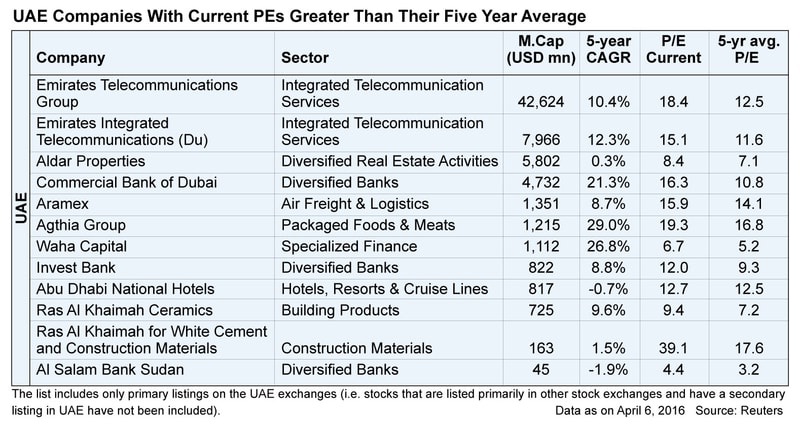

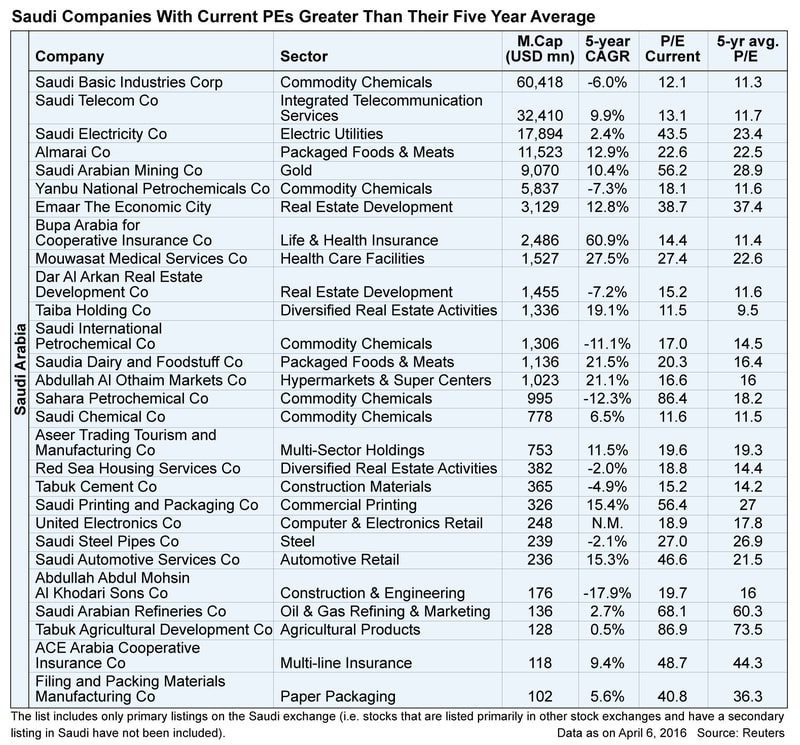

لا تزال هذه الأسهم في الإمارات العربية المتحدة والمملكة العربية السعودية تتداول فوق معدل السعر إلى الأرباح لمدة 5 سنوات على الرغم من تراجع السوق

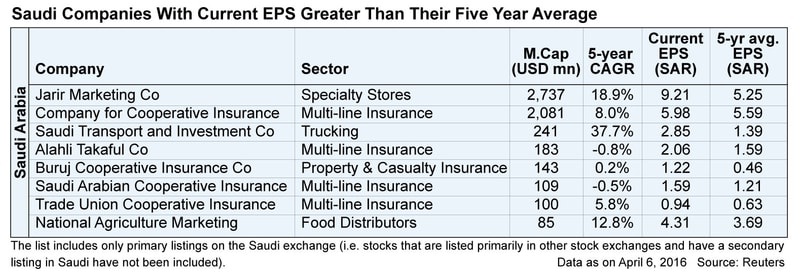

The report, shared exclusively with Wealth Monitor, includes only primary listings on both the exchanges (meaning stocks that are listed primarily in other stock exchanges and have a secondary listing on UAE or Tadawul have not been included). The report also shows that earnings of 8 companies in Tadawul are above their 5-year average, which includes names like Jarir Marketing, Alahli Takaful and National Agriculture Marketing, among others. In the case of UAE however no company had current EPS that is higher than its 5- year average. Whether the higher valuations of these stocks in UAE and KSA are justified or not is a subjective matter, what’s striking is that these stocks have sailed against the tide at a time when Gulf equity markets have had to face the brunt of low crude oil prices.

The terms ‘earnings multiple’, ‘Price to Earnings ratio’, or PE ratio mean the same and is perhaps the most frequently used benchmark for evaluating the outlook of a stock. To interpret it simply, if a stock trades at 12 times its earnings, your share, as an investor and shareholder, of the profits for each of the stock you own is equal to 1/12th of the stock’s value. However, analysts reckon, the PE ratio shouldn’t be viewed in isolation and shouldn’t be the sole criterion for buying or selling a stock, as various other factors should also be factored into. The price relative to earnings is impacted by the growth rate of a company. A company with a high growth rate will cause a high price of its stock, and naturally a high P/E ratio. This means high growth companies have high P/E multiple while low growth rate companies have low P/E ratios.