The rise & rise of GCC Airlines

Here are FOUR questions that you would like to ask about the GCC airline industry. We provide the answers.

#1. How well in recent years has the aviation sector in GCC region grown?

There is only one word for it, “tremendously.” The two figures below tell you the story of growth; the first is country specific and the second is aircraft specific.

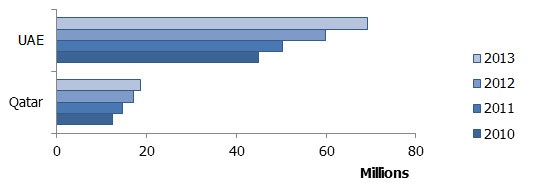

Figure 1- Passengers carried by registered air carriers in the UAE and Qatar

Source – World Bank

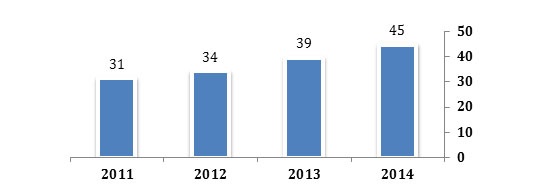

Figure 2 – Passengers carried by Emirates (in Millions)

- The passengers carried by Emirates grew at a CAGR of 12.33% from 2011 to 2014.

- The comparable growth rate for Qatar Airways was 14 percent.

There are broadly three reasons for this growth. The first is the GCC’s geographical advantage. It lies at the crossroad, between the West and the East making it easier for short hauls to fly. Little wonder, it has now become a global transportation hub. Two other drivers are the growth in tourism in the region, which has led to a higher demand from leisure travelers, and the exploding expatriate population.

#2. How did it all begin and how have the GCC Airlines fared?

Thirty years ago, in 1985, the Dubai government provided USD 10million as seed capital to Emirates to start a local airline. It began with two new aircrafts, and one leased from Pakistan Airline. Emirates’ first route was from Dubai to Karachi. Soon, the world realized Dubai’s potential as a commercial hub, given its geographical advantage. Emirates capitalized on the opportunities by continually expanding as also by adding destinations in quick succession.

In 2010, Emirates ordered for 32 superjumbos with Airbus. With such expansion, the airline required more space at Dubai Airport. The massive Terminal 3, in Dubai International Airport, was built especially for Emirates Airline. Emirates carried about 45million passengers in 2014, which is close to 65% of the UAE’s total passenger traffic. Emirates has remained profitable every year for the last 25 years, unlike many of its regional peers. It is now the world’s largest airline in terms of international passenger traffic and is targeting 70million passengers annually by 2020.

Table 1- Emirates Profile

| Parameter | Units |

| Destinations | 164 |

| Aircrafts | 234 |

| Order Book size | 140 |

| Expansion strategy | Organic Growth |

| Average Fleet Age | 6.3 years |

| Passenger load | 79.4% |

| Available Seat Kilometers | 271billion |

Source: Marmore Report – GCC Aviation

Today, Qatar Airways, Emirates, and Etihad Airways are in the international market and are among the top airlines, giving a significant competition to big foreign players. Qatar Airways was ranked second on the list of ‘’The World's Top 100 Airlines in 2014” while Emirates stood fourth. Slowly, but surely, there is a preferential shift to the GCC region-based airlines, due to their competitive prices and high-quality services.

#3. What’s the open-skies agreement? What are the benefits and complaints?

The open-skies agreement majorly entails the following:

- Permit to unrestricted takeoffs and landings in partner countries

- Follow specified level of safety standards

- Ease the regulatory process of both passengers and cargo

- Allowing for airline investment

- Authorize airline Joint Ventures, and cooperative marketing

Benefit wise, the consumers of both the countries stand to gain with such an agreement as it could drive down the prices, and allow more accessibility to the partner country. The US made the open-skies agreement with the GCC countries in 2001-2002.

However there are some complaints and these are from the US partners. The complaint is that the Gulf carriers have a skewed advantage as they receive massive government subsidies enabling them to sell tickets at a lower price, with the sole intention of gaining more market share. The second complaint is the imbalance in the mutual benefits from the agreement. The American airlines feel that GCC carriers’ full access to the vast US market is much more lucrative than American carriers; full access to the GCC region.

#4. What’s this fuss over subsidy and how far is the complaint true?

The US and European players claim that the Gulf governments, given their deep pockets, have been subsidizing the Airlines, giving them an unfair advantage. In 2015, three of the four largest US airlines – American, Delta and United Airways jointly submitted a 55-page dossier to the US Government that is said to prove their allegations. The details disclosed state that in the last decade, three GCC region’s carriers – Emirates, Etihad and Qatar Airways have received subsidies to the tune of USD 42billion. The purpose of the dossier is to urge US lawmakers to reconsider their open-skies treaty with UAE and Qatar.

The proof apparently shows that Etihad has received an alleged USD 17billion of subsidy since 2004, which includes USD 4.6billion in interest-free government loans and government capital injections amounting to USD 6.3billion. Also, Etihad supposedly classified its interest free loan as equity, as it didn’t have any obligation to repay it for the foreseeable future. Similarly, Qatar Airways has allegedly received USD 16 billion in subsidies in the last decade. Like Etihad Airways, Qatar Airway is alleged to have converted these loans to equity in 2009 because repayment was never planned. Emirates has allegedly received subsidies worth USD 5 billion since 2004. The subsidies have been in the form of discounted airport charges, de-unionized labor and tax exemptions from the government.

GCC carriers are refuting the allegations. Emirates has stated that it only ever received USD 10million as a seed capital and USD 88 million worth of infrastructure investment by its government. It says that it has in turn paid a dividend of USD 2.3billion till date to its shareholders. The claims made by the US airline consortium haven’t been verified as yet, and all the Gulf carriers seem ready to issue a comprehensive rebuttal of them.

It remains to be seen what the outcome of these allegations would be.