kuwait registered a gain of 8.7% in March as investors positively registered the news that MSCI proposed to reclassify the MSCI Kuwait Index from Frontier to Emerging Markets as part of the 2019 Annual Market Classification Review. Among the blue chips, Kuwait Financial House (KFH) emerged to be the best performer, with MTD gains of 11.7%. Boubyan Bank and National Bank of Kuwait also registered substantial gains of 11% and 8.1% respectively. Kuwait banking stocks benefited greatly as restrictions on foreign ownership cap of 49% on domestic banks were lifted.

The performance of various GCC market indices diverged during the month with The Saudi Arabian Tadawul index gained 3.8% in the month of March, registering a considerable positive movement from the negative returns of -0.8% witnessed last month. The Qatar Bahrain, and Dubai Financial Market General Index ended the month on a flat note and Abu Dhabi index registered a MTD return of -1.2% for the month of March. Oman was the worst performing market among its GCC peers with a MTD return of -3.9%.

Global Markets: Equity markets continued to perform

Global Equities continued to offer positive returns, however, the pace of growth seems to have slowed down. This was evidenced by MSCI World index which increased by just 1% for the month of March. The US S&P 500 index saw gains of 1.8% in March with YTD gains now at 13.1%. However, growth forecasts for the US economy depicts a negative outlook as the Federal Reserve voted to hold interest rates steady and shaved its growth forecast.

Indian markets dominated the equity indices across the globe delivering MTD returns of 7.82% to its investors. The Chinese markets continued to offer positive returns with a 5.1% gain in March, taking the YTD gains up to a staggering 24% in 2019. The Chinese markets could see further growth upwards as the government has announced stimulus measures of nearly USD 300 billion.

Oil markets have continued the rally for the third straight month in 2019 as Brent Crude prices rose by an additional 3.6% to USD 68.4 during the month of March. Oil prices have found support from efforts by the OPEC and non-affiliated allies like Russia, to trim output and prices are expected to rise further. On top of U.S. sanctions, Venezuela is experiencing massive power cuts, which has crippled its oil industry further pushing the prices higher.

Global Market Trends – March 2019

Source: Reuters