Reasons for poor Analyst Coverage in Kuwait

The present scenario

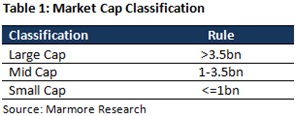

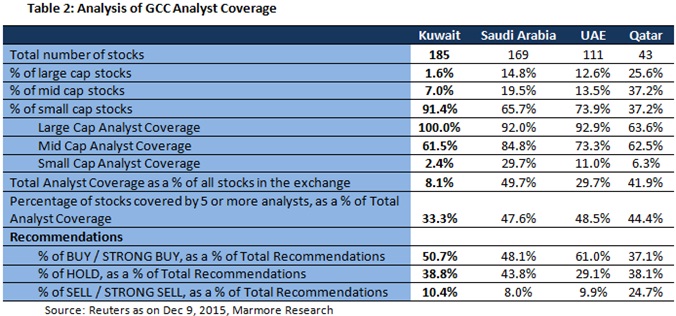

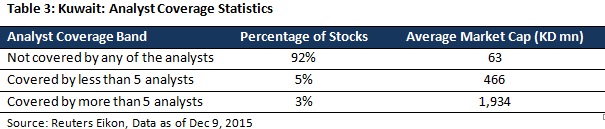

Compared to all other stock exchanges in the GCC the number of large- and mid- cap stocks, as per the above definition, is much lower in Kuwait, than in peer countries, whereas the number of small-cap stocks is over 91% of the market. Qatar has the most even cap divide, while Kuwait sits at the other end of the spectrum. In terms of analyst coverage (as a percentage of all stocks in the exchange), Kuwait is the lowest at 8.1%, while Saudi is the highest at close to 49.7%. For Qatar and the UAE analyst coverage ranges stands at 42% and 30%, respectively. Looking at the cap-wise analyst coverage, other than Qatar (64%), all other GCC nations have over 90% analyst coverage for large-cap stocks, due to the popularity of these stocks among the investors and the relatively higher amount of research and information available in the public domain. This coverage value decreases for mid-cap companies, with a high of 91% seen for Saudi Arabia, and a low of 57% for UAE. It falls further for small-cap companies, with a high coverage of 28% seen for Saudi Arabian small-caps and a low of 3% for Kuwaiti small-caps.

In terms of cap-wise coverage as a percentage of total analyst coverage, Kuwait has a higher coverage among mid-cap companies, followed by small-cap. But the very low total coverage indicates that these numbers are much lower compared to other GCC nations. With the exception of Qatar, Kuwait has the lowest coverage in the small-cap segment among the four GCC nations.

Under GCC stocks that are followed by 5 or more analysts, Kuwait has the lowest coverage at 33.3% (only 5 companies) of stocks with analyst coverage, while the rest of the countries under consideration have more than 40% of stocks with analyst coverage that are covered by 5 or more analysts. Again, since the markets in the region are top heavy, most of the stocks with 5 or more analysts fall under the large cap, with lesser such coverage for the mid-cap and close to nil coverage for the small-cap stocks.

BUY and HOLD recommendations dominate the GCC markets, with close to or over 90% recommendations for Kuwait, Saudi and the UAE, while for Qatar it is 76%. SELL recommendations are the least popular in the region, with Qatar faring marginally better compared to its peers.

Markets driven by retail investors

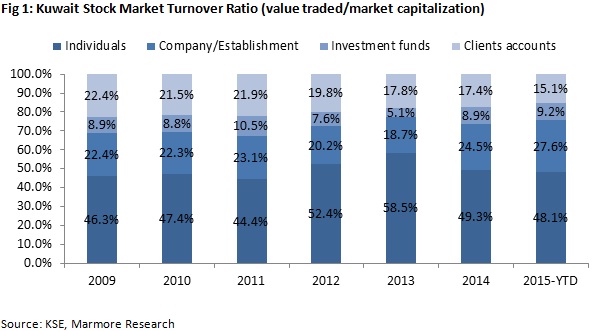

Over 45% of the value traded in Kuwait, across the years, is attributed to retail investors. Companies and funds, which are the major consumers of research, together accounted for around 30%, on average, since 2009.

This figure is over 85% for Saudi Arabia, 73% for Dubai and 47% for Qatar. Primary reason why analyst coverage is low in the region is the relative lower consumption of research in the region

Most research material widely available in English and not Arabic

The presence of larger expat population compared to local population in the region and investments from companies and foreign institutions have pushed demand for research in English, while research in Arabic still lags behind. The demand for research in Arabic is less, which has led to lesser consumption of research among local investors, which has in turn led analysts to shift their focus to research primarily in English.

Investments based on sentiments and speculation

GCC markets are top-heavy, and investments are restricted mostly in the large- and mid-cap space. These investments are driven primarily by sentiments and speculation. Trading volumes are driven mostly by word-of-mouth information.

