شهدت أسواق الشرق الأوسط وشمال أفريقيا ارتفاعًا في أسعار النفط في شهر مارس

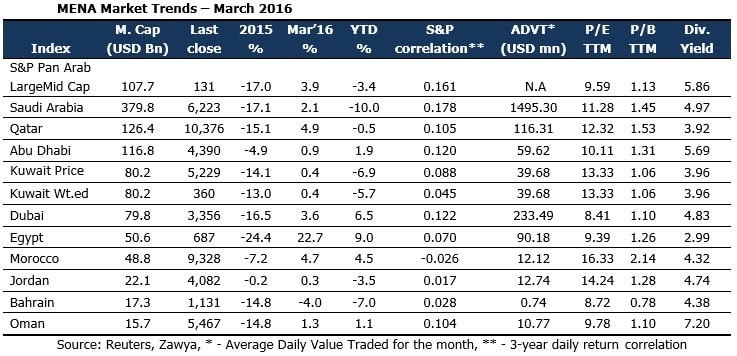

Egypt’s stocks rose in March, as the country’s central bank devalued its currency and stated that it would adopt a more flexible exchange-rate policy, to ease an acute dollar shortage that is hurting the economy. The devaluation, along with other measures, made stocks cheaper for both domestic and foreign investors, who went on a purchasing binge. The exchange closed the month at 687 points, up from 560 points in February, in what has been the single largest monthly gain in over eight years. Strong buying activity by foreign institutions and reduced net selling by domestic investors, especially in the small and large cap segments, lifted Qatari index by close to 5% in March. For GCC markets, rising oil price and stabilizing China provided cheer for investors in March.

MENA markets liquidity had a positive month, with volumes increasing by 26% and value traded rising by 5.5%. Egypt, Dubai, Qatar and Morocco witnessed increases in both volume and value traded, while Abu Dhabi, Bahrain and Saudi Arabia were the only markets to record declines in both. Volume and value traded in Egypt increased by 104% and 93%, respectively, while the Abu Dhabi witnessed a 34% volume and 12.5% value drop.

Most Blue Chips ended the month of March in green, with Ezdan Holding (Qatar) topping the charts at 18.5%, as the company benefitted from the rise in oil price in March. DP World (UAE, 10.7%) and Americana (Kuwait, 7.9%) followed Ezdan, at the top of the table. The former obtained Indian government approval for reorganizing into a merged entity, and announced plans for an IPO for this new holding firm, while shares of the latter grew almost 8%, despite posting 14.8% fall in its Q4 net profit. Americana found a bidder, Adeptio LLC, backed by a consortium of banks, including Citigroup Inc. and Standard Chartered Plc, who have pledged USD 1.5bn for this deal. Banks had a rough month with FGB (-7.8%), Al Rajhi (-3.7%) and NBK (-3.6%) falling the most among blue chips. FGB, the largest lender by market value in the UAE, won shareholder approval to issue debt early in March. Also, the credit crisis among SMEs in the UAE, has put pressure on banks to restructure loans.

GCC Legal, Regulatory and Market Actions

Banks in the United Arab Emirates will suspend legal action against small and medium sized enterprises (SMEs) struggling to repay debt for up to three months to prevent a surge in defaults that may jeopardize the economy. The rescue initiative launched by the banking industry to halt criminal prosecutions for bounced cheques, is a major departure for the UAE’s financial system, which relies on paper cheques as security in business transactions.

Saudi Arabia's central bank will allow mortgage companies to supply a greater share of funding for home purchases, raising the maximum permitted contribution to 85 per cent from 70 per cent of the value of the house. In December, the bank licensed a national home finance company, Bidaya, and in February, it introduced an “affordable mortgage” programme through which the Ministry of Finance would guarantee 15 percent of the financing for a home purchase.

Bahrain's stock exchange has established a market for real estate investment trusts (REITs). Under the plan, REITs licensed by the central bank can be listed and traded by investors in the secondary market. REITs are common in many markets, but are relatively new to the Middle East, with Emirates REIT becoming the regions first in April 2014. Saudi Arabia's Capital Market Authority (CMA) is also studying plans to introduce rules governing the listing of REITs.

Oil Market Review

Brent crude hit a high of USD 42 per barrel before closing the month at just below USD 40 per barrel, up 10.1% from February. Brent crude rose over talks of a consensus being reached by major oil producers to freeze production levels. Despite Iran’s reservations, other oil producers expressed optimism at the deal being finalized. However, concerns about oversupply, and a bearish supply signal from Saudi and Kuwait pulled down the gains in the last week of March.