كيف تحاكي أداء سعر سوق النفط الفوري؟ – الجواب هو أن هذا الأمر مستحيل تقريباً.

Crude oil by a wide margin is the most traded commodity in the world and arguably the most important. Having hit lows of less than USD 43 a barrel in the summer, WTI crude has spent the second half of the year on a steadily rising trend and looks set to end 2017 somewhere close to USD 60. The main driving force behind the oil price rise has been OPEC’s decision to maintain oil production cuts that started in December 2016. The degree of compliance by members of the oil cartel has also improved as the year progressed.

The last few years indicate that calling the direction of oil prices with any degree of accuracy is very difficult. However as the oil prices show a recovery trend many will be tempted to gain from the surging oil prices. The spot price is relatively unimportant in global oil markets. Most refiners purchase oil with the help of long-term contracts, either one-off privately negotiated contracts or standard contracts from an exchange. But the idea of spot price is one that fascinates investors – everyone is intent on trying to invest in something that tracks “the price of oil” as closely as possible. In 2016, WTI oil price return was a remarkable 46% which further extended by 9.4% YTD as of 15th December.

WTI Spot price (Dollars per Barrel)

Source: EIA; Data as of December 15, 2017

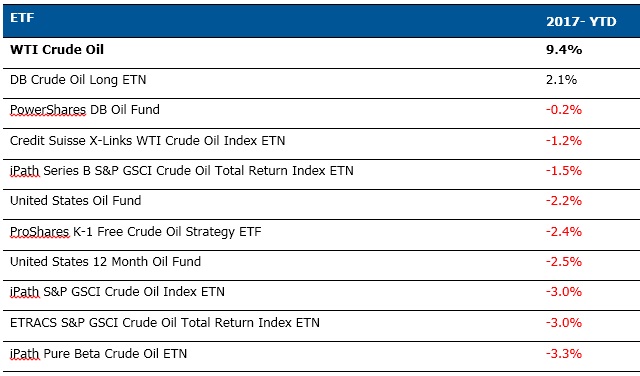

Crude Oil ETFs track the price changes of crude oil, allowing investors to gain exposure to this market without the need for a futures account. There are many exchange-traded funds (ETFs) that focus solely on oil. Each ETF is structured slightly differently depending on the futures contract it holds, but all aim to give investors an easy way to invest in oil. The oil ETFs are all highly correlated with the spot price of benchmark it tracks. However, it is important to understand the reason behind the variation in the returns of these investable alternatives as none exactly tracks the spot’s return. In fact, against the near double digit returns of spot oil this year 90% of the top performing oil ETFs have lost the money.

Top performing Oil ETFs vs WTI Crude oil

Source: ETFdb; Data as of December 15, 2017

The simple reason for wide variance between ETFs and spot oil price performance is that the ETFs rely on future contracts to get exposure to oil, and futures prices, by definition, are not spot oil. As a futures contract comes close to its due date, its price can approach (or converge) to spot. But the futures price starts either higher or lower than spot, meaning that the market values futures oil more or less than spot oil it can take delivery today. One of the key reasons behind the mismatch in ETF returns and spot oil price is due to a phenomenon termed ‘contango’ which has a huge impact on investors return in oil futures contracts. Contango is the situation where the ‘out-month’ contracts are more expensive than the ‘near-month’ contract. When that’s the case, there are real costs to allowing a contract to roll forward into the next month’s contract. Thus there is a roll cost or yield involved in buying next month’s futures which lower the profit margins. In fact, contango can turn rising oil prices into a loss if it is steep enough.

As opposed to this when markets are in backwardation a situation where long-dated contracts are cheaper than next month futures, futures-based products will generally outperform spot prices. The oil ETFs actually outperformed spot WTI when crude prices plummeted in 2008 (ETFdb). While contango destroys value for oil ETF investors, backwardation creates it.

Conclusion

Ultimately, there may be no possible solution or financial instrument to accurately capture the price performance of spot oil. However, it is of utmost importance to understand clearly what it is we are really trying to capture. It’s natural to think about the spot price of oil. But including oil as a commodity play within an asset allocation framework could add substantial risk in an investor’s portfolio. The front-month contract may simply be the best economic proxy available, since the roll yield inherent in the futures market can severely affect the return performance of ETF which is significantly influenced by factors other than just the movement in the price of oil. Thus while an investor can watch the daily movement in oil price, they cannot hold it and realize returns identical to the spot price movements.