العقارات السكنية القطرية

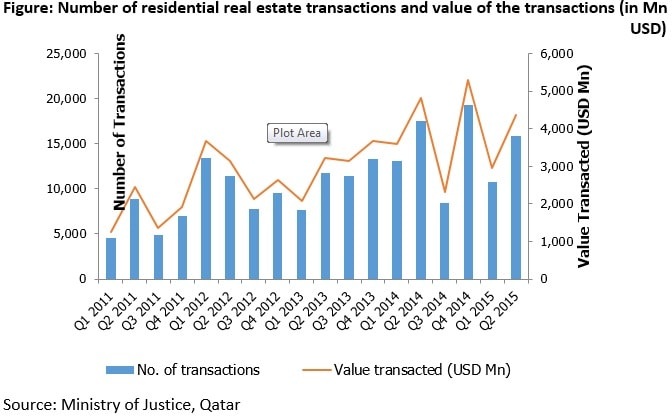

The residential real estate market in Qatar is characterized by undersupply and the increasing demand is expected to add to the existing market pressure. Qatar is forecasted to add a cumulative supply of 22,000 units during 2014-2018 to the residential real estate market, a CAGR of 2%, while the demand is estimated to increase at 10% CAGR during the same period.

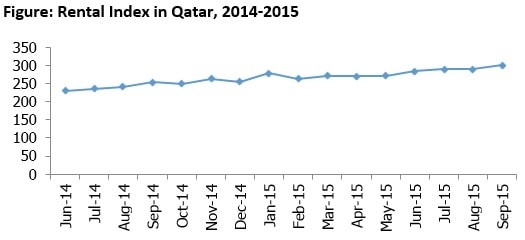

Doha has had one of the highest rental yields compared to world cities such as Dubai, Tokyo and New York, with the rental price index rising by 30% during the Jun’14 and Sep’15.

Qatar’s GDP growth rate is forecasted by IMF to remain positive during 2015-17 period, especially for the non-hydrocarbon sector, which is expected to grow at approximately 10% over the next three years, mainly driven by the growth in construction and real estate. According to Marmore’s Qatar residential real estate report, Real estate sector is expected to attract 49.2% of the total estimated USD 80.2bn spending until 2017.

The increased spending in real estate will help in creation of more housing units in affordable and high end housing segments.

The demand for housing units can be expected to increase as 85% of Qatar’s population comprises of non-nationals, with projects such as Pearl Qatar allowing free hold ownership for non-Qataris, which may lead to an increase in the sale price. Many of the expatriates in Qatar, especially the white-collared professionals, would be willing to invest in Qatar’s real estate and own dwelling units. Allowing free hold of property for expatriates in all major developments would boost the demand for residential units in the country.

Land prices in Qatar are high mainly due to lower supply available for residential construction purposes when compared to the GCC countries3. Higher cost of construction, shortage of manpower and low investor confidence are major challenges to the development of the real estate sector in Qatar.