ما هي شركات دول مجلس التعاون التي تجنبت سوق الصكوك

This article was first published in Islamic Finance news Volume 15 Issue 18 dated the 1st May 2018.

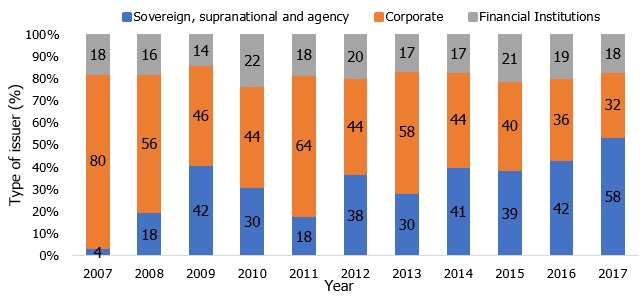

The sukuk segment of the Islamic financial industry, witnessed a lot of activity in 2017. There was a global sale of nearly USD 100 bn in sukuk which increased the amount raised by 40% from 2016 as there was sustained growth in the GCC region along with the continuation in non-Islamic markets like U.K and Australia and entry by new markets like Nigeria. While this can be seen as positive development in the global sukuk market, corporate sukuks present a slight cause of concern. There has been a decline in the number of issuances when compared to the number of issuances of sovereign sukuk. Majority of sukuk issued in 2017 were by sovereigns and financial institutions (around 63%).

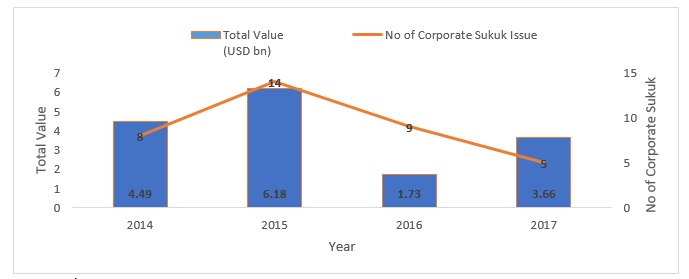

There has been a similar trend in the GCC region which has seen a decrease in the number of issuances of corporate bonds (which make up around 36% of the GCC sukuk market) from 9 in 2016 worth USD 1.73 bn to 5 in 2017 worth USD 3.66 bn. This increase in capital can be attributed to the issuance of Saudi Aramco sukuk bond (USD 3 bn). Although there was substantial interest shown by the corporates towards sukuk issuances in the past, there appears to be a wane in preference of sukuk as preferred option to access the debt capital markets. Through this note, we have tried to assess the potential reasons that have stopped corporate from issuing sukuks.

Graph: Global Sukuk Issuance

Source: Financial Times (Middle East)

Graph: Corporate Sukuk in GCC

Source: Thomson Reuters

Underdeveloped Regulatory Framework

The need for strong legal and regulatory frameworks is essential for a continued development of bond market. While the Accounting and Auditing Organization for Islamic Financial Institution (AAOIFI) develops Shariah rules which are mostly followed in GCC, they may not necessarily be accepted by other countries such as Malaysia. However, this could be a contradiction. With the absence of a global central body which can enforce standard laws to be followed among all countries, there is a lack of agreement among Shariah scholars on sukuk structure which create confusion among investors as to which sukuk are Shariah complaint and which are not. Companies such as Beximco Pharma had tried to take advantage by filing a case of non-compliance under Shariah law after defaulting against the agreement of sukuk. This undermines the trust in the corporate sukuk which leads to lower demand. A positive step in this area would be to standardize the process and laws for issuing sukuk.

Decreased Investor Confidence

Many investors were left puzzled when Dana gas declared that its two sukuk bonds, having a net value of USD 700 mn was Shariah non-complaint under UAE’s law and had subsequently stopped payments on the sukuk. This news was not received well among the bondholders who dumped the sukuk for which it lost over 13% in the latter half of 2017. There were concerns that other issuers could break their commitment of payment on the grounds of sukuk not being Shariah complaint. Further proposal by Dana Gas Company to exchange the sukuk for new instruments did not sit well with bondholders as profits earned would be less than half of the existing one. With no resolution in place, this issue has led to decreased investor confidence in companies. They feared for the loss of capital invested with minimal or no return and hence are hesitant to further investment. And this has not been the first time such an issue had occurred as Investment Dar, a Kuwaiti company similarly contradicted a transaction with BLOM bank for breaching Shariah law in 2009. Such occurrences of non-compliance do not bode well for investment in corporate sukuks.

Complex Nature of Instrument

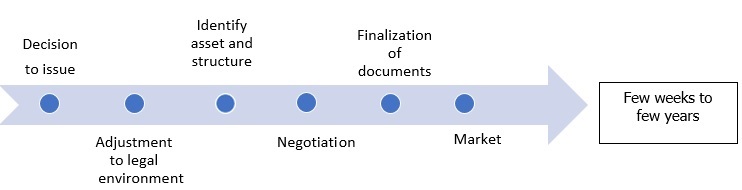

Sukuk are complex finance instruments. An issuance of sukuk depends on many factors such as assessing the market capacity for transaction, issuance cost, level of preparation for legal and regulatory environment for sukuk issuance, identification of appropriate sukuk assets as well as finalizing the structure of the sukuk. An issuing body issues a conventional bond in only few hours or a maximum of few days due to availability of standardized documents for issuance after reaching a decision to issue. For sukuk, the issuing body has to evaluate the issuing market for legal compliance, identify appropriate asset and structure for sukuk, consider all reviews from Shariah scholars and implement them for Shariah compliance, finalize documents and issue the sukuk in the market. It might take few weeks to few years for the sukuk to be bought by the investors as they are few in numbers. This might have led to loss in opportunity for the company for which it was raising capital in the first place by raising sukuks. Issuance of sukuks requires patience and an investment in time and resources which corporates may not be inclined to do so.

Exhibit: Time Process of Issuance

Bond

Sukuk

Source: S&P Global Ratings

Absence of Benchmarks

In the past, there was no major benchmark for sukuks in the GCC region. Due to the absence of benchmark for sukuk, there was no practical means to measure the risk attached as well as to cite price for a particular sukuk in terms of its spread. This provided investors with very less information about the sukuks in terms of investment. A positive step towards this was the inclusion of sukuk in certain private index such as Emerging Markets Bond Index (EMBI), which might lead to enhancement in trading in the secondary market and increase demand for the issuance of new sukuks.

Conclusion

Although the sukuk markets have a positive vibe, there are certain factors which can impede the growth of the sukuk market. Underdeveloped legal and regulatory framework, complexity of sukuks and decreased investor confidence might meet with reluctance by investors in investing in the sukuk market. Recognising the seriousness of the issue, governments in the region have undertaken steps to make it more attractive. Improved laws for more standardization and inclusion in certain index will definitely help in the growth of sukuk markets and may facilitate trading in the secondary market.