IMF forecasts steeper fall in GCC countries’ 2020 GDP

As the world charts its recovery from COVID-19’s impact amidst the resurgence of cases in some countries and lingering threat of spike in others, the countries’ recovery path and economic outlook are being closely watched.

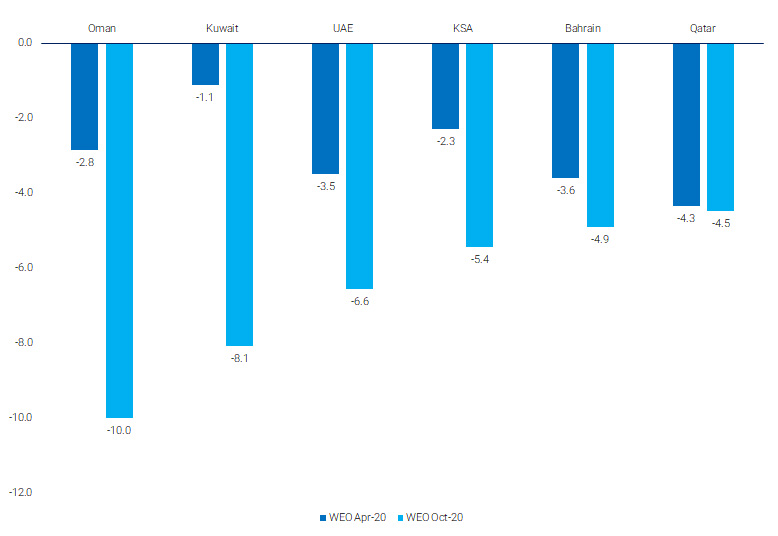

IMF in its recent World Economic Outlook (October 2020) has revised GDP forecasts for GCC countries downwards from its April forecast, citing deeper-than-expected impact of lockdowns on mobility and weak global growth.

For GCC as a whole, IMF expects GDP to contract by 6% in 2020. Non-oil GDP is expected to contract by 5.7% mainly due to collapse of service sector caused by a decline in domestic and external demand. Oil GDP is expected to contract by 6.2% on the back of production cuts based on OPEC+ agreements caused by sluggish oil demand.

The revision has been steepest for Oman and Kuwait. Kuwait’s lockdown measures to curb the spread of the pandemic has been one of the longest continuous stretches in the world, impacting spending and investment activity (World Bank).

Figure 1: Revision of Real GDP Growth Forecasts 2020

Source: IMF World Economic Outlook (WEO)

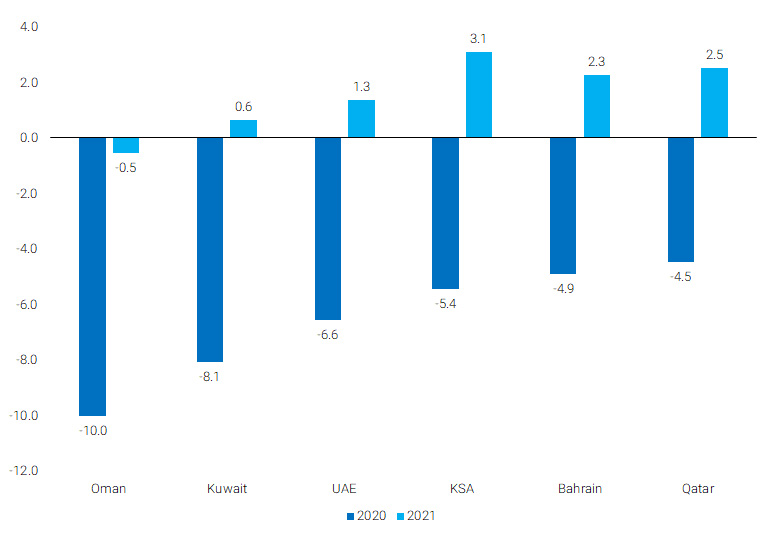

Figure 2: Real GDP Growth Forecasts for 2020 and 2021

Source: IMF World Economic Outlook (WEO)

- Kuwait banks have the highest provision coverage among GCC banks, at 230% of NPLs

- Saudi Arabia has improved its position the most – surging past 30 countries, in Ease of Doing Business rankings for 2020.

- Qatar enjoys the lowest break-even oil price at USD 53/bbl.

GCC region is expected to grow by 2.3% in 2021 with all countries other than Oman expected to return to growth in 2021. However, the estimate hinges on the path of the pandemic. Oil prices in 2021 are expected to be stagnant in the range of USD 40-50 per barrel. Fiscal break even oil price for all GCC countries except Qatar is estimated to be higher than this range. Oil exports from GCC for 2021 is also expected to be below 2019 levels. Except UAE, all GCC countries are also expected to post negative fiscal balance in 2020 and 2021. The countries have been resorting to measures such as spending cuts, borrowing (except Kuwait), and hike in VAT (Saudi Arabia) etc. to counter the fall in oil revenue. Economic diversification by boosting non-oil sector, continued coronavirus safety measures, targeted implementation of pandemic related policies with streamlined procedures would play a key role in strengthening the recovery of GCC economies.

The article is an excerpt from our “GCC أسواق المال Monthly Review: October 2020” report. Read more