لماذا لم يتم سحب صناديق الاستثمار العقاري في دول مجلس التعاون الخليجي؟

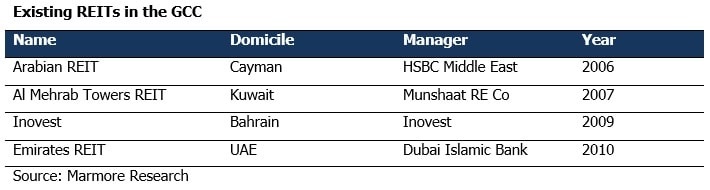

Islamic REITs can be a popular investment option for traditional investors who wish to invest in Sharia complaint products in assets other than equities such as real estate. However, GCC countries do not have any clear regulations in place for Islamic REITs and their listing. Countries such as Malaysia and Singapore have enlisted regulations for Islamic REITs due to which two UAE companies are expected to list their REITs in Malaysia worth RM 2 billion (USD 0.49 Bn) (Lancaster University).

Tax benefits for investors is found to be the major advantage of investing in REITs as dividends are not taxed. This advantage does not add much value to the GCC investors.

Emirates REIT is the only listed REIT in GCC. It manages 1.8 million sq.ft leasable area with a portfolio of 8 properties. Its occupancy rate has been 77%, quite lower compared to the occupancy rates in the US that are mostly above 85%. Portfolio market value of Emirates REITs is AED 2.5 Bn (USD 0.68 Bn).

In Bahrain, Inovest REIT was launched in 2009 and got listed in the Bahrain bourse in 2015. Delays in implementation of regulations and approvals for the REITs are challenges in GCC countries including Bahrain. Inovest raised funds worth USD 79.5 mn for the iREIT with the main aim of purchasing income generating properties within GCC region.

Al Mehrab Tower REIT is the first sharia complaint REIT established in 2007 in Kuwait and was formed by Munshaat Real Estate Projects Co. K.S.C.C. Kuwait was the first GCC country to launch an Islamic REIT, though it is not listed in the stock exchange. Al Mehrab REIT was worth USD 100 bn in 2013 and was estimated to have generated an Internal Rate of return (IRR) of 24% during the same time.

Where is the opportunity for REITs in GCC?

The recovery of the real estate market in most of GCC countries, especially UAE, Saudi Arabia, Qatar and Kuwait after the Global financial crisis in 2008 is attracting investors again to invest in asset classes such as REITs. The new segment of affluent investors who wish to generate higher income from diversified income sources would prefer liquid investments such as REITs().

Islamic REITs are one type of investment that capital market authorities in GCC can focus to develop regulations and popularize it with cues and studies from countries such as Malaysia and Singapore. With huge appetite for Islamic investment products within the GCC region, affluent and HNW investors as well as Government owned entities such as pension funds, investment funds and sovereign wealth funds might invest in such REITs to diversify their portfolio. If Islamic REITs are popularized and listed in GCC exchanges, institutional investors such as takaful companies might also invest in these products.

GCC region is a place of attraction with large scale and world class malls such as the Dubai Mall in UAE, The Grand Avenues in Kuwait and many more across the region. Most of these malls are developed by real estate players or holding companies who rent or lease out commercial space to the retailers. Their income is generated in the form of rent or lease. With major events such as the World Expo 2020 and Qatar World cup 2022 lined up, activity in malls construction is on the increase in GCC. REITs can be formed by the mall owners, in order to capitalize the opportunity and diversify their sources of funding. HNW and affluent investors from GCC and across the globe might be interested to invest in Commercial REITs in GCC, as the outlook for luxury retail sector in GCC is positive till 2022(GCC Luxury Retail, Marmore). However, regulatory agencies must provide a proper framework for the REITs to develop in the GCC region.

For both conventional as well as Islamic REITs to be popularized and listed in GCC, there is a pre-requisite that there is must be regulations in place for their operations. Capital market authorities can consider implementing broadly followed regulations such as the US model for conventional REITs and Malaysian model for the Islamic REITs after analyzing their suitability to the local market conditions.