Lack of Liquidity in the mid-cap and small-cap space

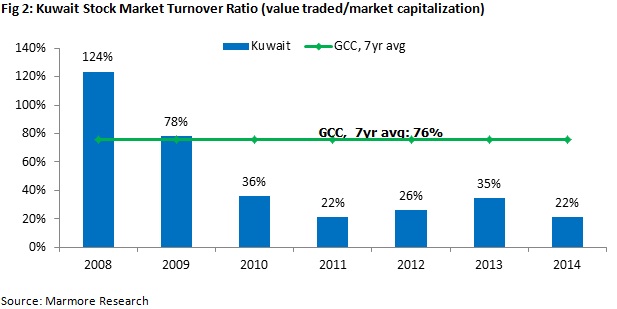

Lack of liquidity, especially in the mid-cap and small-cap space, and general lack of investor interest has led to lower research offerings in this segment. The draining liquidity and the top heavy nature of the Kuwait bourse has led to dwindling analyst interest in the mid-cap and small-cap segment. Lack of new listings in the domestic market and landmark events in other regional indices has also contributed to lower liquidity in Kuwaiti bourse. Stock turnover ratio has been on a declining trend and stood at 22% in Kuwait Stock Exchange as against GCC average of 76%.

A lot of the companies in the Kuwait stock exchange, especially in the small-cap segment, are shell companies or investment companies that trade on many of the asset classes, such as equities and real estate. Many of these experienced severe losses in the wake of the 2008 global financial crisis, and have not recovered since. Before the crisis, credit towards purchasing of securities, to the real estate sector and investment companies amounted to almost 50% of the total credit disbursed. The fall in equity value was exacerbated by leveraged positions of the market participants and consequently, credit disbursal fell to low single digits contributing further to lower liquidity in the bourse, which led to these companies halting their trading operations.

Information disclosure and Time taken

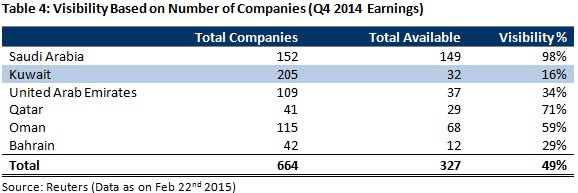

Kuwait companies lag in timely disclosures compared to their regional peers, and the time taken for compliance is a lot more lenient. This can be seen in regular filings of financial results, where Kuwait lags behind the rest of the GCC. Delays in acquiring time-sensitive information and minimal public disclosures discourage analysts from following companies.

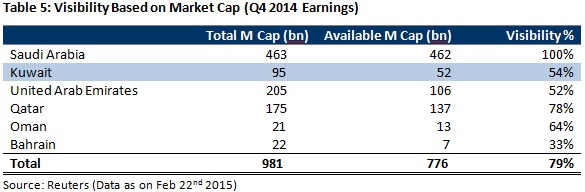

From the above two tables it can be seen that while the number of companies that have declared results seem much lower, in terms of market cap it is relatively higher. The reason for this is the declaration of financial results happens faster large-cap companies, as compared to mid- and small-cap companies. In the case of Kuwait, while only 16% of companies had declared Q4 results on 22 Feb 2015, this represented a market cap visibility of 54%, which implies that large-cap companies are quick to comply with exchange regulations compared to other companies. Also, compared to the GCC countries, Kuwait seems to have relatively lenient regulations as can be seen with the lowest company visibility.

Following the outbreak of financial crisis, regulators have increased required disclosures and filing requirements. But the cost of compliance, which includes auditing and disclosure costs has increased. In certain cases, the various costs associated with listing such as continued expenditures related to filing financials and ad hoc material information disclosures may no longer be a viable proposition, especially for smaller and undervalued companies.

The issuance of new regulations by the Capital Market Authority (CMA) of Kuwait in 2013 to improve investor confidence, gave the CMA greater independence to stop market irregularities, and boost transparency in bourse dealings. This gave the regulatory authority teeth to go after companies that are non-compliant with issued regulations and exchange rules, as seen with a number of companies that have been delisted recently – voluntarily or involuntarily – due to long inactivity, suspension of trading or failure to publish financial results within the stipulated time. Poor operational performances of firms resulting in losses that cumulatively exceed 75% of their capital are also delisted. But the strict enforcement of corporate governance and exchange rules still lags behind the rest of the GCC peers.

What should be done to increase analyst coverage?

Kuwait is behind the curve compared to other GCC countries in improving capital market efficiencies. Despite being the oldest stock exchange with the maximum number of listed stocks, the market lacks the required breadth and depth due to the concentration of stocks to a limited number of sectors. Increasing the depth would encourage research activities. Steps should be taken for Kuwait to represent the MSCI EM Index similar to UAE and Qatar. The first step to achieve that would be encouraging foreign investors to invest in the market. The fact that the market is dominated by retail participant’s disincentives the needs for research. Steps should be taken to encourage domestic institutional investors who have a longer term investment horizon to invest in the stock market which would also bring in the much need liquidity.

The Capital Market Authority should look at enforcing corporate governance codes to improve quality of disclosures. It should also encourage companies to engage with the analysts on a regular basis to ensure maximum information sharing. The CMA should also ensure that there is timely availability of information and data on listed companies either on through a separate website or through the existing system. Cross-listing stocks on other regional exchanges where there is more analysts coverage could aid in spurring research in Kuwait.